Community banking

Community banking

-

The pressure is on CEO Christopher Myers, one of our community bankers to watch, to make the most of CVB Financial's biggest acquisition to date.

December 26 -

Investors are spooked by banks' exposure to oil and other sectors threatened by a global slowdown as well as by policy uncertainties, but banks argue credit quality is strong and recession fears are exaggerated.

December 26 -

The Jacksonville, Fla.-based credit union purchased the facility from Atlantic Coast Bank for $2.2 million.

December 26 -

Cadence has upped the exchange ratio by 10%, a move made necessary by the 40% decline in its stock price since the deal was announced in May.

December 26 -

While these five bankers made headlines this year, not all of them did so for good reasons.

December 25 -

The settlement of a fight with an insurance company over officer and director coverage yielded a $6 million payout for FNCB in Dunmore.

December 24 -

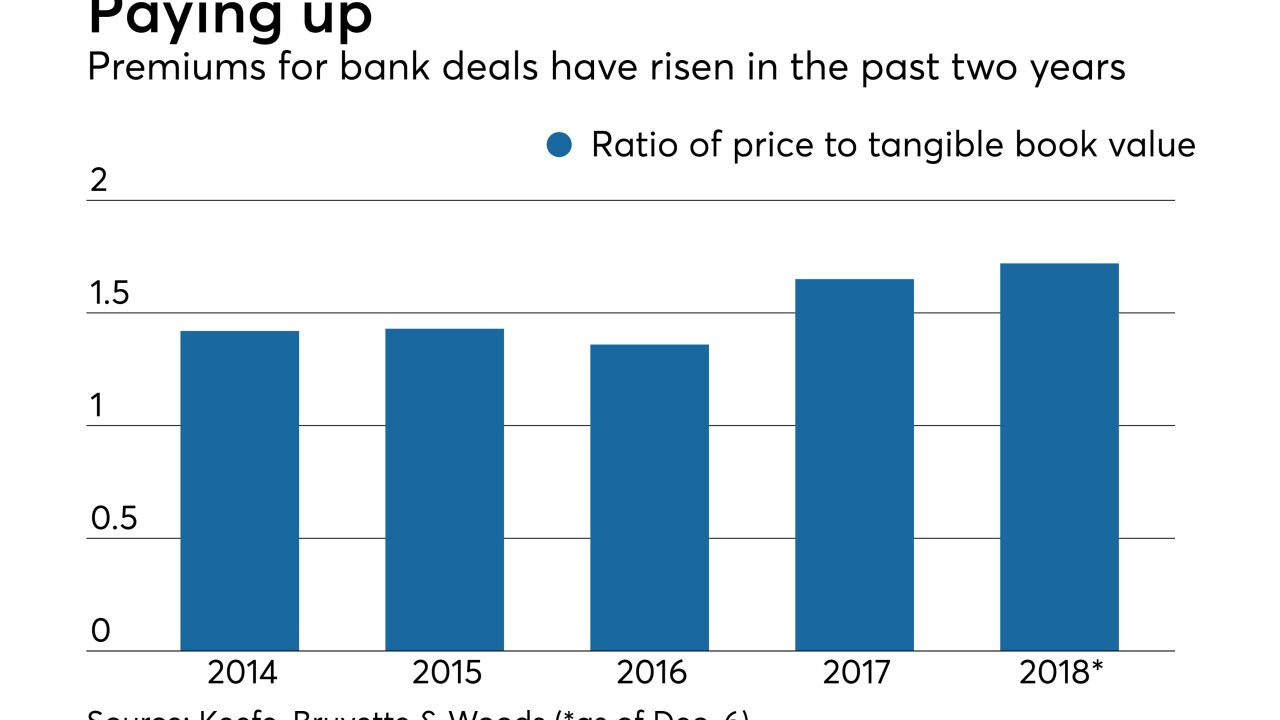

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

CBTX said an unauthorized person obtained personal information for about 7,800 customers.

December 21 -

The combination of CCF Holding, Heritage Bancorp. and Providence Bank will create a $1 billion-asset institution. Veteran bank investor Kenneth Lehman will be its chairman.

