Community banking

Community banking

-

The central bank’s top regulatory official discussed how the Fed is using listening sessions in isolated communities to understand the effect of losing the one bank in town.

October 4 -

The 2018 Most Powerful Women in Banking festivities kicked off Wednesday night with cocktails and conversation at the Alley Cat Amateur Theater in New York's Financial District.

October 4 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

A new agency Web page has information on nearly every aspect of the agency's operations, including de novo applications, bank exams and failures.

October 3 -

Better incentives to lend and invest in underserved communities are also worthy of consideration, Loretta Mester says, as regulators try to blend the best of the Community Reinvestment Act with new ideas in updating its rules.

October 3 -

The agencies issued a joint statement on the types collaborative arrangements that a bank could employ to make BSA/AML compliance more efficient.

October 3 -

Hanmi alleges that SWNB's directors actively advised the Houston bank's investors to reject the merger.

October 3 -

Applications this year are more than double the 2017 mark and the most since 2009. But with some fintechs withdrawing their bids, observers are urging caution.

October 3 -

The regional bank is putting its corporate stamp on branches in the two states.

October 3 -

The economy could “positively slow down in mid-2019” and consumer debt levels are a huge concern, but technology and lessons learned from the crisis could still create opportunity for small banks, says Beneficial’s Gerry Cuddy ahead of a big speech on current conditions.

October 2 -

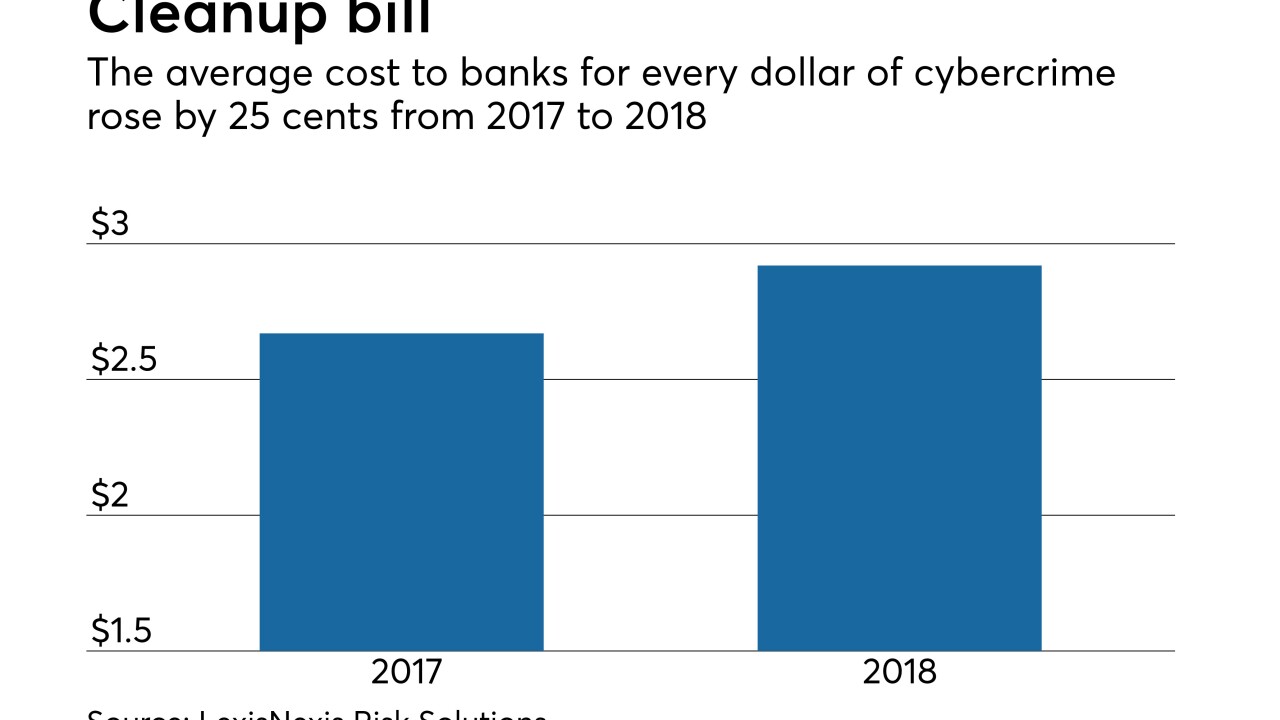

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

The company will pay $96 million to buy HomeTown Bankshares to gain scale in western Virginia.

