-

The credit union's organizers believe there is a funding gap in the state for agriculture — and they want to fill the void.

November 2 -

By creating corporate governance courses for prospective board members and a multifaceted financial literacy program for high schoolers, Virginia National aims to deepen its bench for years to come.

November 1 -

Organizers of the credit union believe there is a funding gap in the state for agriculture and want to fill the void.

November 1 -

Harvest is when farmers need funding the most. ProducePay has financed over $850 million of produce in under four years, disrupting traditional finance rules in the farm-to-table process.

October 31 -

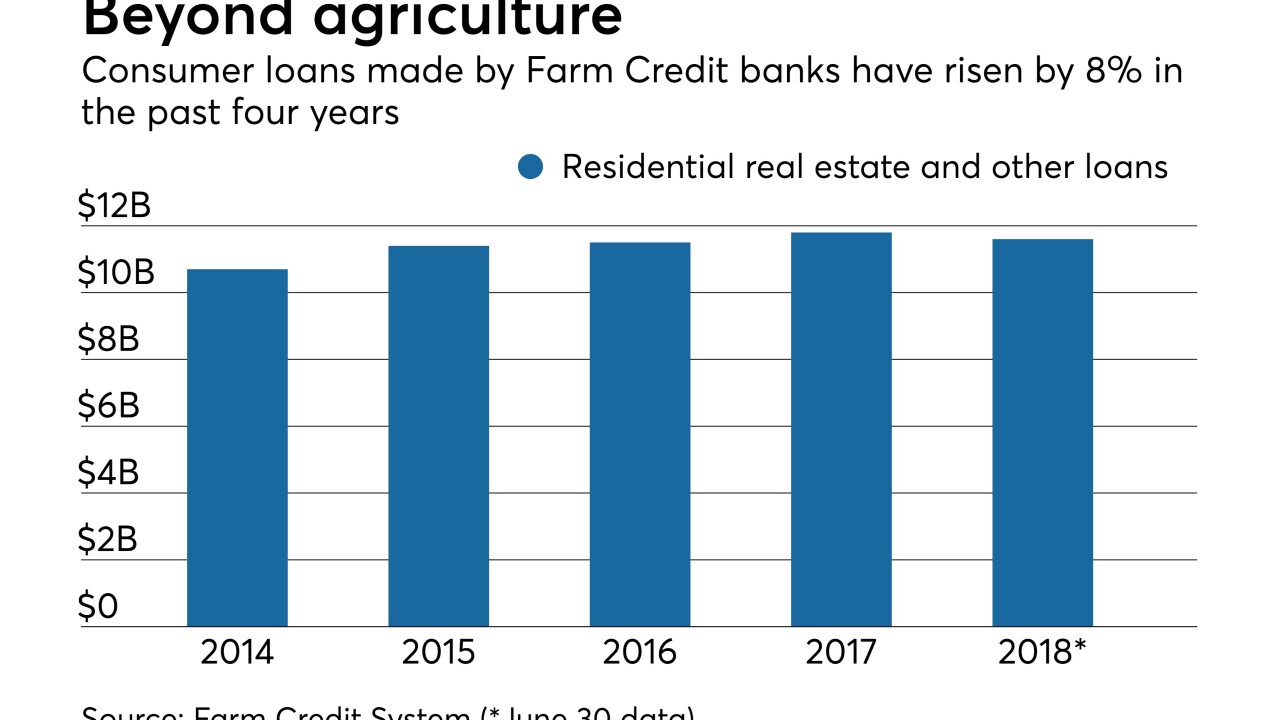

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

Azlo, Bento, Bank Novo and other neobanks argue they are better at helping small businesses, giving them extra attention, technology and advice.

October 31 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

The New York unit of Popular has contracted with Biz2Credit to automate commercial loan approvals and handle the underwriting for applications under $100,000.

October 30 -

If approved, the Fed would consider risk factors besides size in how strenuously it oversees individual banks; Capital One's CIO on operating a bank as a technology company.

October 30 -

Federal "Opportunity Zones" that reduce exposure on capital gains could draw rich investors — and commercial lenders along with them — into economic development projects in thousands of troubled communities around the country.

October 29 -

On Jun. 30, 2018. Dollars in thousands.