December 21 -

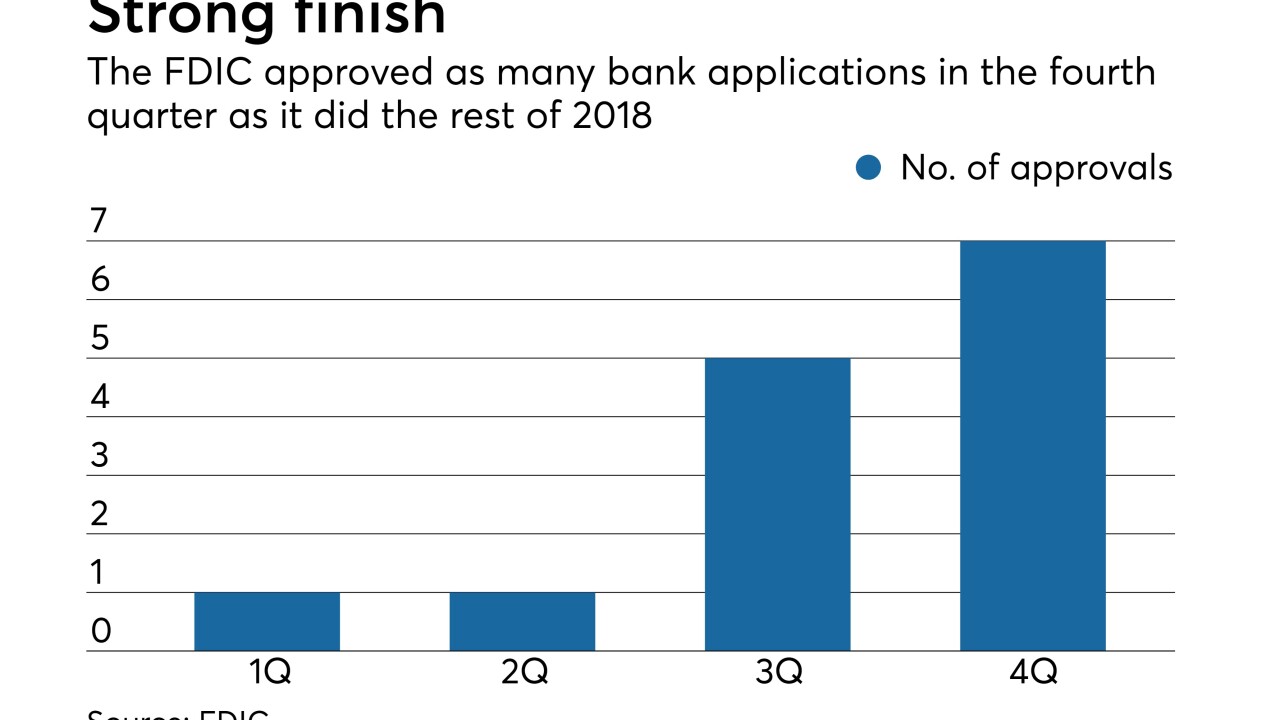

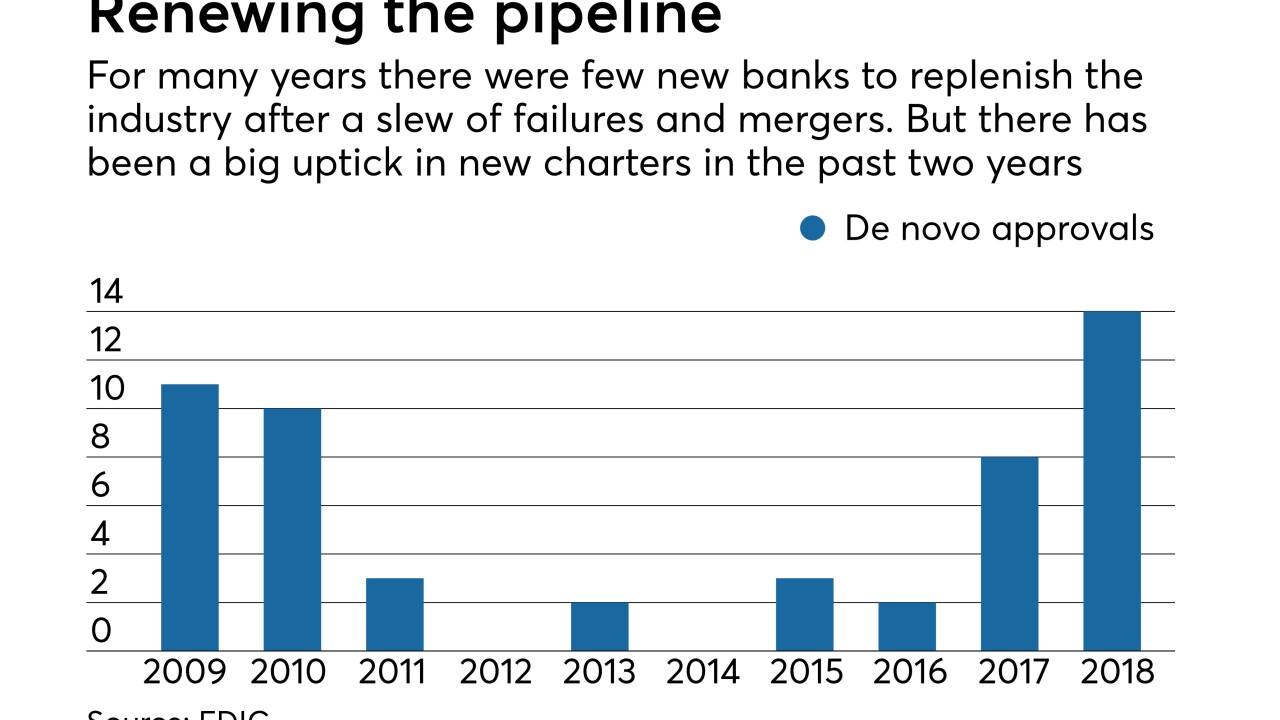

More banks were approved this year than any since the financial crisis. But challenges with raising capital, and a change in the political landscape, could deter prospective applicants next year.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

The federal banking regulators have proposed allowing more directors and management officials to serve at more than one institution in an effort to provide relief to community banks.

December 20 -

David Rupp was CEO of Four Oaks Fincorp in North Carolina when it sold itself to United Community Banks last year.

December 20 -

The FDIC has approved more new banks this year than in the last four years combined. Here is a look at the class of 2018.

December 20 -

Detractors are suddenly hopeful that the controversial accounting standard could be delayed or altered after FSOC's longer-than-expected closed session on the issue.

December 20 -

Stock Yards will remove a competitor in Louisville, Ky., and enter two markets outside of the city.

December 19 -

The payments processor was among numerous firms earlier this year to withdraw an ILC charter application over questions about its plan.

December 19 -

Banks hoping to make working with the cannabis industry easier saw a positive sign this week when Congress removed the prohibition on a less potent substance.

December 19 -

The agency’s rate cap for banks that are less than well capitalized contains several flaws and poses problems for community banks.

December 19 -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 18