- Hawaii

First Hawaiian is going the way of Citizens Financial, spinning off from its foreign parent and becoming a stand-alone company. But don't expect big changes anytime soon.

August 5 -

First Hawaiian Bank in Honolulu expects to raise up to $558 million in an initial public offering after its parent BNP Paribas Group decided to spin off the unit rather than sell it.

August 2 -

The Federal Deposit Insurance Corp. is raising concerns about potential spillover effects from depressed oil prices even as banks had sounded more optimistic. Tougher capital requirements for energy lenders could be on the horizon.

August 2 -

Carver Bancorp in New York is dealing with a new set of challenges just months after being released from a longstanding enforcement order. The companys woes highlight the challenges for banks with narrowly constrained business models.

July 29 -

Eagle Bancorp in Bethesda, Md., has issued $150 million in subordinated debt after increasing the amount it originally planned to sell.

July 22 -

BNC Bancorp in High Point, N.C., plans to raise about $55 million through a common stock offering.

July 21 -

Over the past two years, regulators have issued several proposals as part of efforts to make capital rules simpler, but the initiative should be more streamlined and allow more public input.

July 19 American Bankers Association

American Bankers Association -

The debate over Rep. Jeb Hensarling's bill to overhaul the Dodd-Frank Act is increasingly focusing on widely different philosophies about capital regulation.

July 12 -

A couple of years ago, the activist investor Joseph Stilwell said Anchor Bancorp in Lacey, Wash., deserved more time to try to right itself. Apparently he thinks that time is up.

July 12 -

The management team at Bank of the Ozarks knows it has a dependency on commercial real estate. But they assert that sound underwriting, and efforts to diversify, are what really matters when assessing risk.

July 11 -

First Hawaiian Bank in Honolulu will be spun off rather than sold.

July 11 -

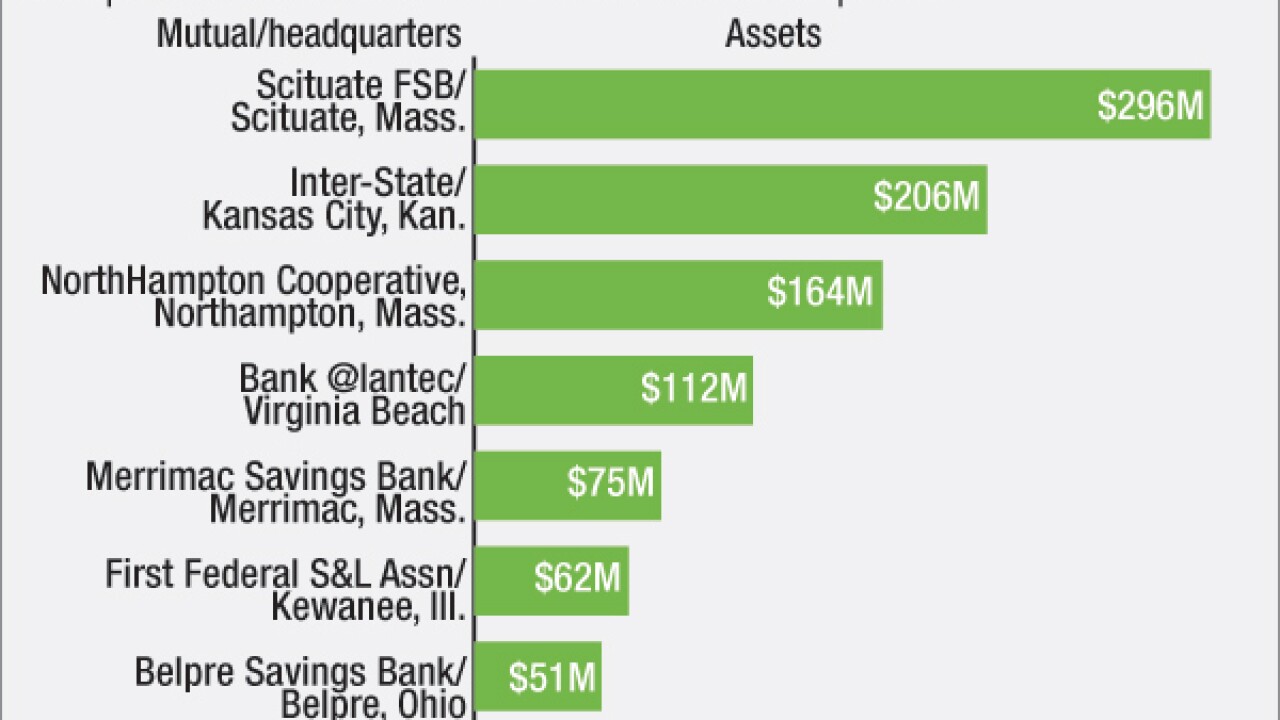

At least eight small mutuals have agreed in recent years to merge with another institution rather than convert to stock ownership. More deals could be on the way.

July 7 -

On the day Maurice Spagnoletti was murdered, his black Lexus sedan was full of balloons. It was June 15, 2011, the day before his wife's birthday, and he was planning a celebration.

July 6 -

Community banks are stepping up efforts to raise cheap capital to fuel loan growth, make acquisitions and redeem pricier sources of funds.

July 6 -

North Carolina has lost more than 40% of its banks in the past decade, creating a new tier of larger institutions. More deals are expected to occur, raising questions about the pace of M&A and the fate of those bigger banks.

July 5 -

Medallion Bank in New York has sold nearly $100 million in prime-credit consumer loans, largely consisted of home improvement and recreational vehicle installment loans, to an unnamed buyer.

July 5 -

The $99 million-asset thrift said in a recent press release that Best Hometown Bancorp, a holding company it created, raised $8.3 million as part of an initial public offering tied to its mutual-to-stock conversion. Home Federal also plans to change its name to Best Hometown Bank.

July 1 -

Liberty Shares in Hinesville, Ga., one of a handful of banks still stuck in the Troubled Asset Relief Program, has raised $26 million in capital.

July 1 -

Flagstar Bancorp in Troy, Mich., is paying $371 million to put behind it the vestiges of its dealings with the Troubled Asset Relief Program.

June 30 -

First Bank in Hamilton, N.J., has raised $13.7 million by selling common stock.

June 30