Community banking

Community banking

-

Community banks are grappling with a quickly changing operating environment, but they might have some practical advantages over large banks in building partnerships with fintech firms, and those relationships could give them the competitive edge they seek.

April 22 -

Bankers blamed regulators' new methodologies for rating certain energy loans and a new two-stage shared national credit review process for an increase in downgrades and loan-loss provisions. Regulators reportedly are reacting to an increase in second liens tied to exploration and production companies.

April 22 -

The biggest investor in Middleburg Financial plans to withhold support for the company's director nominees.

April 22 -

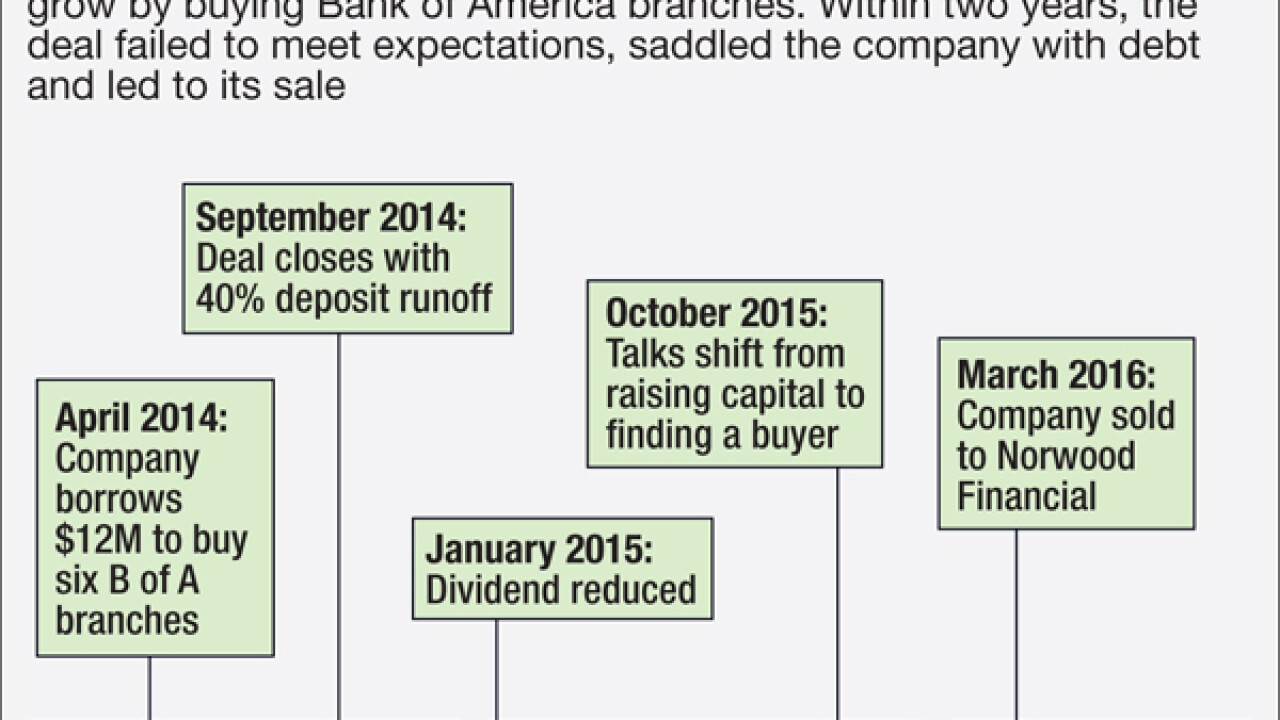

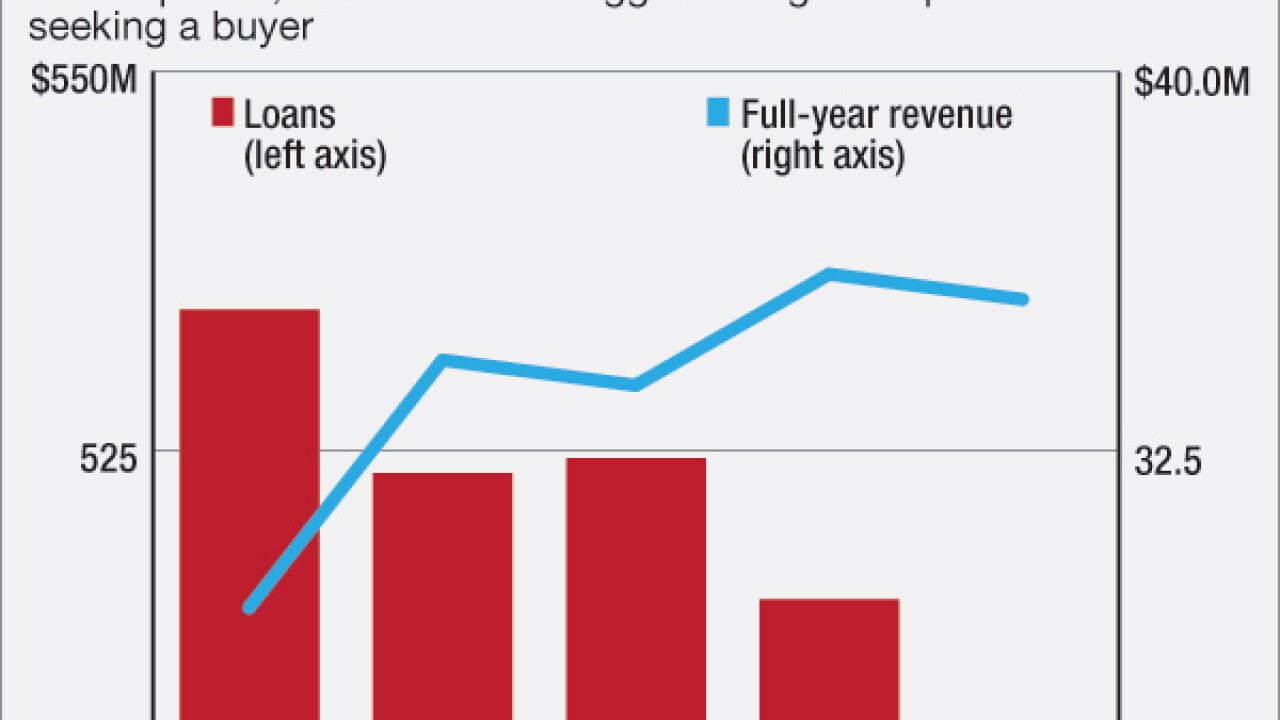

Delaware Bancshares in New York thought it was set to grow and diversify after buying six Bank of America branches. Instead, the deal led to the company selling itself.

April 22 - South Carolina

South State in Columbia, S.C., is planning to close 11 branches over the rest of this year.

April 22 - Pennsylvania

F.N.B.'s acquisition of Metro Bancorp bulked up the Pittsburgh company's loan book, but M&A costs ate into its first-quarter profit.

April 22 - Arizona

Western Alliance Bancorp. in Phoenix reported higher first-quarter profit as its remains a busy dealmaker.

April 21 -

The Paris Agreement on limiting the rise in global temperatures opens up new lending opportunities related to low-carbon projects while highlighting an array of new risks for financial institutions.

April 21 - Connecticut

People's United Financial in Bridgeport, Conn., reported higher first-quarter profits as it increased lending for both commercial and residential real estate.

April 21 -

High Point Bank considered bulking up to the size of other community banks in its market but quickly realized that the strategy would involve significant expense, risk and capital. So the company ended up selling to BNC Bancorp.

April 21 -

There are countless considerations banks face when joining another institution, but blending two distinct organizational philosophies into a healthy culture must be a top priority.

April 21 -

Glacier Bancorp in Kalispell, Mont., has agreed to buy Treasure State Bank in Missoula, Mont., for $12.9 million in cash and stock

April 21 -

Competitive pricing and softening demand at the high end of the apartment- and condo-building market had executives at BankUnited, Signature and New York Community answering tough questions about their growth projections and diversification strategies.

