-

There are opportunities to make loans for strip malls and regional distribution centers but executives need to put the right risk management in place.

August 9 -

On Mar. 31, 2019. Dollars in thousands.

August 5 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

Bankers are downplaying such concerns, but others say a sharp decline in values on rent-regulated buildings means landlords will have less cash flow to acquire new properties.

July 31 -

The Columbus, Ohio, company said Thursday that it expects the Federal Reserve to cut interest rates twice this year and two more times in 2020.

July 25 -

Pressure to raise rates on deposits offset strong loan growth at the Salt Lake City company.

July 22 -

As budget questions loom over the most popular Small Business Administration loans, lenders have embraced the previously overshadowed 504 program after a key policy tweak.

July 19 -

As budget questions loom over the most popular Small Business Administration loans, lenders have embraced the previously overshadowed 504 program after a key policy tweak.

July 18 -

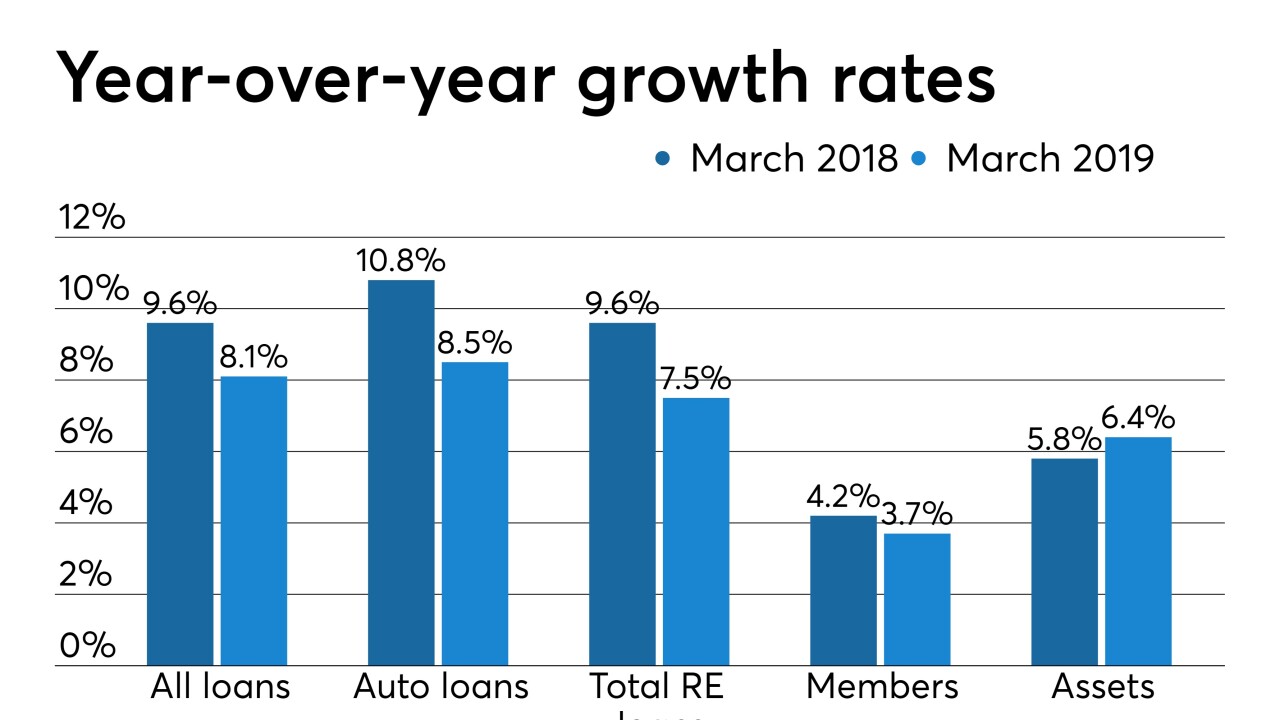

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

While a bill to require firms to identify their owners has gained bipartisan support, some small companies argue it is burdensome and would subject them to harsh penalties.

June 20 -

New York's sweeping rewrite of rent stabilization laws could pose a credit risk to lenders that finance capital improvements to regulated apartment properties, according to a report Monday by Fitch Ratings.

June 17 -

Banks fear that more competition from nonbanks in commercial real estate will drive down pricing and lead to a relaxation of terms.

June 14 -

The Rhode Island company is counting on disruption from the megamerger to accelerate its Southeast expansion, according to commercial banking chief Don McCree. But BB&T’s Kelly King has a message for him: Not so fast.

June 11 -

Five executives were appointed to new roles within the revamped business unit that houses business banking, government and institutional banking and middle-market banking. All will report to commercial banking head Kyle Hranicky.

June 4 -

Readers weigh in on the role of the Financial Accounting Standards Board, consider personnel changes at the Consumer Financial Protection Bureau, debate the viability of public banks and more.

May 23 -

On Dec. 31, 2018. Dollars in thousands.

May 20 -

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

The New York bank says it acted appropriately in withholding the collateral on a loan to a developer that First Foundation Bank later refinanced. First Foundation’s CEO begs to differ.

May 14 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10