Community banking

Community banking

-

Executives at banks that have not taken advantage of low stock prices to buy up their own shares could get hammered during quarterly earnings calls in April.

March 18 - Ohio

Banks change top executives all the time, but it's rare that one leaves for another venture and simultaneously gets recruited to the board of the bank he or she is leaving.

March 18 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 18 -

Old Point Financial in Hampton, Va., has agreed to nominate an activist investor's candidate for its board.

March 17 -

Independent Bank Corp. in Rockland, Mass., has agreed to buy New England Bancorp in Hyannis, Mass., the parent of Bank of Cape Cod, for $30.7 million.

March 17 - Virginia

C&F Financial in West Point, Va., has named Jason Long chief financial officer of the company and its Citizens and Farmers Bank subsidiary.

March 17 -

A small Connecticut bank takes the plunge into mobile-friendly mortgages in a bid to turn an attractive pool of student-loan borrowers into lifetime customers.

March 17 -

Atlantic Bancshares in Bluffton, S.C., has raised about $4 million to redeem shares issued through the Troubled Asset Relief Program.

March 17 -

Consolidation is increasing risk to the Federal Deposit Insurance Corp. while reducing diversification in the industry.

March 17 -

Wings Financial Credit Union has scored a deal to take over a branch from U.S. Bank at Minneapolis-St. Paul International Airport.

March 17 - Louisiana

First NBC Bank Holding in New Orleans will likely cut its 2015 profit after it discovered errors in its accounting for tax credits.

March 17 -

Lawmakers sharply criticized the Federal Deposit Insurance Corp. on Wednesday over a watchdog report that said the agency used abusive tactics to stop banks from offering refund anticipation loans.

March 16 -

Guaranty Bancorp in Denver has agreed to buy Home State Bancorp in Loveland, Colo., for $133.7 million in cash and stock. The deal is expected to close in the summer.

March 16 - Georgia

The Federal Reserve recently announced that it had released five community banks from enforcement actions.

