-

New York's sweeping rewrite of rent stabilization laws could pose a credit risk to lenders that finance capital improvements to regulated apartment properties, according to a report Monday by Fitch Ratings.

June 17 -

Banks fear that more competition from nonbanks in commercial real estate will drive down pricing and lead to a relaxation of terms.

June 14 -

The Rhode Island company is counting on disruption from the megamerger to accelerate its Southeast expansion, according to commercial banking chief Don McCree. But BB&T’s Kelly King has a message for him: Not so fast.

June 11 -

Five executives were appointed to new roles within the revamped business unit that houses business banking, government and institutional banking and middle-market banking. All will report to commercial banking head Kyle Hranicky.

June 4 -

Readers weigh in on the role of the Financial Accounting Standards Board, consider personnel changes at the Consumer Financial Protection Bureau, debate the viability of public banks and more.

May 23 -

On Dec. 31, 2018. Dollars in thousands.

May 20 -

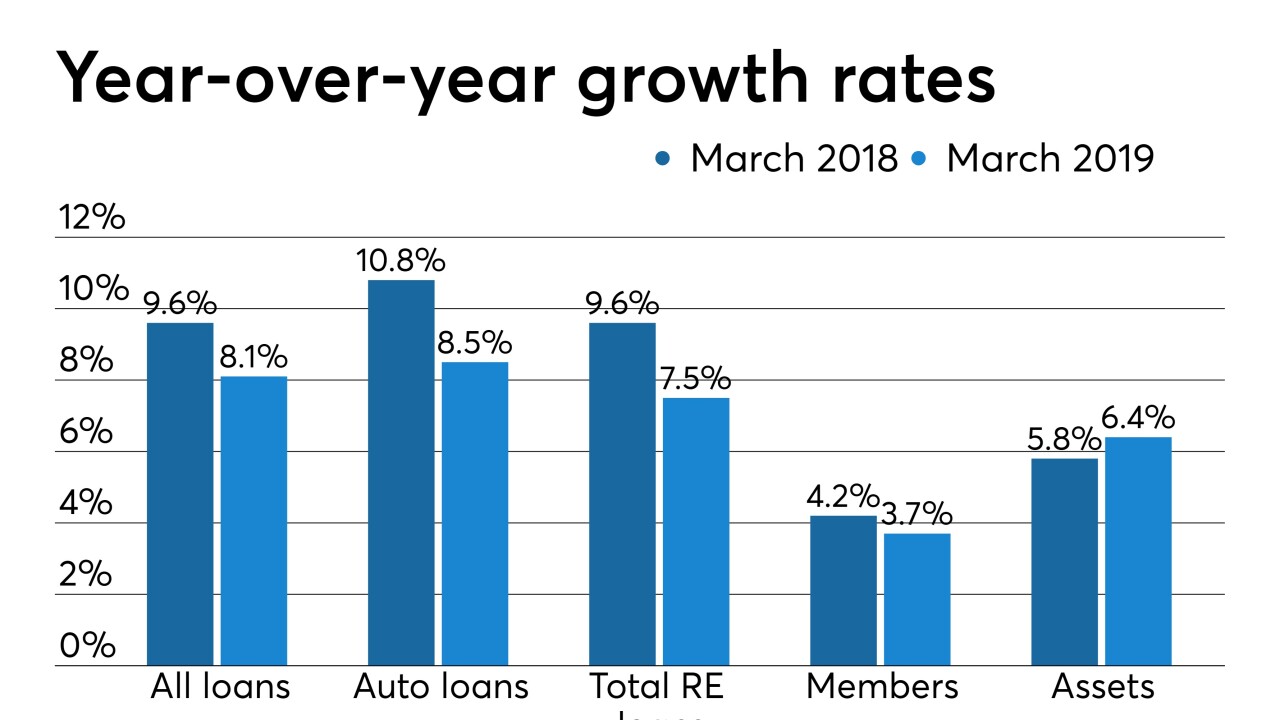

A new study from CUNA Mutual Group shows CUs ended March with tepid growth in membership and auto and real estate loans compared with a year earlier.

May 17 -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

The New York bank says it acted appropriately in withholding the collateral on a loan to a developer that First Foundation Bank later refinanced. First Foundation’s CEO begs to differ.

May 14 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

Even as consumer and CRE lending slowed in the first quarter, business lending — particularly to middle-market companies — surged. But some banks are already warning that the growth could taper off as competition from nonbanks heats up.

April 29 -

Overall loan growth at the Tulsa, Okla., company was muted, however, as an increase in early paydowns lowered commercial real estate loan balances.

April 24 -

The Alabama company recorded a $91 million loan-loss provision and raised deposit rates during the first quarter.

April 18 -

Sloane, who died on Saturday, refused to bulk up on commercial real estate loans, a move that helped him survive two severe economic downturns.

April 9 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

Some lenders, especially in markets like California, are preparing in case of a technology-industry stumble that hurts business, real estate and other loan segments. Whether those fears are well founded is a matter of debate.

March 26 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

Brick-and-mortar retail isn’t dead yet. Though the trend of retailers closing stores in the face of stiff competition from e-merchants is certainly troubling to commercial real estate lenders, it would be a mistake to conclude that all retail loans are risky. Here's a look at which ones are the safest and, potentially, the scariest.

March 5 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

Bank of Marin CEO Russ Colombo is tightening up pricing and terms, citing soaring real estate prices in markets like San Francisco.

February 28