April 20 -

University Bancorp in Michigan says the main goal of its recent debt offering was to raise capital, but it also was designed to comply with Sharia and other religious standards that guard against usury.

April 20 -

Research published in 2014 found that just 18% of U.S. checking account holders pay 91% of all bank overdraft fees.

April 20 -

Emigrant Bank in New York has asked for regulatory approval to double its ownership stake in The Bancorp in Wilmington, Del.

April 20 -

Two St. Louis-area investors have been indicted on charges they defrauded the failed Excel Bank on real estate loans.

April 20 -

Profit declined at Fulton Financial in Lancaster, Pa., in the first quarter, as broad-based loan growth was offset by a drop in noninterest income.

April 19 -

Hancock Holding in Gulfport, Miss., reported a steep drop in quarterly earnings that reflected ongoing energy woes.

April 19 -

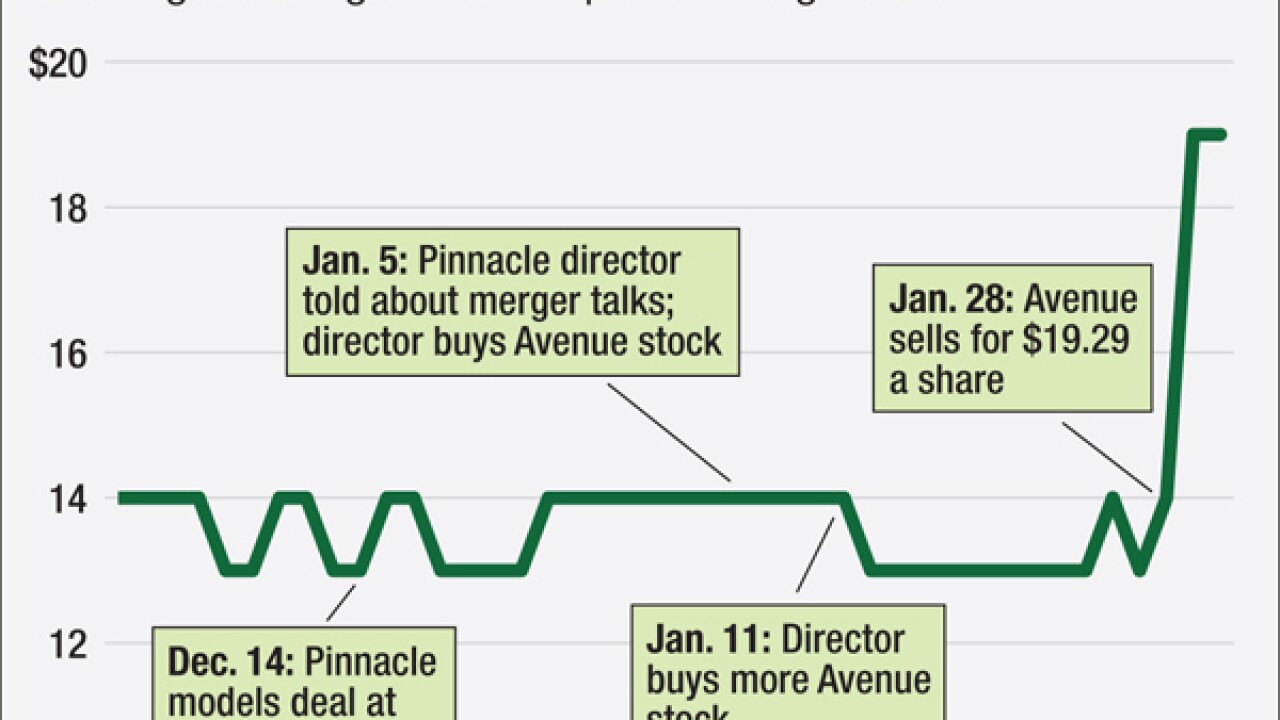

Sometimes boards have to police their own, as an insider-trading case involving a Pinnacle Financial director shows. The risks are especially high when banks enter confidential merger talks.

April 19