-

The nascent industry's early success will mean very little if these new companies don't take necessary steps to position themselves for the long term.

May 23

-

Banks and nonbanks should accept that more fintech regulation is inevitable, but how far regulators go will depend in part on how well companies demonstrate they are managing risk.

May 20

-

One of the country's largest online lenders is cutting jobs and shelving expansion plans in response to investors' rapid retreat from the beleaguered sector.

May 20 -

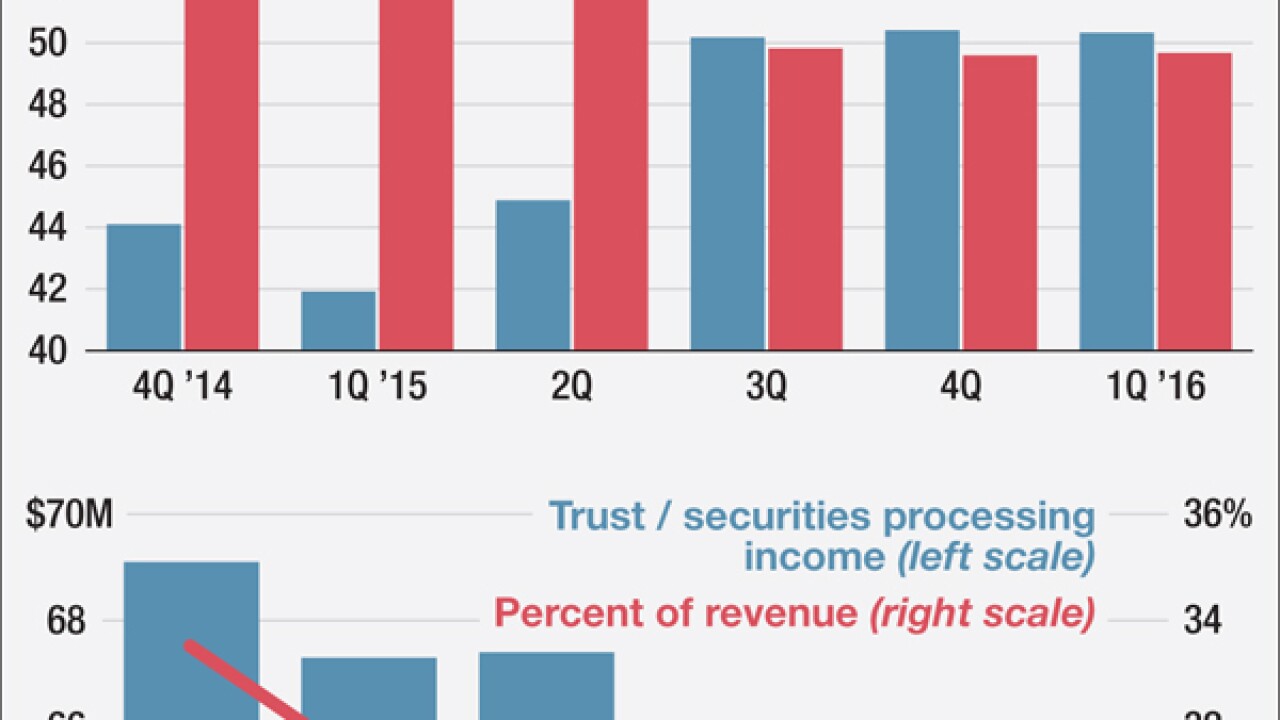

UMB Financial took its lumps last year when its funds management business suffered from large outflows. The challenge prompted UMB to tighten up on expenses and rely more on revenue tied to its balance sheet.

May 19 -

The financial services sector would benefit from companies banks included submitting dedicated disclosures on the impact of climate change.

May 19

-

A study commissioned by the Massachusetts Bankers Association found a correlation between a spike in credit unions with low-income designations and an increase in member business lending in the state.

May 18 -

New York's bank regulator is investigating LendingClub Corp. over loans issued to consumers and its relationships with financial institutions, saddling the embattled company with another probe after its chief executive was forced to resign earlier this month.

May 18 -

Following the scandal-tinged departure of CEO Renaud Laplanche, the company is contemplating drastic steps to restore the confidence of loan buyers. Scenarios that would have been far-fetched a short time ago such as diluting shareholders and funding loans off its own balance sheet are now under consideration.

May 17 -

Prosper Marketplace Inc. has met with investors including Fortress Investment Group about potential capital injections, according to a person with knowledge of the matter.

May 17 -

LendingClub Corp., which plunged 51 percent last week after the surprise departure of its leader and disclosure of faulty internal controls, said the scandal is prompting investors to suspend debt purchases and spurring government probes.

May 16