-

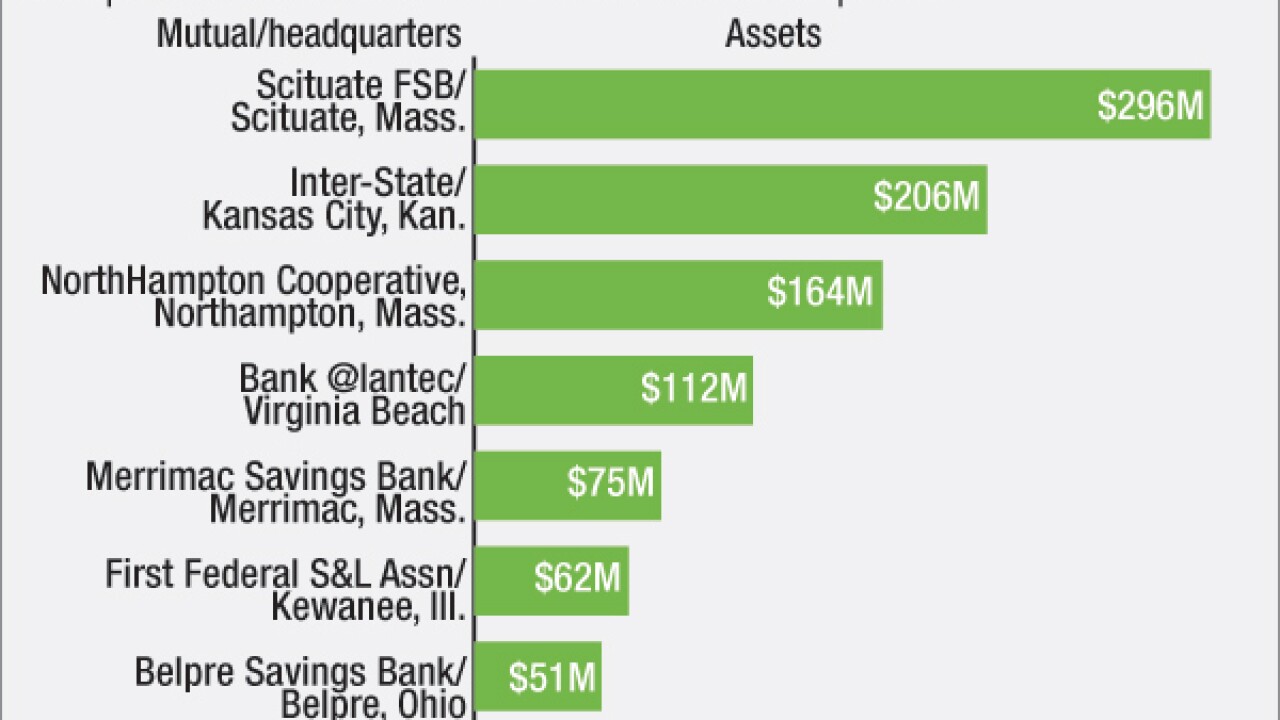

At least eight small mutuals have agreed in recent years to merge with another institution rather than convert to stock ownership. More deals could be on the way.

July 7 -

On the day Maurice Spagnoletti was murdered, his black Lexus sedan was full of balloons. It was June 15, 2011, the day before his wife's birthday, and he was planning a celebration.

July 6 -

Community banks are stepping up efforts to raise cheap capital to fuel loan growth, make acquisitions and redeem pricier sources of funds.

July 6 -

North Carolina has lost more than 40% of its banks in the past decade, creating a new tier of larger institutions. More deals are expected to occur, raising questions about the pace of M&A and the fate of those bigger banks.

July 5 -

Medallion Bank in New York has sold nearly $100 million in prime-credit consumer loans, largely consisted of home improvement and recreational vehicle installment loans, to an unnamed buyer.

July 5 -

The $99 million-asset thrift said in a recent press release that Best Hometown Bancorp, a holding company it created, raised $8.3 million as part of an initial public offering tied to its mutual-to-stock conversion. Home Federal also plans to change its name to Best Hometown Bank.

July 1 -

Liberty Shares in Hinesville, Ga., one of a handful of banks still stuck in the Troubled Asset Relief Program, has raised $26 million in capital.

July 1 -

Flagstar Bancorp in Troy, Mich., is paying $371 million to put behind it the vestiges of its dealings with the Troubled Asset Relief Program.

June 30 -

First Bank in Hamilton, N.J., has raised $13.7 million by selling common stock.

June 30 -

BankFinancial in Olympia Fields, Ill., said it expects to record an $875,000 gain in the second quarter after selling three loans.

June 27