October 2 -

The company will record a quarterly charge after reporting potential fraud tied to commercial deposit accounts.

October 1 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

On Jun. 30, 2018. Dollars in thousands.

October 1 -

Citizens & Northern will pay $43 million for the $348 million-asset Monument.

October 1 -

AmeriNational Community Services plans to form an industrial bank in Nevada.

October 1 -

Copying big banks, smaller institutions are pairing with robos to meet changing mass-affluent preferences in long-term investment products.

September 28 -

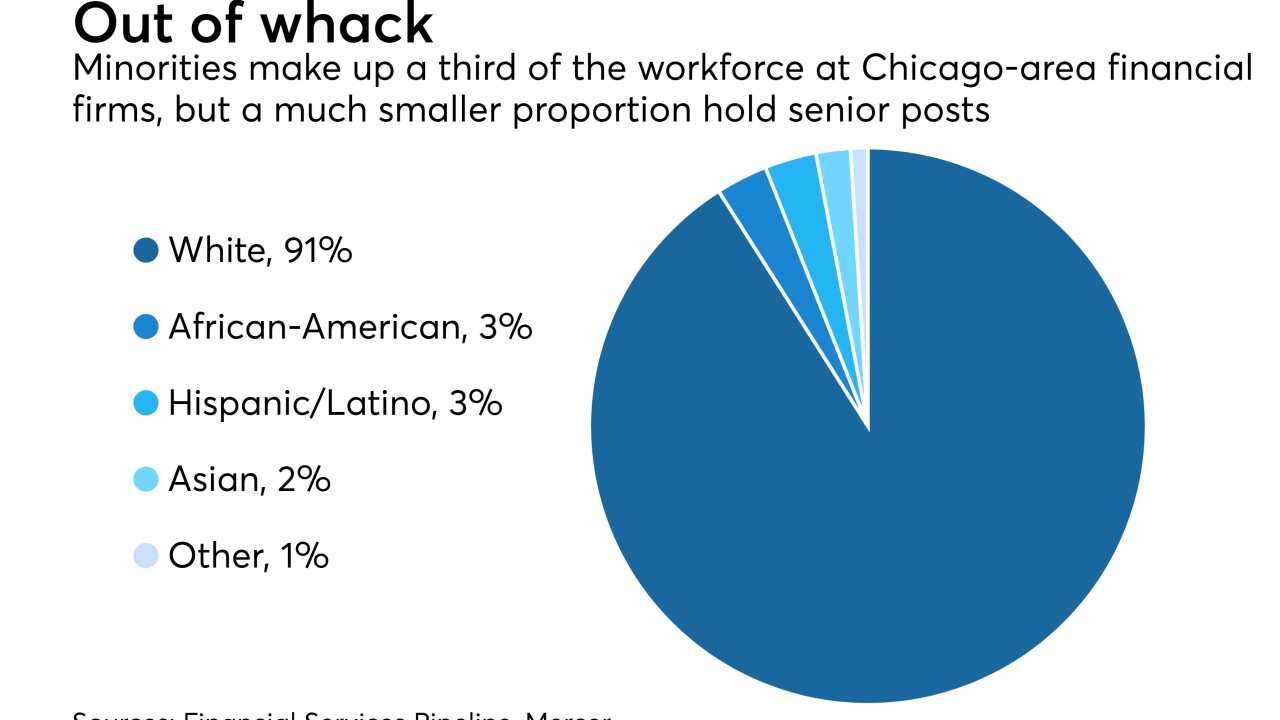

Perseverance and commitment are two requirements to get more minority bankers into senior leadership positions.

September 28