-

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

With one Texas acquisition integrated and another deal set to close next month, Huntington Bancshares is projecting double-digit growth in loans and revenue this year.

January 22 -

The fintech investment firm Portage is now managing a $280 million portfolio acquired from the venture arm of Mets owner Steven Cohen's firm Point72.

January 15 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

The company's asset and wealth management business is completely cutting ties with proxy advisors, opting to build its own research and public company voting system. JPMorgan is the first bank to stop using firms such as Glass Lewis and ISS.

January 7 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

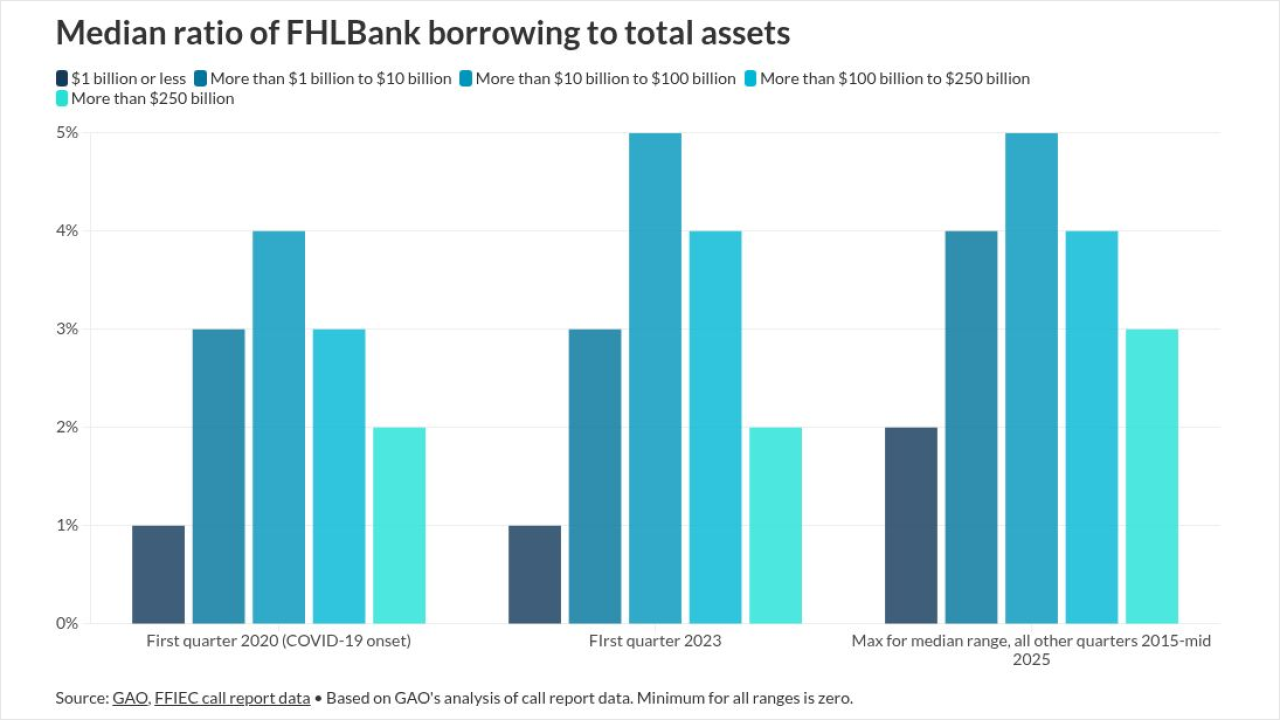

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Once artificial intelligence has eliminated all the human-driven volatility from financial markets, will there even be a reason to trade anymore?

December 19

-

The Treasury official renewed a pledge to avoid hurting how mortgages trade in a Fox Business News interview as a new study highlighted one way to do that.

December 17 -

The Nashville community bank is focusing on growing its "digital branches" through fintech partnerships and embedded banking with its latest funding round.

December 16 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

The student lending giant offered forecasts of future earnings that were far below Wall Street's expectations. In recent months, Sallie Mae has been upbeat about the new opportunities it sees under the Trump administration.

December 9 -

The New York Stock Exchange disclosed the news on Monday of the sudden passing of its head of International Capital Markets.

November 25 -

The Federal Reserve played a behind-the-scenes role in facilitating the sale of PacWest Bancorp, providing an enticement to private-equity interests to make a deal happen, according to agency records and recent comments by a prominent banking lawyer.

November 20 -

The parent of Crosscountry Mortgage plans to use proceeds to pay down its mortgage-servicing rights line of credit as well as for general corporate expenses.

November 19 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

As opportunities grow for private student lending, Sallie Mae has entered a multiyear "strategic partnership" with the world's largest private equity firm.

November 12 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

Barwick Banking Co. will have the wherewithal to accelerate its expansion in Georgia and Florida after a $50 million investment from a new venture capital platform.

November 10 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9