-

Alliance Data Systems, which has substantial exposure to the mall-based retail sector, sought Tuesday to assuage investors' fears about the impact of the COVID-19 outbreak.

March 25 -

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

March 25 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23 -

Banks are avoiding the once booming hospitality business, or charging a premium for additional credit, as new data shows how big a hit hoteliers have taken from the pandemic.

March 18 -

Lenders are concerned that the coronavirus outbreak will increase vacancies and add to credit risk.

March 17 -

Banks with the most exposure to oil and gas companies say they’ve added capital and changed their borrower mixes since the 2015 market fall. But skeptics question whether they can stave off losses if low prices endure.

March 10 -

The credit card issuer is seeking to rebound following a tumultuous year in which top executives departed and key retail partners declared bankruptcy.

March 4 -

A spike in loan-loss provisions dragged down first-quarter profits at the Toronto company’s U.S. unit.

February 25 -

The company revised its results to a net loss of $700,000 after deciding to record a $16 million loan-loss provision for the commercial loan.

February 24 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

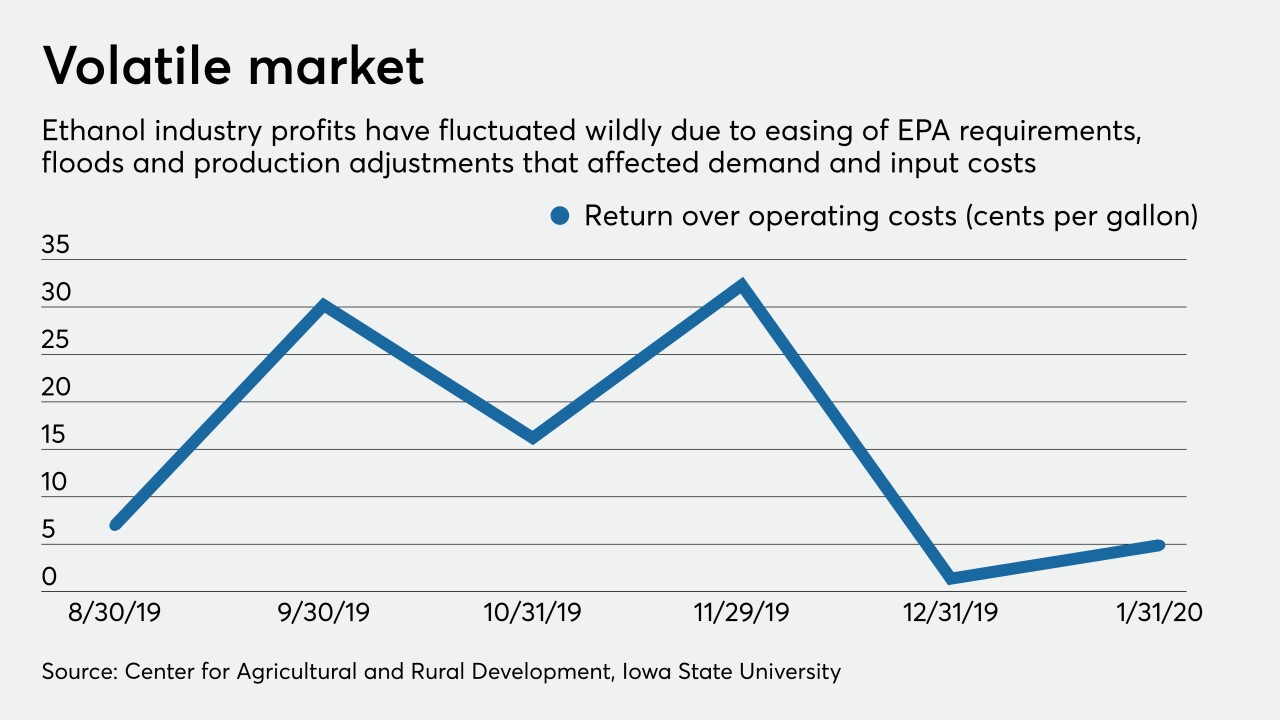

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31 -

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

January 29 -

The largest bank in Puerto Rico said hundreds of millions of dollars of its mortgages and consumer loans are tied to the parts of the island hit by the recent quake or still recovering from two hurricanes.

January 28 -

Shares of Discover Financial Services slumped the most in more than a decade after credit card lender warned that it will spend more on marketing and technology, including to beef up collections on troubled debt.

January 24 -

The credit card lender has seen problem loans spike since it introduced a feature that lets at-risk customers restructure loans through its online and mobile channels.

January 24 -

Franklin Financial agreed to be sold less than a year after issues surfaced in its portfolio of shared national credits.

January 22 -

The Dallas bank’s troubled energy loans reached a nearly two-year high as crude prices plummeted.

January 21 -

The Arkansas bank is bracing for a rough 2020 amid record prepayments and a big substandard loan in its commercial real estate book, but CEO George Gleason insists shareholders will see "a nice payoff" in the long run.

January 17