Community banking

Community banking

-

They all agree that legislation is needed, but the two approaches being offered are exposing tensions.

February 14 -

Criticism of the National Credit Union Administration is unwarranted given the myriad of abuses banks commit.

February 14 -

While proponents contend the model could help reach the underbanked, there remain many arguments against it.

February 14 -

Now the organizers of American Bank & Trust must raise $20 million to open the state's first new bank since the financial crisis.

February 13 -

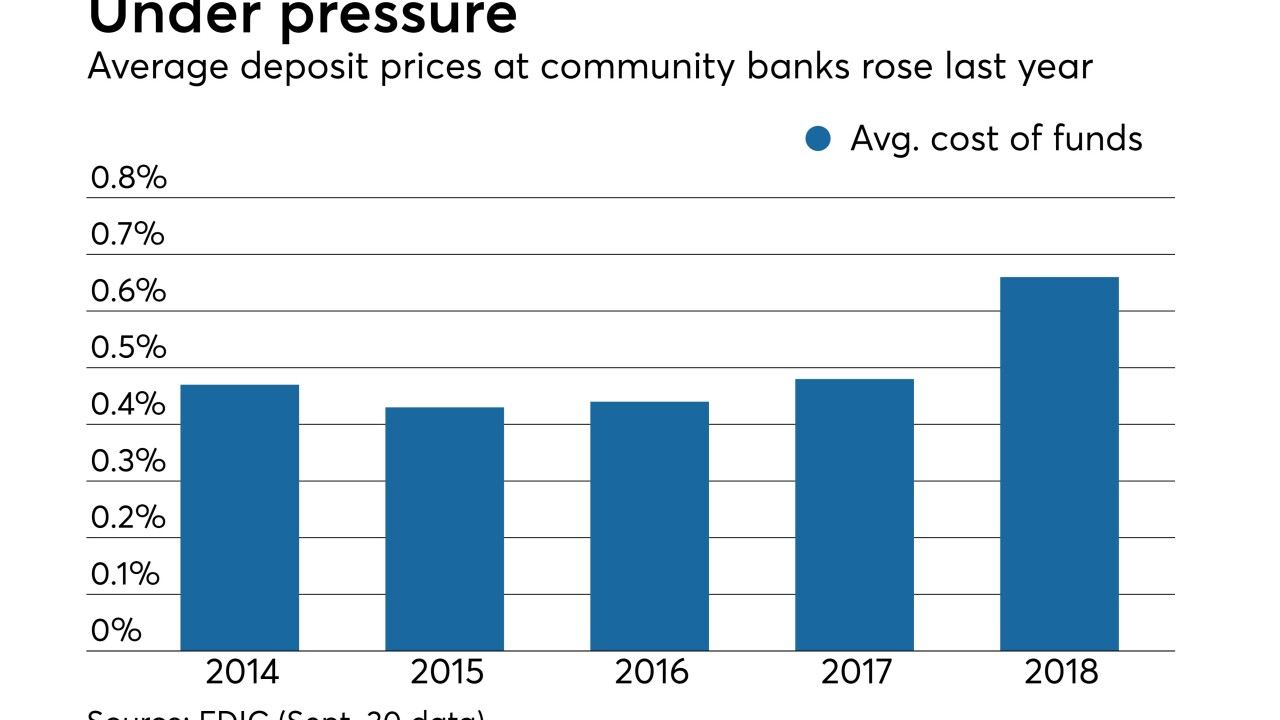

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

Members of both parties want to make it easier for legal cannabis businesses to access financial services, but myriad obstacles stand in the way of that goal.

February 13 -

The biggest merger in years is reviving the idea that the industry is headed for a barbell-like shakeout, with very large banks on one end, community banks on the other and very few in between.

February 13 -

The New Jersey bank said it will save millions of dollars by eliminating the jobs as well as selling and leasing back some of its real estate.

February 13 -

OceanFirst in New Jersey shuttered more than a third of its branches but says nearly all the customers stuck with the bank because it trained employees to show customers how to go digital.

February 12 -

The agency's update is good news for banks digesting data suggesting that nonbanks cut into their share of small-business loans during the partial government shutdown.

February 12 -

Rheo Brouillard, the head of SI Financial, finally had a solid offer in hand after more than two years of searching for a buyer. But the resignation 10 days later of the man who made him that offer — Berkshire Hills’ Michael Daly — sent Brouillard scrambling.

February 12 -

The possible replacement for Libor's volatility raises concern about its viability; new Fed governor says community banks punished for crisis the did not cause.

February 12 -

If the government insists on forcing another shutdown, business owners are intent on letting Congress know how much the last one hurt.

February 11 -

In her first speech as a governor, the former community banker and Kansas state regulator highlighted the strengths of smaller institutions and the banking agencies' tailoring efforts.

February 11 -

On Sep. 30, 2018. Dollars in thousands.

February 11 -

On Sep. 30, 2018. Dollars in thousands.

February 11 -

Regional and community banks are eager to buy branches and hire top performers from the merging companies.

February 8 -

Nine banks agreed to be sold to credit unions last year. Some industry observers believe that number could double this year.

February 8 -

After a 50% increase in bank acquisitions by credit unions last year, analysts are predicting even more deals in 2019.

February 7 -

John Asbury says his Virginia bank, soon to be renamed Atlantic Union Bank, could eventually stretch from Charlotte, N.C., to Baltimore and take on the big players that dominate those markets.

February 6