Community banking

Community banking

-

The economy could “positively slow down in mid-2019” and consumer debt levels are a huge concern, but technology and lessons learned from the crisis could still create opportunity for small banks, says Beneficial’s Gerry Cuddy ahead of a big speech on current conditions.

October 2 -

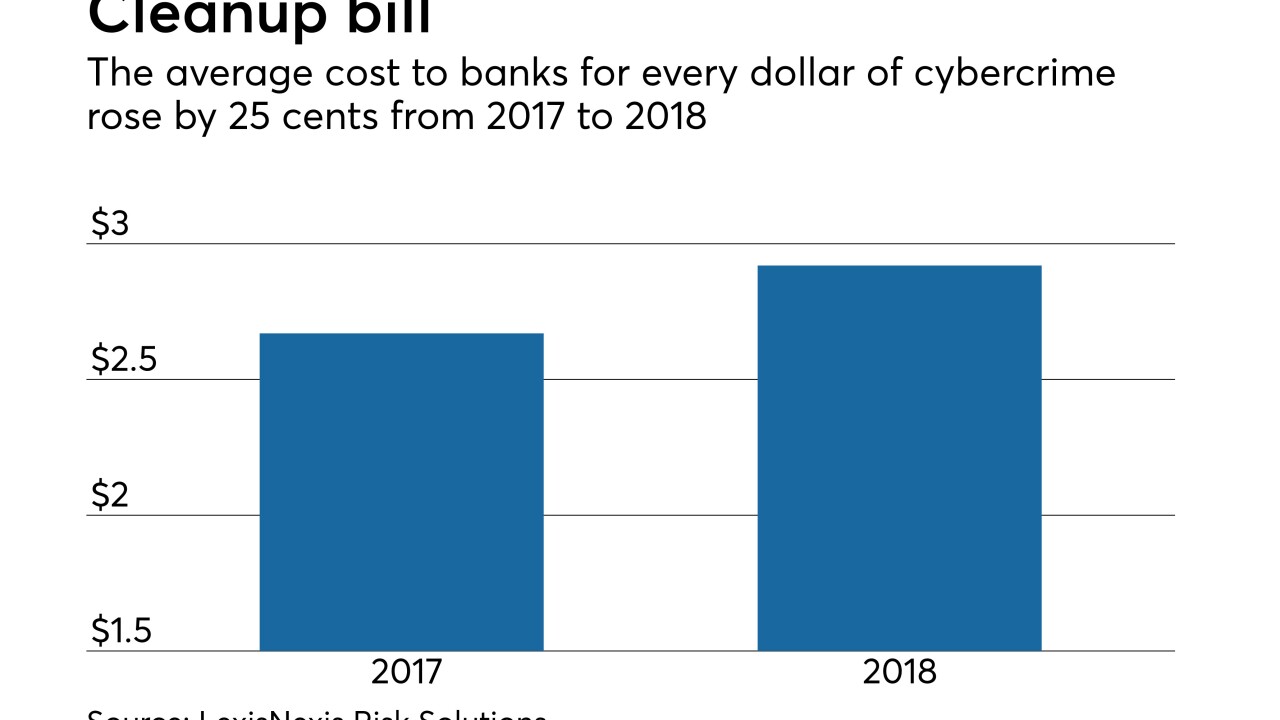

Banks’ tab to fight hackers rose 9% from last year by one measure. Investors want them to rein in tech investments, but security experts say the crooks are getting smarter and smarter.

October 2 -

The company will pay $96 million to buy HomeTown Bankshares to gain scale in western Virginia.

October 2 -

The company will record a quarterly charge after reporting potential fraud tied to commercial deposit accounts.

October 1 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

On Jun. 30, 2018. Dollars in thousands.

October 1 -

Citizens & Northern will pay $43 million for the $348 million-asset Monument.

October 1 -

AmeriNational Community Services plans to form an industrial bank in Nevada.

October 1 -

Copying big banks, smaller institutions are pairing with robos to meet changing mass-affluent preferences in long-term investment products.

