-

Caroline Taylor, who recently ran Small Business Administration lending at Capital One, aims to expand her team at Regions, help steer borrowers into economic recovery and reach out to women and minority small-business owners who have been underserved.

March 31 -

Legislation the president signed this week will extend the deadline for the Paycheck Protection Program to May 31 from March 31, giving businesses two additional months to apply for loans.

March 31 -

Lawmakers approved a bill that will allow the Paycheck Protection Program to remain open until May 31. It was originally set to expire on March 31.

March 25 -

The depositor-owned banks are discouraged from participating in the Emergency Capital Investment Program because they can't issue preferred stock to back loans for underserved communities. It's another reason to overhaul their capital rules, mutuals argue.

March 22 -

First Internet CEO David Becker used to be dismissive of the Small Business Administration. But after getting to know some of the borrowers during the pandemic — and after his bank collected hefty fees from selling 7(a) loans — he's become a convert.

March 17 -

By an overwhelming majority, the House approved a two-month extension of the Paycheck Protection Program, which still has almost $93 billion left to distribute.

March 17 -

Government relief programs and lenders’ forbearance have kept U.S. small businesses from defaulting on their debt en masse as revenue slumped during the pandemic crisis, according to a new analysis.

March 16 -

Legislators expressed concerns that thousands of pending applications are stuck in limbo just weeks before the Small Business Administration is legally required to stop accepting them.

March 10 -

Lenders are preparing scores of Paycheck Protection Program applications to secure approval from the Small Business Administration by March 31, but unresolved error codes continue to hinder their efforts.

March 9 -

“We were already shifting to recruiting more problem solvers than people handling transactions,” said Robert Fisher, CEO of Tioga State Bank in New York and incoming chairman of the Independent Community Bankers of America. “That pace of change has accelerated.”

March 8 -

Nonbanks had worried the end of the Paycheck Protection Program Liquidity Facility would hurt their ability to lend to small businesses. On Monday, the Federal Reserve announced the facility would be extended for three months.

March 8 -

A big funding source for the Paycheck Protection Program is set to expire on March 31. Its demise would pinch nonbanks that are originating and buying loans, especially if Congress continues the PPP beyond this month.

March 5 -

The Small Business Administration is still writing rules for the Paycheck Protection Program two months after its relaunch. Lenders fear they may not have enough time to review those rules before the program’s March 31 expiration date.

March 3 -

The payment processing company will offer loans and deposit accounts to its small-business customers through a Utah-based industrial bank.

March 1 -

Turnaround times on loans in the 504 program are stretching out for weeks as the Small Business Administration grapples with a spike in applications and responsibilities tied to the Paycheck Protection Program.

March 1 -

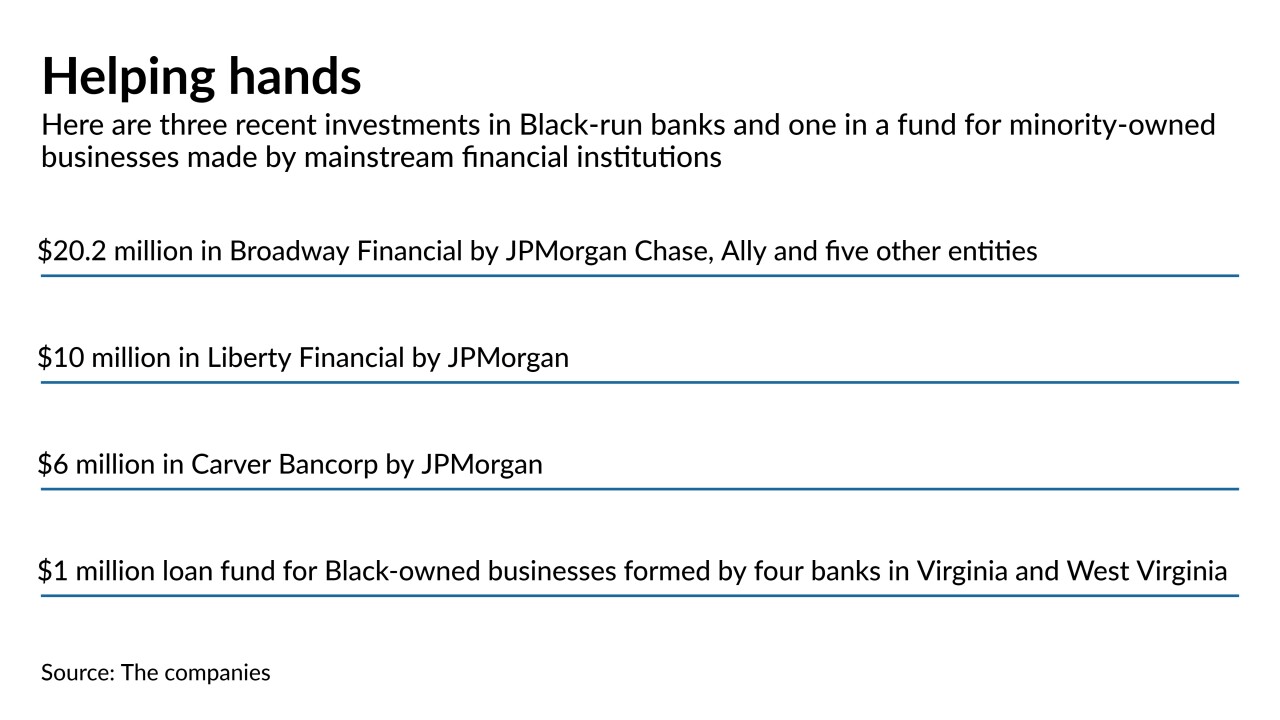

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

It would ignore technical glitches plaguing the entire Paycheck Protection Program and could end up delaying loans to larger borrowers who also need relief, bank executives and their trade groups say.

February 22 -

Only businesses with 20 or fewer employees will be eligible to apply for forgivable loans from the Small Business Administration's Paycheck Protection Program.

February 22 -

The Small Business Administration wants to vet Paycheck Protection Program loans of $2 million or more, but lenders have grown tired of waiting for months with no updates.

February 19 -

Banks have diverted resources from traditional Small Business Administration lending to make Paycheck Protection Program loans, but many are taking steps to rev up 7(a) and 504 lending once the PPP winds down.

February 12