March 16 -

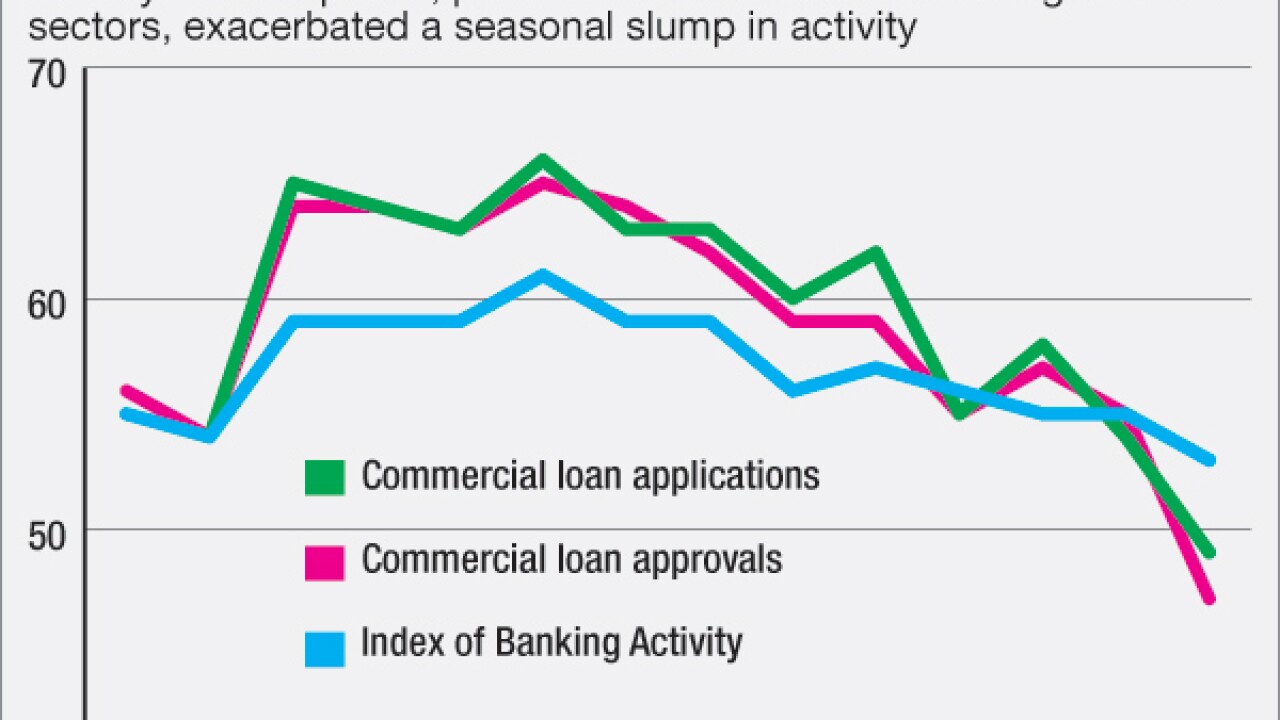

American Banker Research's Index of Banking Activity, which had the lowest reading in its nearly four-year history in January, revealed that issues in oil-producing states are contributing to decreases in commercial loan applications and approvals.

March 16 -

Research shows the more consumers interact with branch staff, the more they dislike the brand. To improve their image, banks need to emulate Apple and focus on every customer experience detail in tech and in person.

March 16 -

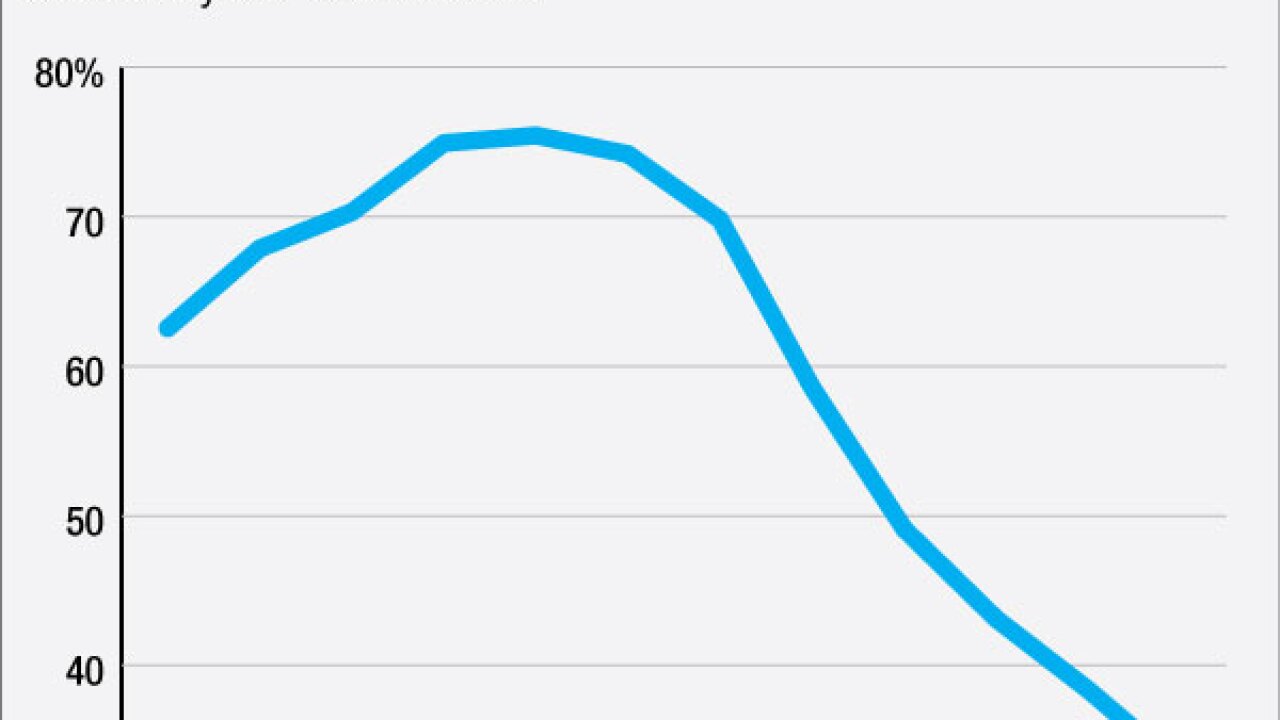

Loans outpacing GDP and the expressed optimism of CEOs on recent earnings calls are among the signs that growth figures are too good to be true.

March 16 -

Unity Bancorp in Clinton, N.J., has bought its corporate headquarters building for $4.12 million.

March 16 -

The San Rafael, Calif., company has stayed at roughly the same asset size for six years now, even though it has the capacity and desire to become much larger. The reasons speak to the competitiveness among lenders and the fickle nature of bank M&A.

March 15 -

First Resource Bank in Exton, Pa., has redeemed its remaining preferred shares tied to the Small Business Lending Fund.

March 15