-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

During the fourth quarter, the Buffalo, New York-based bank reported its lowest ratio of nonperforming loans to total loans since 2007.

January 16 -

Significant regulatory, legislative and business developments could shape the industry this year, putting pressure on banks to respond.

January 9 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

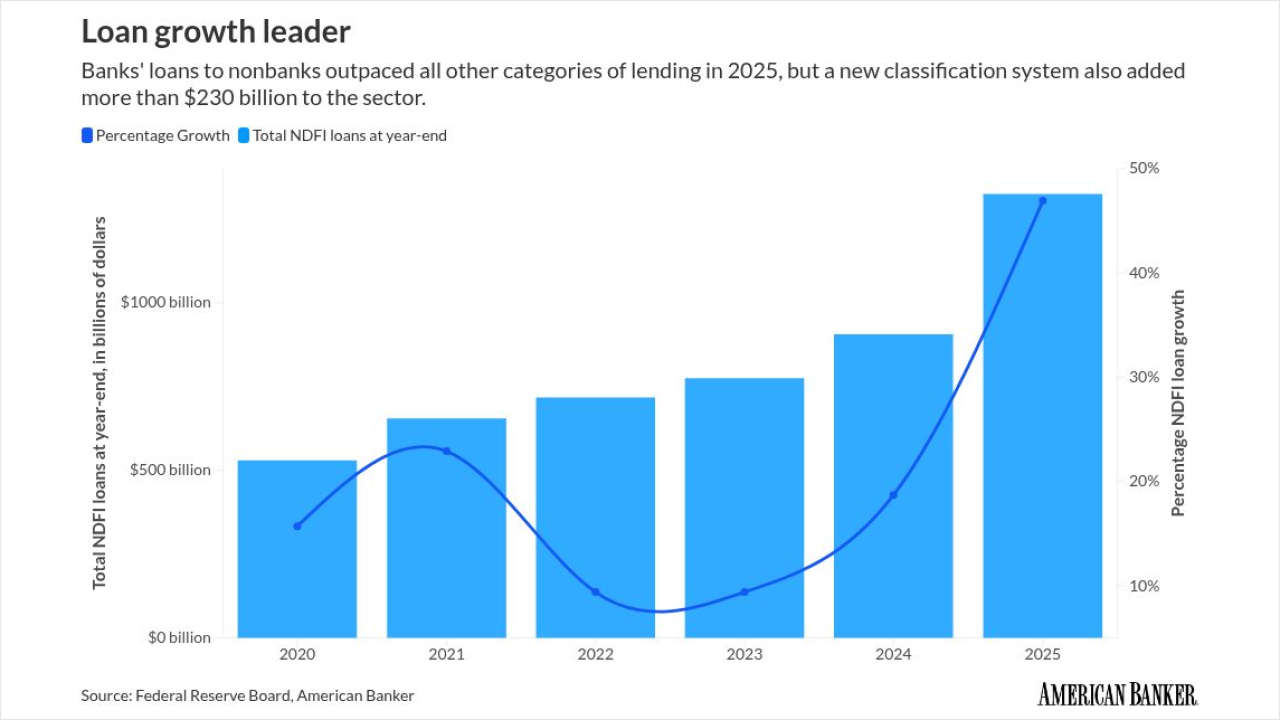

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

A survey compiled by the American Financial Services Association showed deteriorating business conditions during the third quarter of this year. The outlook for subprime borrowers was particularly grim.

December 8 -

Noelle Acheson looks at recent proposals to allow payment institutions access to central bank liquidity, and what this could mean for both banking and economic resilience.

November 25 -

The credit score firm partnered with Plaid to bring additional cash-flow data into its previously released UltraFICO score.

November 20 -

-

The credit reporting bureau released a new model that combines traditional and alternative credit history with cashflow data into a single score lenders can use for underwriting decisions.

November 11 -

Jerry Plush had helmed the South Florida-based bank for nearly five years before agreeing to depart this week. News of the leadership change comes little more than a week after Amerant reported a 43% increase in nonperforming assets.

November 6 -

Credit analysts say climate risk could still pose a financial threat to financial institutions, even though the federal government has taken an ax to Biden-era climate guidance.

October 29 -

The North Carolina bank is the latest lender impacted by the bankruptcy of U.S. auto parts maker First Brands. First Citizens executives said credit was in good shape overall.

October 23 -

Following a $60 million credit hit, the Salt Lake City bank said that it hasn't found any other related problem loans.

October 20 -

Regional banks say their asset quality is solid amid skittish investors. The KBW Nasdaq Regional Banking Index was largely stable Friday after falling by as much as 7% the day before.

October 17 -

The Cincinnati, Ohio-based bank delivered third-quarter earnings that mostly met expectations, even as it took a $200 million blow to credit.

October 17 -

Zions Bancorp. is among the latest banks to report material losses due to alleged borrower fraud. Stocks of regional lenders plunged on Thursday.

October 16 -

New Federal Reserve research reveals that identity theft victims who use extended fraud alerts often see significant and lasting credit improvements.

October 8 -

The credit scoring agency's rollout comes after years of criticism from home lenders over its prices, with delivery costs rising over 40% in the past year.

October 2 -