-

The administration's 25% import tax on cars and parts can squeeze dealerships' parts and service revenue, one of their largest profit centers. Buy now/pay later lenders could see a windfall.

March 31 -

After a slowdown in 2020, inventory shortages and other factors could make the months ahead a grind for many lenders.

January 20 -

Ride-hailing services and public transit were gaining ground until the pandemic struck, but the outbreak has quickly and radically changed how consumers think about buying cars.

July 2 Credit Union Leasing of America

Credit Union Leasing of America -

Loan volumes were already slowing before the pandemic. New restrictions and changes in consumer behavior are likely to make growth in this portfolio even harder.

June 2 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

With prices rising rapidly and loan terms increasing, some institutions may want to consider adding a leasing option to their auto loan portfolio.

March 6 Credit Union Leasing of America

Credit Union Leasing of America -

Credit unions that don't embrace digital retailing as part of their auto lending strategy will end up spinning their wheels.

February 27 Cox Automotive

Cox Automotive -

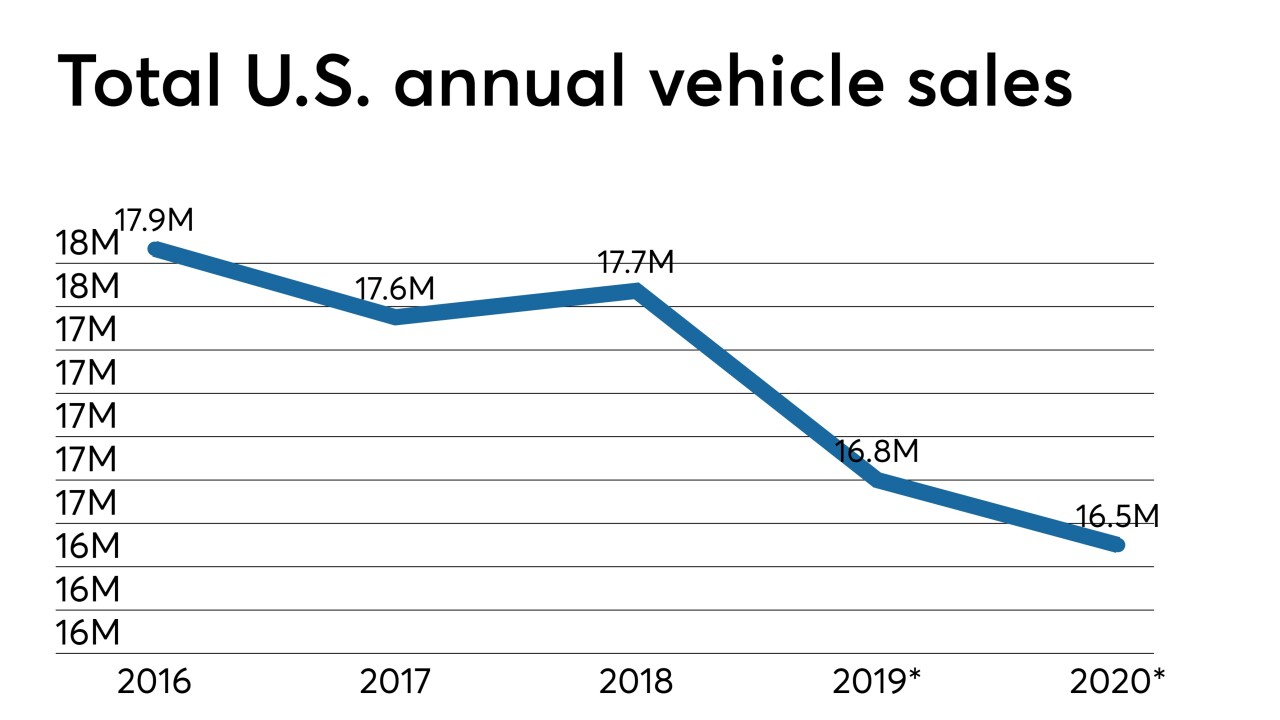

Slowing sales, decreasing market share and other factors could make it harder for credit unions to grow one of the industry's biggest products in the year ahead.

January 31 -

The average price of a previously owned car has fallen in two consecutive months, and if the trend continues, lenders could see losses mount, Richard Fairbank said this week.

December 12 -

Credit unions have been heavily focused on millennials but serving older consumers is just as important. Vehicle leasing is one way to reach both demographics.

