-

CenterState in Florida and Union Savings in Connecticut are adding specialists to their retail locations at a time when many other banks are cutting back or have been relying heavily on universal bankers.

May 24 -

During the ascension of marketplace lending, banks responded to the competitive threat in several different ways. Now some banks are better positioned than others to take advantage of the online sector's recent woes.

May 24 -

Nonperforming commercial-and-industrial loans are soaring, and loans to farmers and construction firms not just oil and gas companies are a big reason.

May 23 -

The nascent industry's early success will mean very little if these new companies don't take necessary steps to position themselves for the long term.

May 23

-

Banks and nonbanks should accept that more fintech regulation is inevitable, but how far regulators go will depend in part on how well companies demonstrate they are managing risk.

May 20

-

One of the country's largest online lenders is cutting jobs and shelving expansion plans in response to investors' rapid retreat from the beleaguered sector.

May 20 -

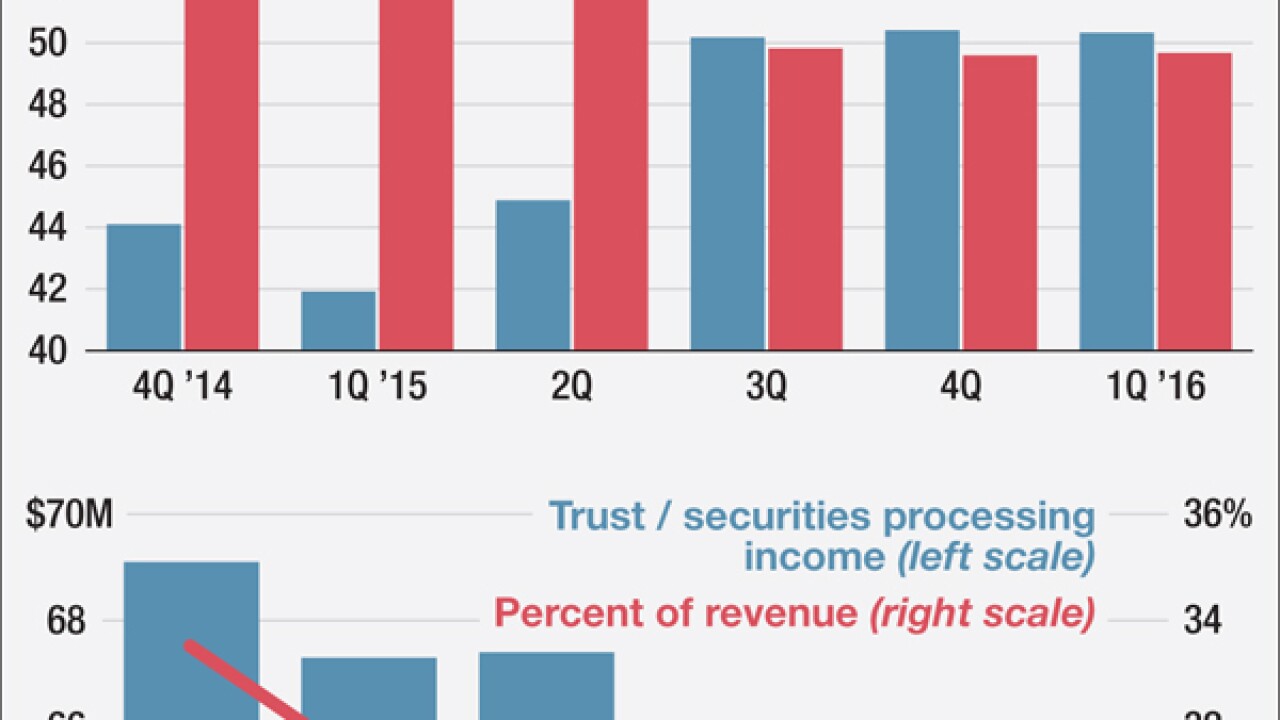

UMB Financial took its lumps last year when its funds management business suffered from large outflows. The challenge prompted UMB to tighten up on expenses and rely more on revenue tied to its balance sheet.

May 19 -

The financial services sector would benefit from companies banks included submitting dedicated disclosures on the impact of climate change.

May 19

-

A study commissioned by the Massachusetts Bankers Association found a correlation between a spike in credit unions with low-income designations and an increase in member business lending in the state.

May 18 -

New York's bank regulator is investigating LendingClub Corp. over loans issued to consumers and its relationships with financial institutions, saddling the embattled company with another probe after its chief executive was forced to resign earlier this month.

May 18