-

After years of laying the groundwork, Thrivent Financial for Lutherans has converted its credit union into an all-digital bank. Here's a look at the company's strategy.

June 9 -

Community banking highlights in 2024 included strong deposit growth at a Los Angeles-based digital-only bank, continued regulatory scrutiny of banking-as-a-service arrangements, along with a transformational deal in the Old Dominion.

December 31 -

VersaBank in London, Ontario, agreed nearly two years ago to buy a small Minnesota bank. The buyer's CEO says he remains hopeful approval will come soon.

March 27 -

CEO Scott Sanborn said it's unclear when demand from banks to buy the fintech's loans will return.

October 26 -

The partners aim to lend $150 million in the next three years to sellers from "socially and economically distressed communities."

September 29 -

Singapore country head Shee Tse Koon describes the bank's push to create a massive marketplace that offers everything from hotel reservations to health care.

September 8 -

Octane Lending is among the financial companies that have begun adopting software that the startup FairPlay calls "fairness as a service" as regulators scrutinize banks' artificial intelligence-based loan decisions.

July 18 -

Changing the retailer's prepaid card into a demand deposit account gives customers access to more digital banking tools.

June 24 -

A comprehensive strategy around when and how consumers pay bills online can better help credit unions understand members' behavior patterns and deepen those relationships.

April 5 Payveris

Payveris -

Join Jim McKelvey, co-founder of Square as he offers his insights into where the Fintech industry is headed next year. Will a Biden administration insist on greater regulation? What will happen in the cryptocurrency markets? What will be the big IPOs in the sector? Will GooglePlex make a big splash? What new technologies or applications should we be expecting?

-

Though most bank customers expect to return to calling or meeting in person with their bankers when the pandemic is over, Citigroup is gauging how much business it can keep in the videoconferencing channel.

November 10 -

Clients of the challenger bank's robo-adviser are able to see one another's trades, add comments and watch a leaderboard of top investors.

October 14 -

Ownership will transfer to DotCoop, which has committed to continuing to develop the domain for industry use.

October 2 -

BofA, which has applied for or been granted thousands of patents, has been working recently on technologies that analyze spending patterns to give budgeting advice and use augmented reality to provide estate-planning services.

September 14 -

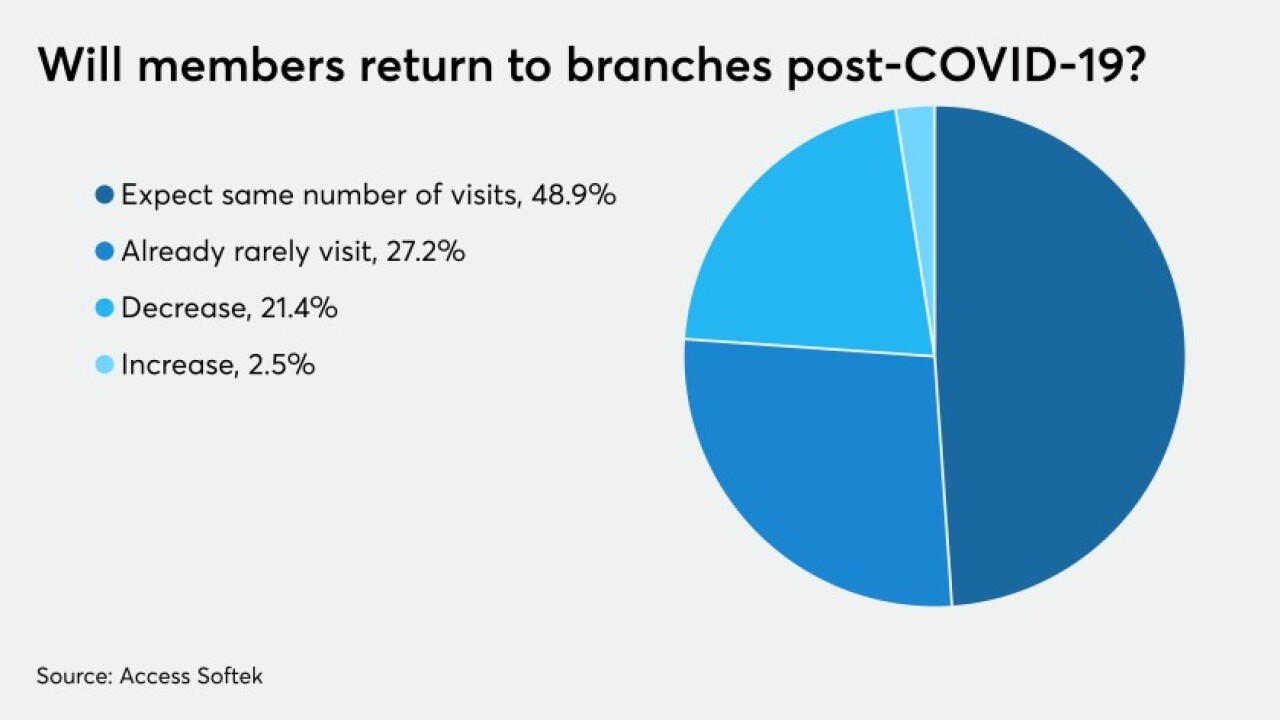

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 PenFed

PenFed -

More than half of adult consumers who don't use their parents' credit union say it is because they have moved out of that market, according to a new study from Access Softek.

August 19 -

Many will need to ramp up security protocols and reconsider which services require a high-tech versus human touch.

August 10 CCG Catalyst

CCG Catalyst -

As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

August 7 American Bankers Association

American Bankers Association -

Five banks, including BBVA USA and BMO Harris Bank, and one credit union will begin offering Google-branded bank accounts in 2021.

August 3