October 18 Credit Union Leasing of America

Credit Union Leasing of America -

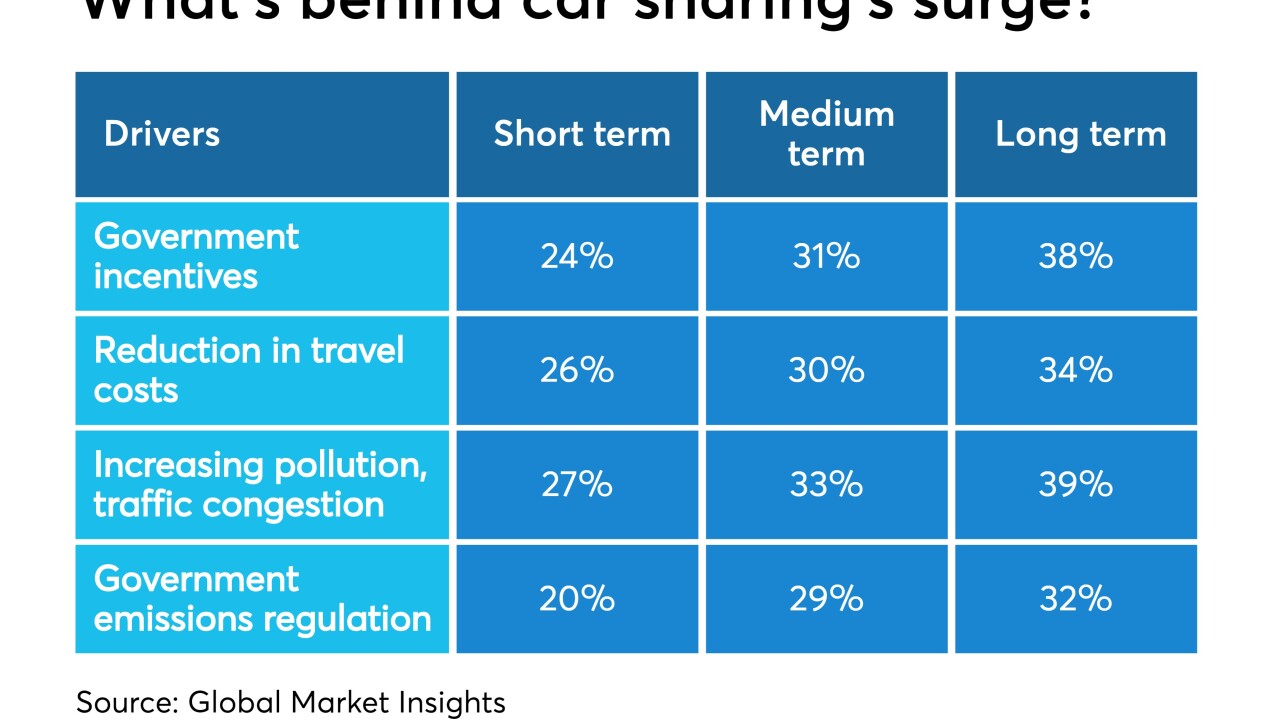

As apps like Uber and Lyft gain more traction, the need for new cars — and loans — is expected to diminish.

October 11 -

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The autonomous vehicle lending market isn’t expected to peak for decades, but some CUs are already jumping in, and they could be at the forefront of rapid shifts in the automotive industry.

July 12 -

The first full day of America's Credit Union Conference in Orlando hit on a variety of topics, including narrowing the gender gap and ongoing attacks from banks.

June 19 -

A look back at Credit Union Journal's May 2019 special report on auto lending.

May 31 -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

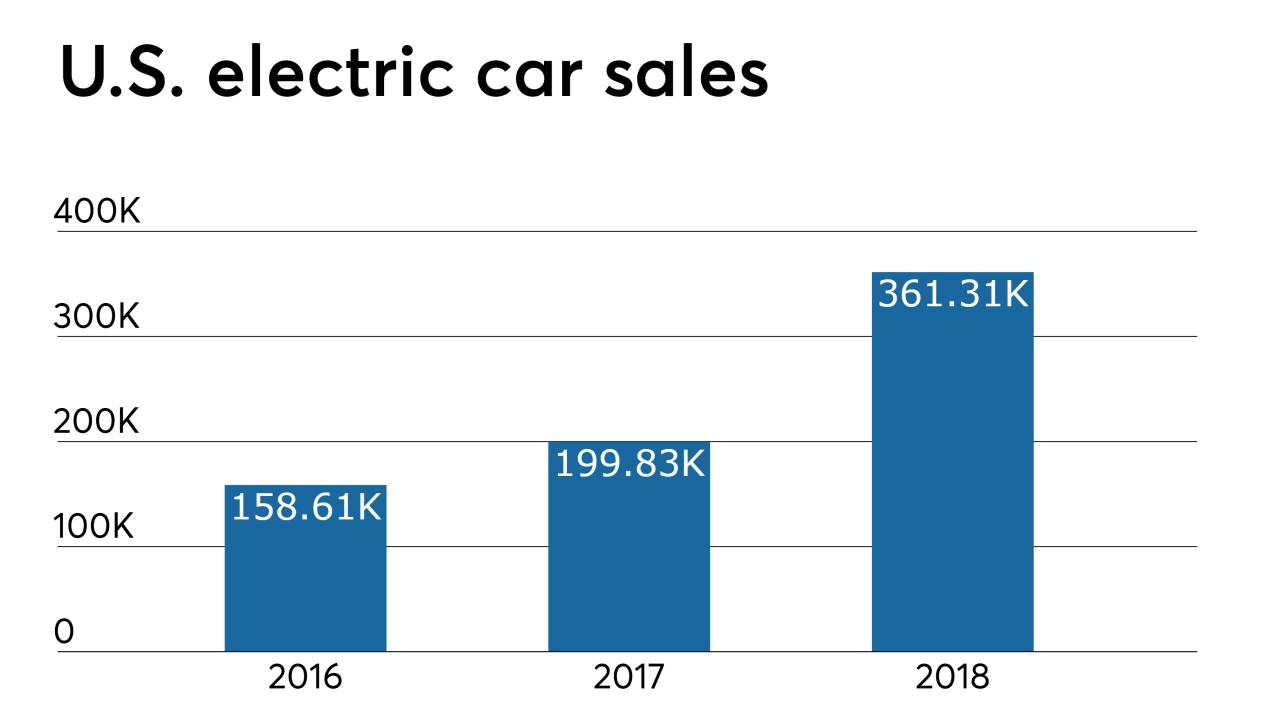

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

Mainland-based credit unions with operations in the territory witnessed a surge in auto lending after Hurricane Maria ravaged the island but demand for these loans seems to be ticking down.

May 21 -

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20