September 28 -

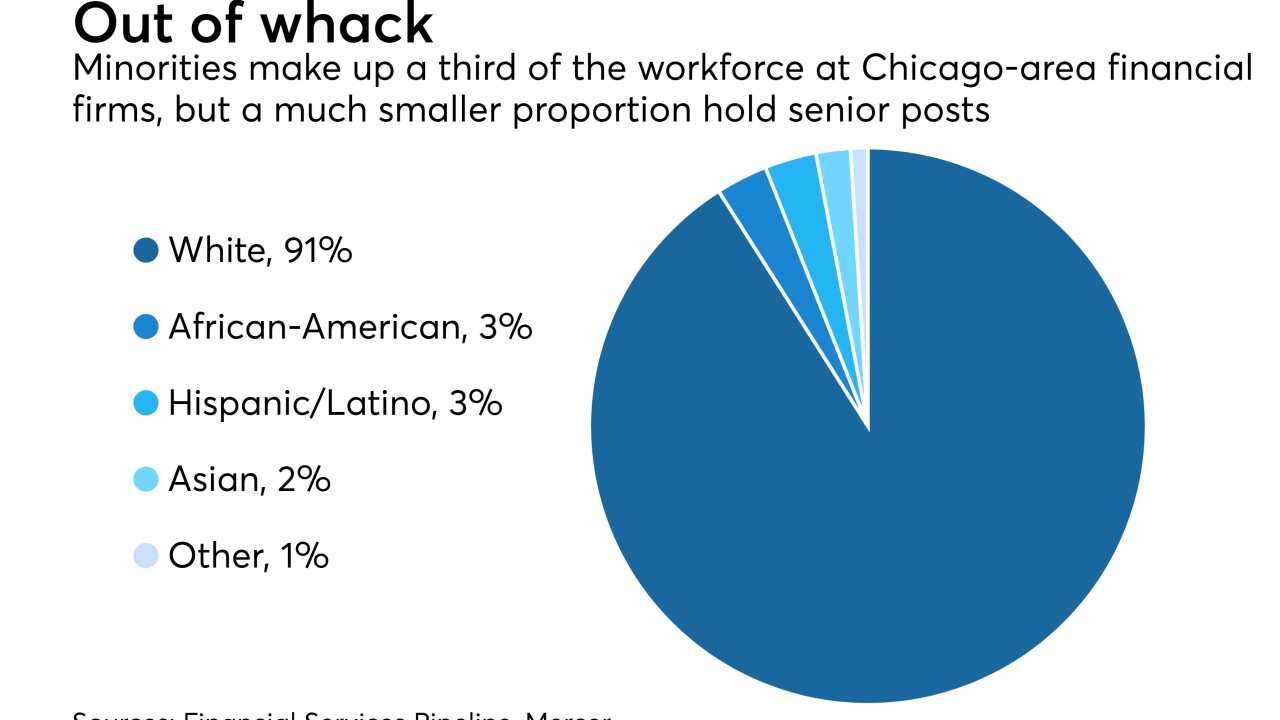

Perseverance and commitment are two requirements to get more minority bankers into senior leadership positions.

September 28 -

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

Hanmi Financial wants SWNB in Houston to pay a termination fee, citing "material breaches" of covenants tied to their now-defunct merger agreement.

September 27 -

Colin Walsh, Varo Money's CEO, learned a lot from his first stab at deposit insurance. Lesson one: Work with one regulator at a time.

September 27 -

Paul Yonamine will succeed Catherine Ngo as the company's leader next month. Ngo will continue to run Central Pacific's bank.

September 27 -

The Alabama-based credit union will gain three locations, along with $138 million in loans, as part of a deal with Georgia-based Synovus Financial.

September 27 -

In our "On Life" series of videos, top banking executives from the likes of Bank of America, Goldman Sachs and U.S. Bancorp share their favorite way to get exercise.

September 27 -

Jefferson Financial Federal Credit Union will gain three locations, along with $138 million in loans, as part of the transaction.

September 26 -

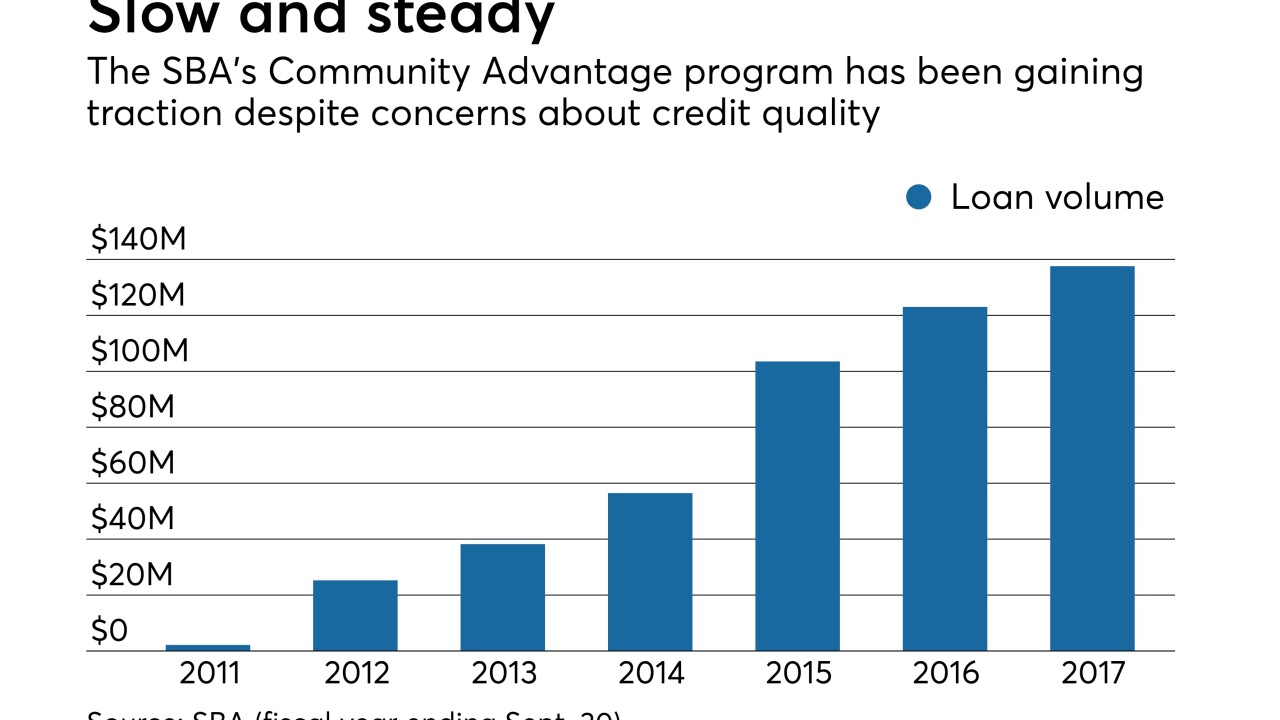

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

Gen Z recruits add a fresh perspective and provide a talent pipeline for the future, bankers say.

September 25