October 29 -

On Jun. 30, 2018. Dollars in thousands.

October 29 -

What keeps execs up at night in the payments, retail and banking industries? Quite a lot, including disruption from tech giants and competition from foreign rivals.

October 29 -

From Democrats winning control of Congress to an escalating trade war and technology companies applying for a fintech charter, there are plenty of scary prospects facing the industry.

October 28 -

Wells Fargo puts two top execs on leave as scandal's reach grows; regional banks freed from SIFI label lobbying regulators hard for more relief; FDIC to launch innovation office to help banks compete with fintechs; and more from this week's most-read stories.

October 26 -

The agency wants to change underwriting requirements in the regulation that lenders say will put them out of business, and give companies a break on the compliance deadline.

October 26 -

Amalgamated Bank of New York said it will begin tracking the carbon emissions it is financing through its $3.4 billion loan portfolio, using as a guide the science that would limit global warming to 2 degrees Celsius, which is the goal of the Paris Climate Agreement.

October 26 -

The Federal Reserve is getting more concerned about risks from the leveraged loan market, with a key official saying it's now taking a "closer look" at whether banks are chasing deals without adequately protecting themselves against losses.

October 24 -

The results did not include the company's purchase of CoBiz, which closed last month.

October 24 -

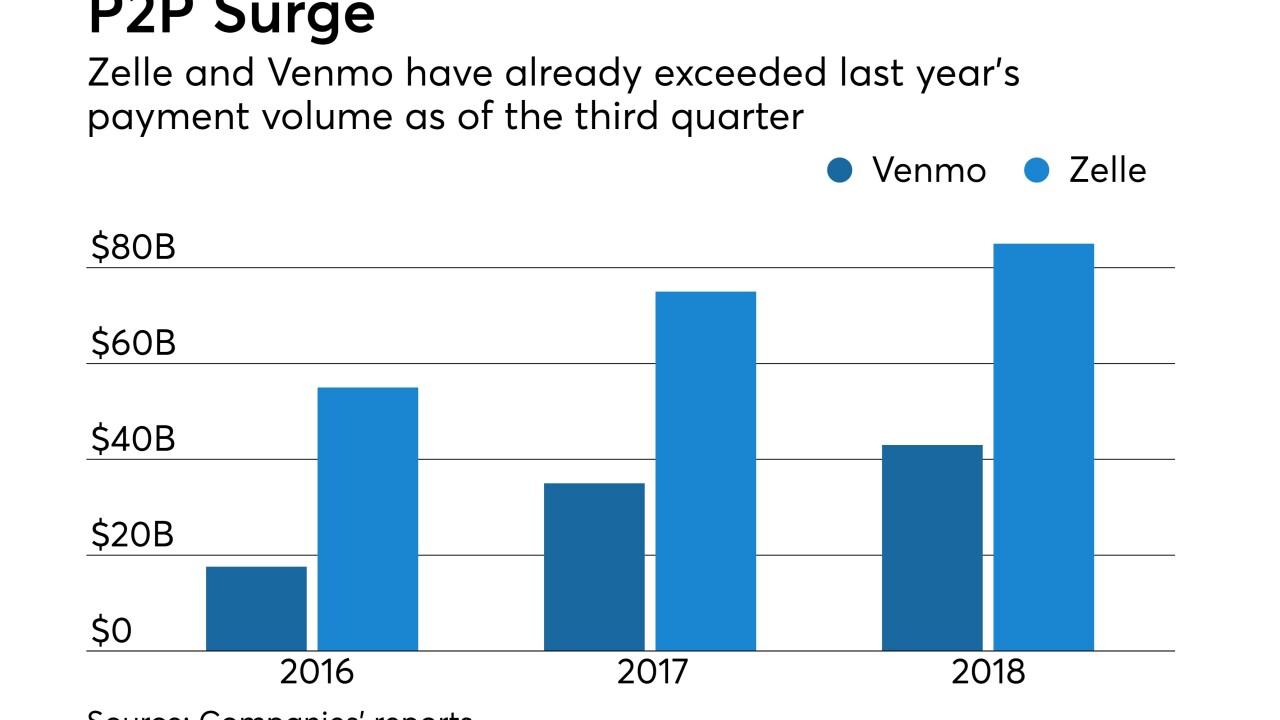

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23