Community banking

Community banking

-

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

WSFS, in an effort to catch up with bigger rivals, plans to upgrade digital channels in three years instead of five.

February 24 -

The company revised its results to a net loss of $700,000 after deciding to record a $16 million loan-loss provision for the commercial loan.

February 24 -

The company is buying a homebuilder finance portfolio with $47 million in loans and $80 million in commitments.

February 24 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

Community banks are entering the business as intermediaries to counter the pinch of low loan yields and intense competition on spread income.

February 23 - Finance and investment-related court cases

Tech firm accuses PNC of stealing trade secrets; online lender LendingClub agrees to acquire Radius Bank; questions arise whether regulators are turning more partisan; and more from this week's most-read stories.

February 21 -

Lawmakers have also criticized the agency's decision to create qualifying standards for farmers and other small businesses.

February 20 -

The credit union regulator's portfolio sale dashed the hopes of a group of New York taxi drivers looking for relief.

February 20 -

Zember abruptly resigned as CEO of Ameris Bancorp last summer.

February 20 -

David Brager, the California company's sales division manager, will replace Christopher Myers on March 16.

February 20 -

The company will nearly double the amount of marine loans on its books after buying a division from People's United.

February 19 -

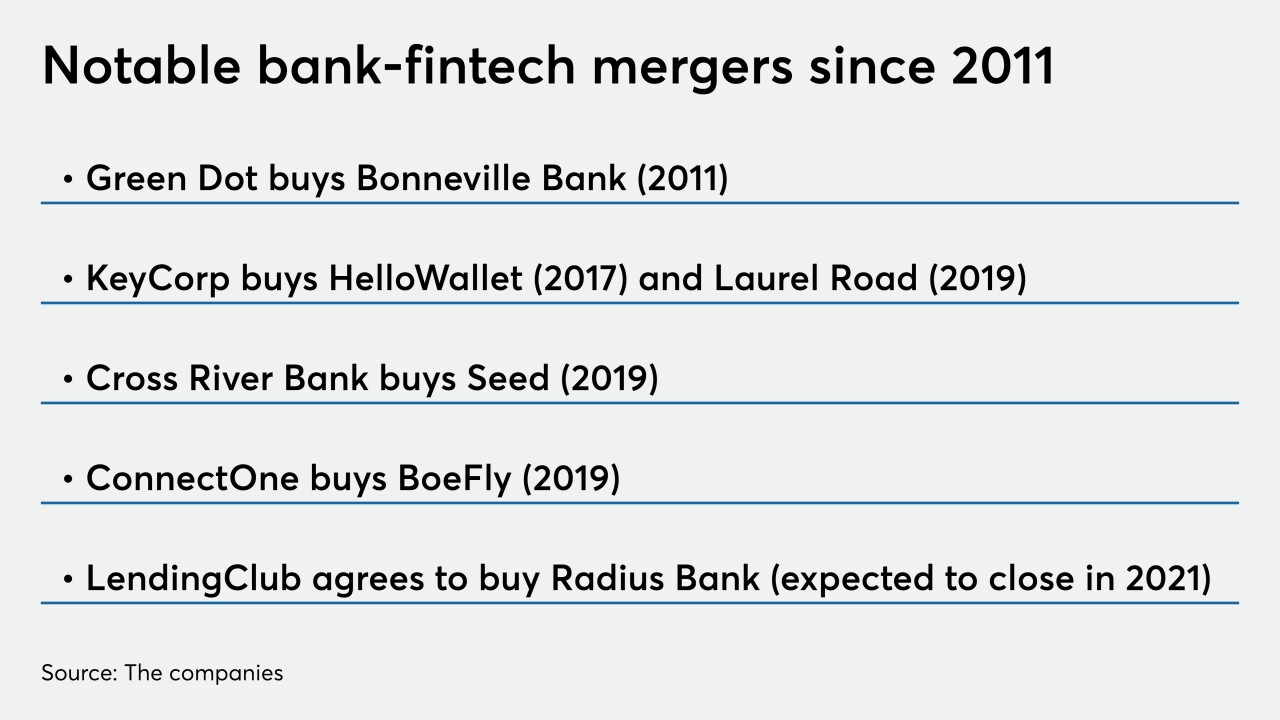

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

February 19 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 -

Clearer standards make it easier for shareholders to boost their stakes in banks without having to file for bank holding company status.

February 18 -

The deal for Boston-based Radius would be the first in history in which an online lender buys a mainstream bank.

February 18 -

The company will pay $130 million for Commerce Financial Holdings.

February 18 -

Ericson State Bank, which had been in regulators’ sights for a decade, was closed by state and federal authorities Friday. Another bank acquired all of its deposits and a fraction of its assets.

February 14 -

Hanover Bancorp is facing a proxy battle after its CFO and two other bankers bolted to a rival.

February 14 -

The entire banking industry needs to join the fight instead of waiting for Congress to act.

February 14