Community banking

Community banking

-

The beleaguered Long Island bank has recently seen at least 16 teams walk out the door, according to announcements by Dime Community Bancshares and Peapack-Gladstone Financial.

April 9 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

A combination of higher interest rates and increased vacancies — especially in office buildings — are leading to more apprehensions in commercial real estate.

April 8 -

A year ago, the National Community Reinvestment Coalition accused KeyBank of redlining. On Wednesday, the NCRC and Key announced a $25 million "agreement" that NCRC CEO Jesse Van Tol says could open the door to a new community benefits plan.

April 3 -

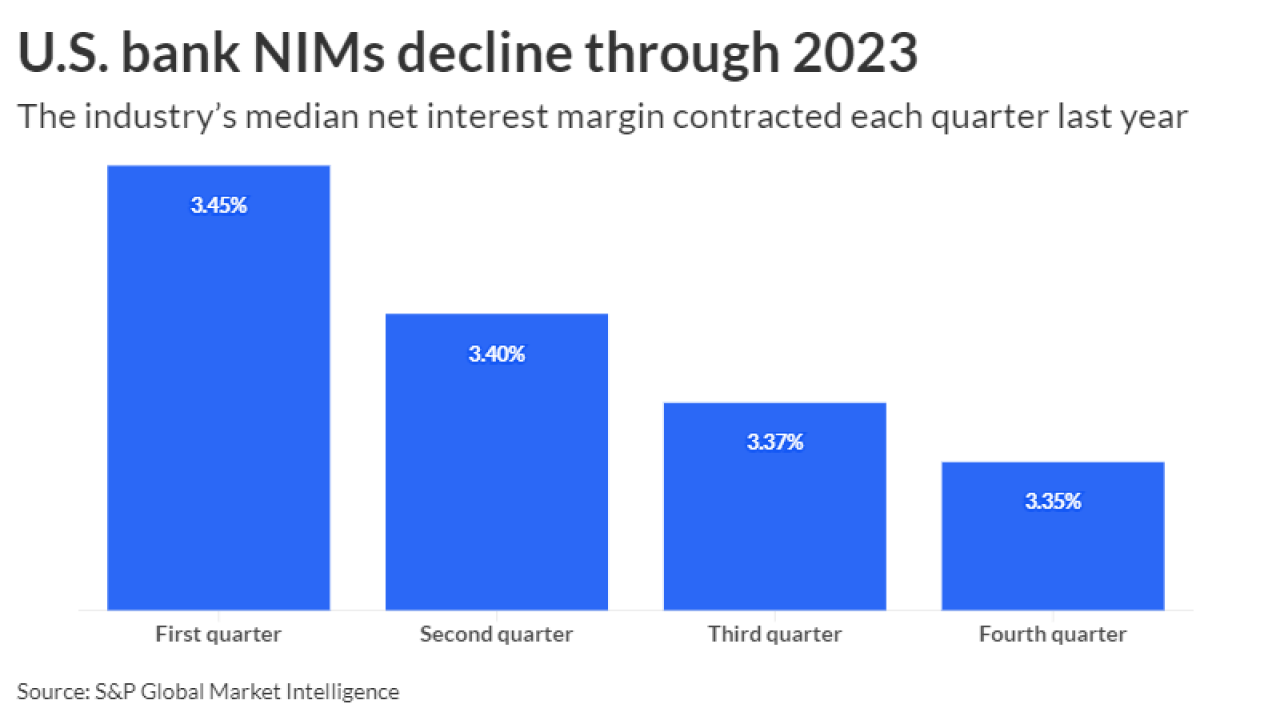

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Houston-based Prosperity Bancshares said it closed its purchase of Lone Star State Bancshares about a year later than initially planned.

April 2 -

Mergers have left Virginia without an independent statewide financial institution. Atlantic Union CEO John Asbury is trying to change that.

April 1 -

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

VersaBank in London, Ontario, agreed nearly two years ago to buy a small Minnesota bank. The buyer's CEO says he remains hopeful approval will come soon.

March 27 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

The Justice Department and the CFPB are increasingly relying on emails among employees that contain discriminatory comments to strengthen their hand in cases against lenders.

March 24 -

Harborstone Credit Union in suburban Lakewood, Washington, plans to buy Savi Financial. That's seven deals in less than three months this year; the highest full-year total was 16 in 2022.

March 22 -

At an American Bankers Association event, Sen. Jon Tester, D-Mont., who's up for reelection this year, said that he hopes the Durbin-Marshall credit card bill won't go anywhere and criticized the Federal Reserve's debit interchange proposal.

March 20 -

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

March 18 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

Peapack-Gladstone's wealth unit is pursuing an ambitious de novo expansion in New York and perhaps elsewhere because M&A has become expensive as private equity money has inflated seller expectations.

March 13 -

The new team at Dime Community Bancshares intends to attract funding from an array of niche business segments, including medical billing, so-called death care services and hedge funds.

March 13 -

Sound Credit Union said it would acquire Washington Business Bank in a cash deal slated to close in the fourth quarter.

March 11