-

Santander Consumer Holdings USA on Monday delayed the release of its quarterly results amid ongoing accounting woes.

July 25 - Minnesota

Fee income, niche financing lines and auto lending drove second-quarter profits at TCF Financial in Wayzata, Minn.

July 22 -

Regional banks like BB&T, Huntington Bancshares and Citizens Financial are growing through acquisition and targeted business-line initiatives, but they are having to contain spending simultaneously.

July 21 -

Profits rose at Citizens Financial in the second quarter thanks to higher-than-expected fee income and loan growth, including improvements in mortgages and auto finance as well as a continuing surge in student lending.

July 21 -

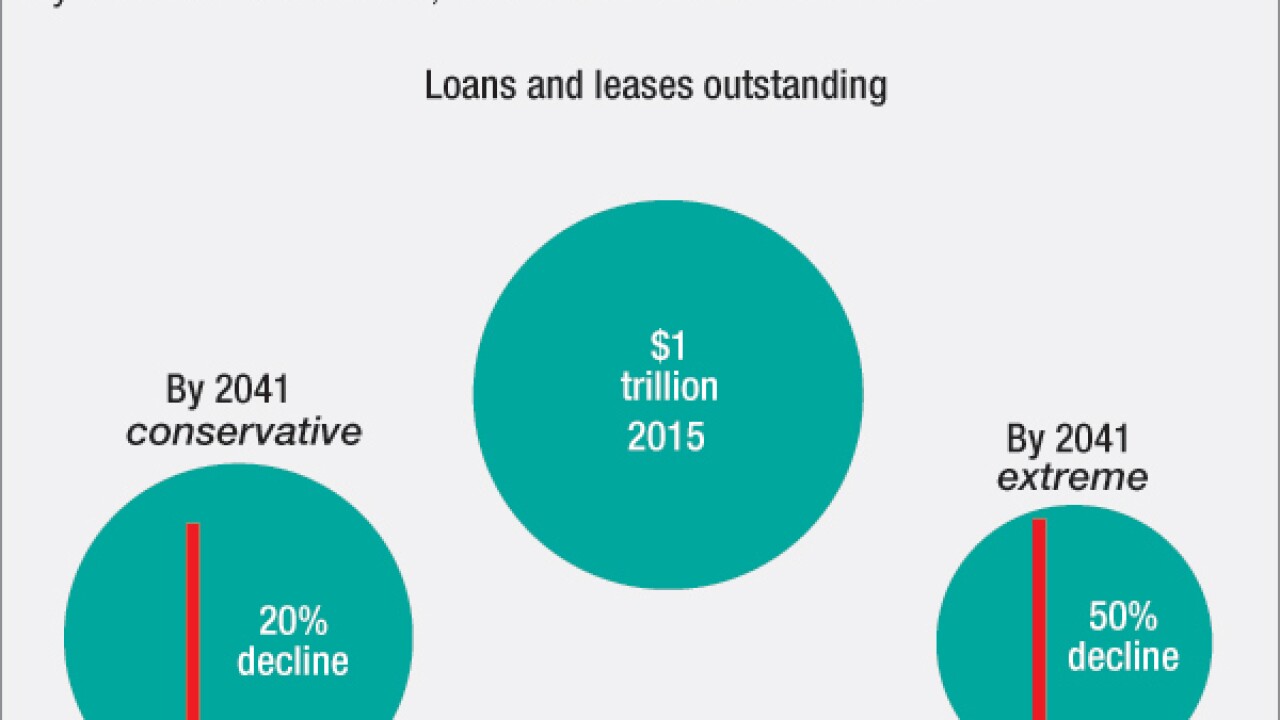

Despite recent controversy over Tesla crashes, the march toward autonomous driving technology continues. And that means big changes for auto lenders.

July 12 -

Santander Consumer Holdings in Dallas on Tuesday appointed William Rainer chairman, and it announced that Blythe Masters has resigned to advise Banco Santander its Spanish parent company on the blockchain.

July 12 -

The sharp fall in gas prices early this year helped U.S. consumers to stay current on their credit obligations during the first quarter.

July 7 -

Frustrated by low yields on commercial and real estate loans, banks are finding innovative ways to beef up their consumer loan books. They are creating new business lines, teaming with established retailers, even partnering with alternative lenders in an effort to diversify and generate new streams of revenue.

June 22 -

Tim Sloan, president and COO at Wells Fargo, is widely viewed as next in line to take over as CEO of the bank. He discussed the speculation as well as energy lending, credit standards, living wills and a number of other topics in a recent interview.

June 16 -

Credit quality has improved across the industry over the past few years, but don't expect that trend to continue because of several economic forces, big-bank CEOs said Thursday.

June 2 -

The credit rating agency argues in a new report that the financing arms of auto manufacturers are better positioned than banks to withstand a widely expected decline in used-car prices. The report also finds that the quality of auto loans made by banks has been declining.

May 26 -

New research findings challenge common assumptions about borrower behavior, illustrating how trended data something mortgage lenders will soon be required to collect could be a game-changer.

May 26 -

As drilling has slowed, energy firms have had to lay off workers, many of whom are falling behind on their bills compounding the troubles of banks already dealing with higher commercial loan delinquencies in the same markets.

May 24 -

Big banks began ceding market share to midsize and small subprime auto lenders, who they said were taking too many risks. Now prominent midsize player Santander Consumer is putting on the brakes and complaining about small, overly daring rivals. How bad a sign is that?

April 27 -

Profits fell double digits at Santander Consumer USA Holdings in Dallas in connection with its exit from the personal loan business and other nagging issues.

April 27 -

Ally Financial reported strong loan and deposit growth in the first quarter, but a shift in the makeup of its automobile loan portfolio forced the Detroit company to nearly double its loan-loss provision from a year earlier.

April 26 -

TCF Financial in Wayzata, Minn., reported sharply higher profits driven by gains on the sale of auto loans even as auto-related chargeoffs rose.

April 21 -

Ally Financial has blasted a proxy advisory firm for its recommendation that shareholders vote against the re-election of four of the Detroit company's directors.

April 19 - North Carolina

B of A is normally thought of as a U.S. economic bellwether, but it has substantial operations overseas, and its international performance last quarter provided a painful reminder of that fact.

April 14 -

The world knows JPMorgan's quarterly profits fell and that it flunked the living wills test. But underneath all that were solid first-quarter results in its core lending businesses that bode well for other banks at the start of earnings season.

April 13