-

Bankers are taking the unusual step of asking the government for additional regulations ones that can be used to block the Consumer Financial Protection Bureau from seeking more data from financial institutions.

July 21 -

Profits rose at Citizens Financial in the second quarter thanks to higher-than-expected fee income and loan growth, including improvements in mortgages and auto finance as well as a continuing surge in student lending.

July 21 -

The Consumer Financial Protection Bureau's fifth anniversary marks an important shift for the agency in which it pivots from rules required by the Dodd-Frank Act to pursuing other areas.

July 20 -

The Consumer Financial Protection Bureau is expected to unveil a proposal on July 28 that would regulate debt collection practices.

July 15 -

WASHINGTON Republican lawmakers put Department of Housing and Urban Development Secretary Julian Castro on the hot seat Wednesday, criticizing his decision to allow nonprofit community groups to bid on more nonperforming Federal Housing Administration loans.

July 13 -

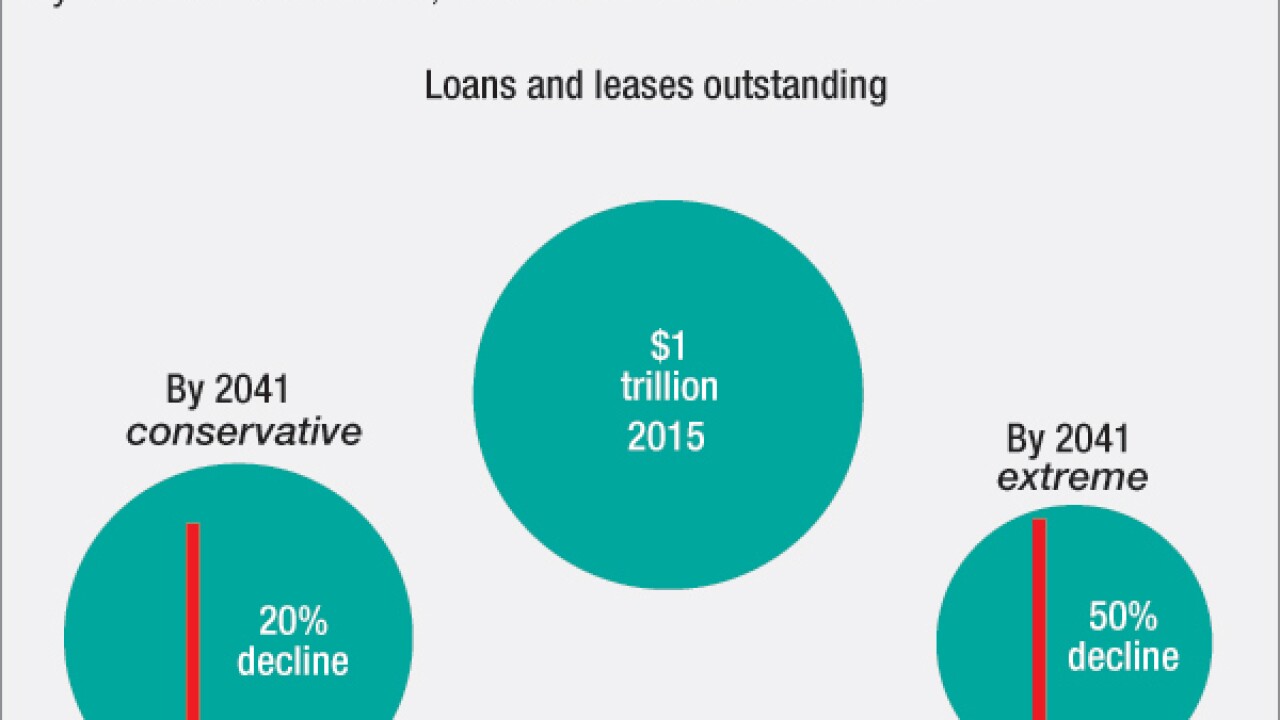

Despite recent controversy over Tesla crashes, the march toward autonomous driving technology continues. And that means big changes for auto lenders.

July 12 -

Santander Consumer Holdings in Dallas on Tuesday appointed William Rainer chairman, and it announced that Blythe Masters has resigned to advise Banco Santander its Spanish parent company on the blockchain.

July 12 -

The sharp fall in gas prices early this year helped U.S. consumers to stay current on their credit obligations during the first quarter.

July 7 -

Reports from the big three credit bureaus do not include information about payday loans, but a CFPB proposal figures to shake up that arms-length relationship.

July 6 -

The number of customers who obtained 10 payday loans in 2015 outnumbered those who obtained just one, the California Department of Business Oversight said in a report Wednesday.

July 6