Commercial banking

-

SunTrust, the lender merging with BB&T, said it won't provide future financing to companies that manage private prisons and immigration holding facilities.

July 8 -

The decision follows similar moves by rivals JPMorgan Chase and Wells Fargo.

June 26 -

The New York bank has recruited a dozen commercial lenders from PacWest, Wells Fargo and other rivals, continuing its shift away from its historic reliance on multifamily lending.

June 25 -

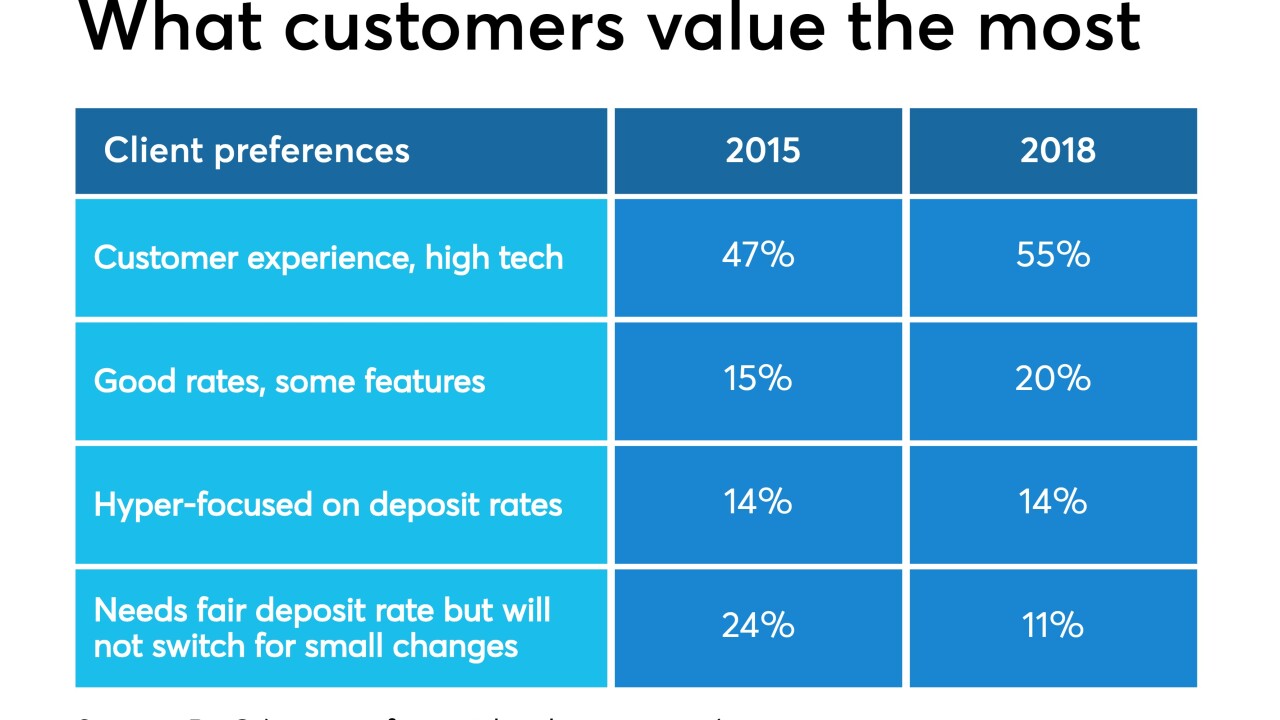

Community bankers want to cut the time it takes for customers to establish digital accounts to mere minutes, but it's hard to do that and make other improvements without increasing fraud risk.

June 20 -

Last year, CEO Darryl White said his goal was for U.S. operations to account for one-third of the bank's earnings in three to five years. It was a matter of months before the goal was reached.

June 19 -

There’s a long list of reasons traditional lenders haven't kept up with the needs of entrepreneurs, says Judith Erwin, the head of Grasshopper Bank in New York. One is not asking for enough feedback.

June 18 -

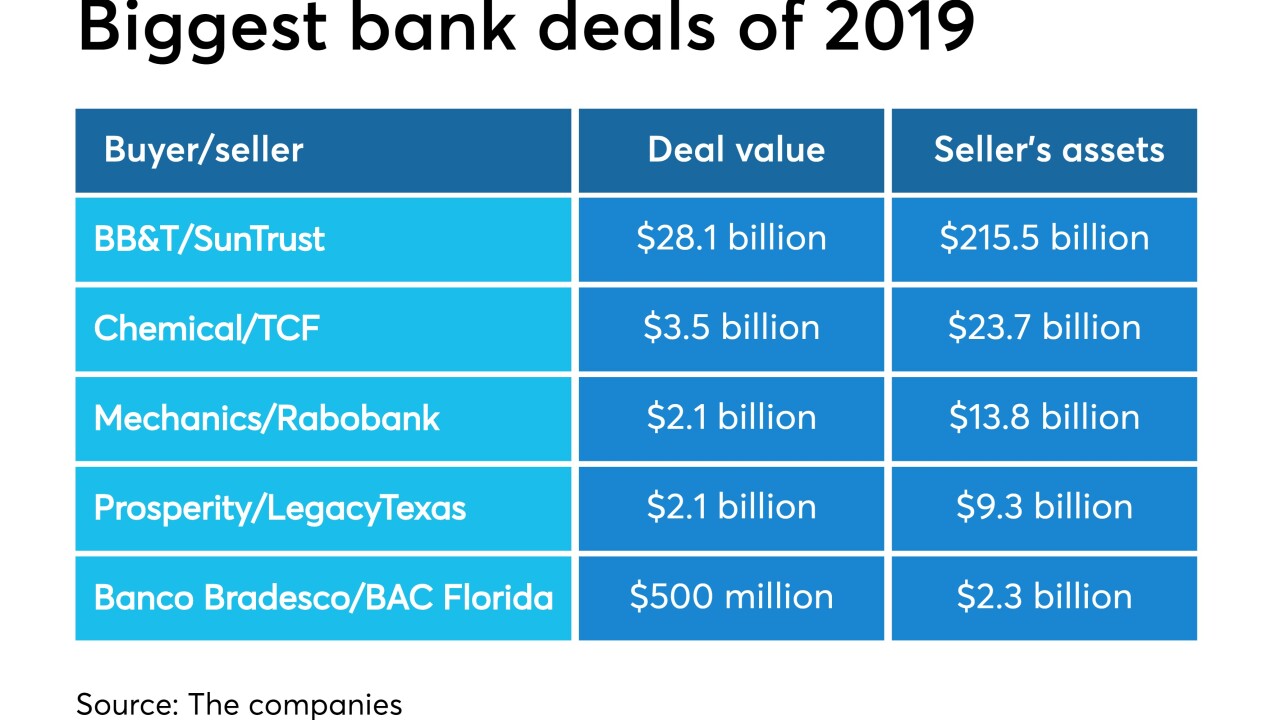

Deal values this year have been smaller than last year despite the hubbub over BB&T-SunTrust. Prosperity's agreement to buy LegacyTexas raises the possibility that the size of bank deals could start climbing.

June 17 -

The German banking giant is also looking to create a "bad bank" to wind down as much as $56 billion in unwanted assets, according to a person familiar with the matter.

June 17 -

CEO Greg Carmichael said Wednesday that online-only banks "aren't relationship-based" and that Fifth Third would stick to its plan of attracting new depositors by selectively expanding into new markets.

June 12 -

The Rhode Island company is counting on disruption from the megamerger to accelerate its Southeast expansion, according to commercial banking chief Don McCree. But BB&T’s Kelly King has a message for him: Not so fast.

June 11