-

Regional banks like BB&T, Huntington Bancshares and Citizens Financial are growing through acquisition and targeted business-line initiatives, but they are having to contain spending simultaneously.

July 21 -

Profits rose at Citizens Financial in the second quarter thanks to higher-than-expected fee income and loan growth, including improvements in mortgages and auto finance as well as a continuing surge in student lending.

July 21 -

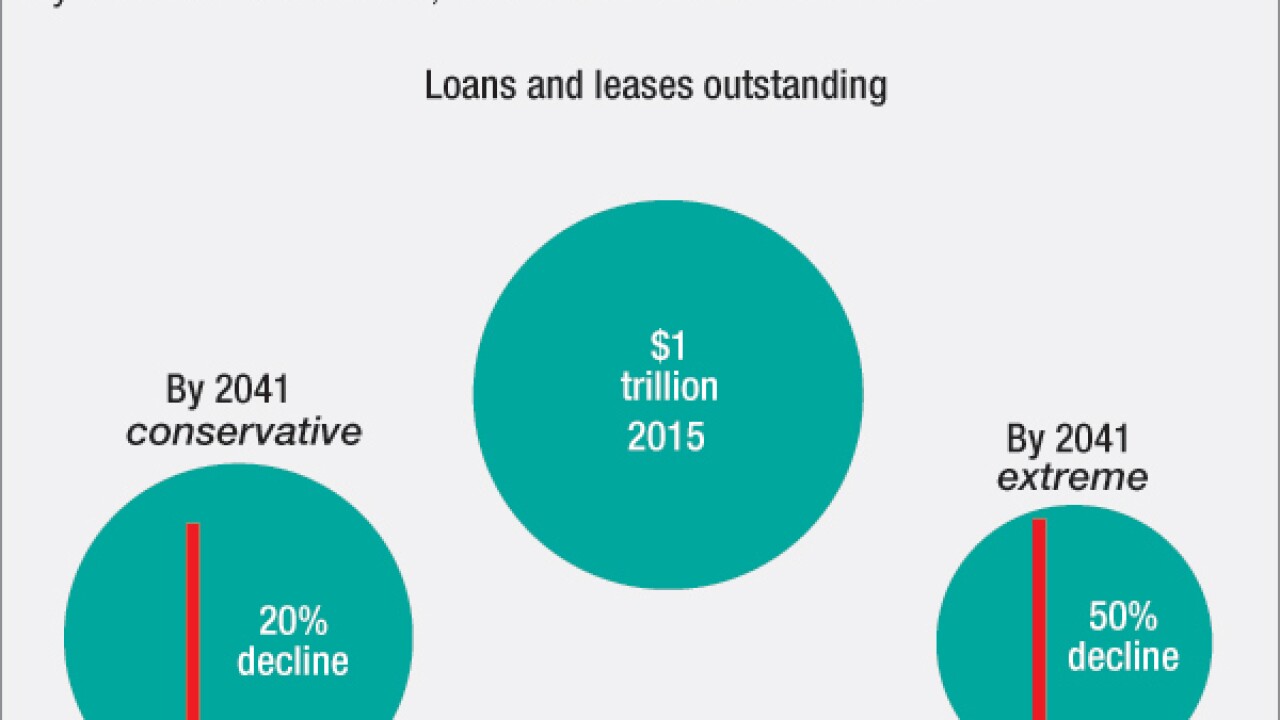

Despite recent controversy over Tesla crashes, the march toward autonomous driving technology continues. And that means big changes for auto lenders.

July 12 -

Santander Consumer Holdings in Dallas on Tuesday appointed William Rainer chairman, and it announced that Blythe Masters has resigned to advise Banco Santander its Spanish parent company on the blockchain.

July 12 -

The sharp fall in gas prices early this year helped U.S. consumers to stay current on their credit obligations during the first quarter.

July 7 -

Frustrated by low yields on commercial and real estate loans, banks are finding innovative ways to beef up their consumer loan books. They are creating new business lines, teaming with established retailers, even partnering with alternative lenders in an effort to diversify and generate new streams of revenue.

June 22 -

Tim Sloan, president and COO at Wells Fargo, is widely viewed as next in line to take over as CEO of the bank. He discussed the speculation as well as energy lending, credit standards, living wills and a number of other topics in a recent interview.

June 16 -

Credit quality has improved across the industry over the past few years, but don't expect that trend to continue because of several economic forces, big-bank CEOs said Thursday.

June 2 -

The credit rating agency argues in a new report that the financing arms of auto manufacturers are better positioned than banks to withstand a widely expected decline in used-car prices. The report also finds that the quality of auto loans made by banks has been declining.

May 26 -

New research findings challenge common assumptions about borrower behavior, illustrating how trended data something mortgage lenders will soon be required to collect could be a game-changer.

May 26