Commercial banking

-

Chemical is paying roughly $3.6 billion for the $23.5 billion-asset TCF. The combined company will be based in Detroit, Chemical's hometown, and operate under the TCF brand.

January 28 -

The parent company of Silicon Valley Bank predicted a strong year, saying the high-tech and other niches it serves are built to withstand current economic uncertainty.

January 25 -

The Florida company's earnings increased after it completed a big acquisition and produced strong year-over-year loan production.

January 22 -

CEO Greg Carmichael says the Cincinnati bank will hire bankers in Denver, Dallas and Houston as part of a broader expansion into fast-growing markets that are home to lots of midsize firms. It is also interested in buying more fee-based businesses.

January 22 -

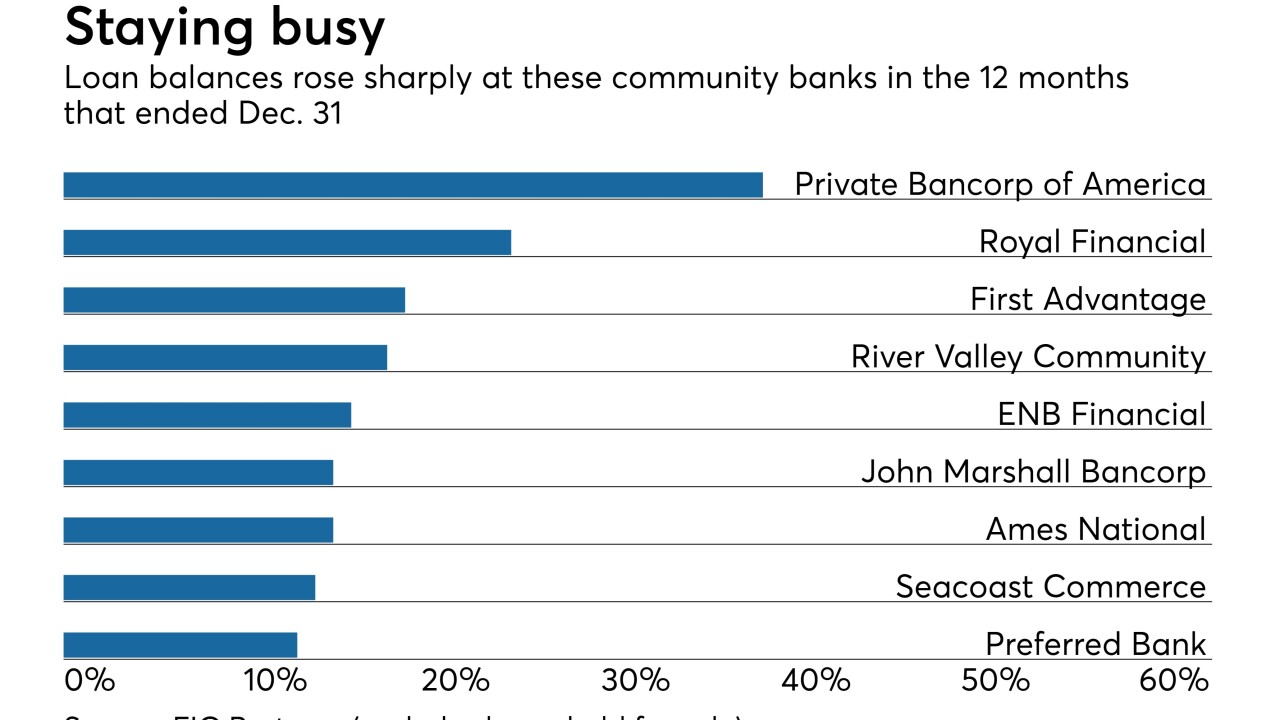

Smaller institutions are booking loans at a faster clip than bigger lenders, raising concerns that they are relaxing standards in order to win business.

January 22 -

The acquisition of VAR Technology Finance bolsters the bank's efforts to expand into new areas of lending.

January 18 -

The New York company added eight new client teams in 2018 and established a new division that caters to private equity firms on both coasts.

January 17 -

The nation’s fifth-largest bank now has the financial flexibility to consolidate more branches in existing markets and open new, smaller ones in cities where it has no retail presence, CEO Andy Cecere said.

January 16 -

The Dallas company beat earnings estimates even as it reported declines in deposits, total loans and fee income.

January 16 -

Goldman Sachs Group Inc., owner of one of Wall Street’s top dealmaking franchises, leaned on that business last quarter to overcome an industrywide downturn in fixed-income trading.

January 16