-

On Sep. 30, 2018. Dollars in thousands.

December 24 -

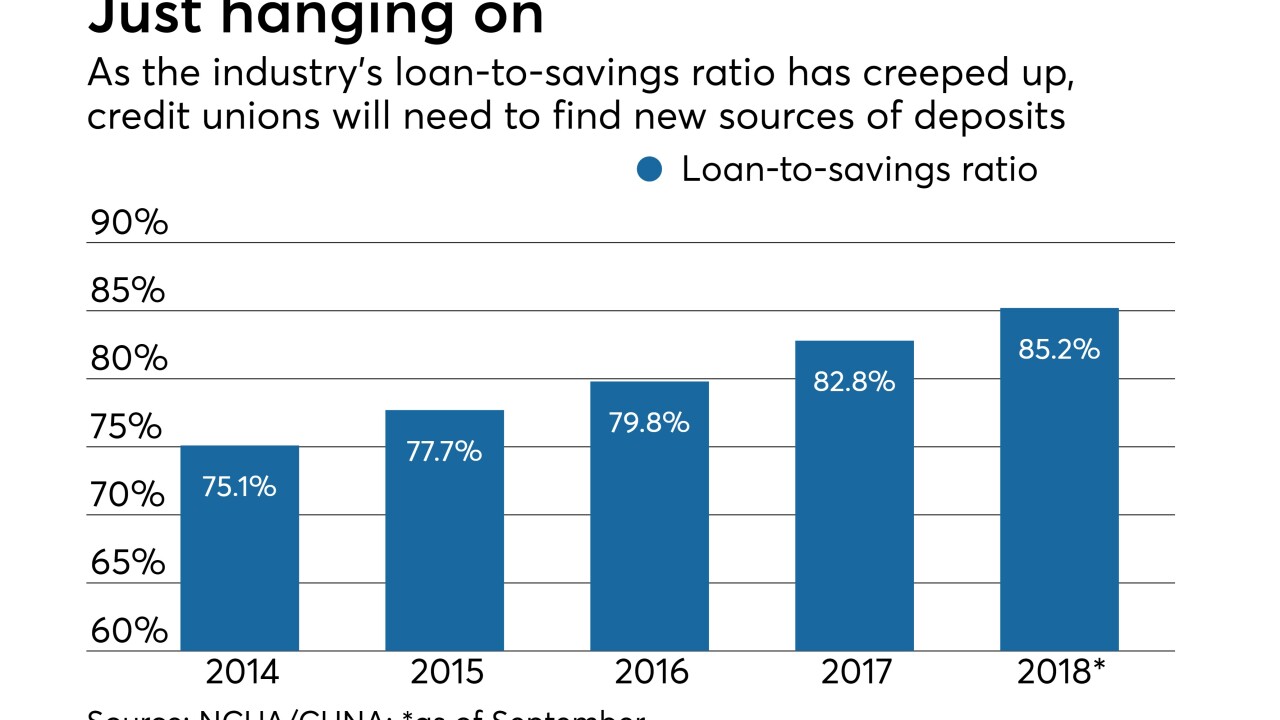

Amid rising rates and a surge in lending, credit unions will need to find additional sources of deposits to fund growth.

December 21 -

The agency’s rate cap for banks that are less than well capitalized contains several flaws and poses problems for community banks.

December 19 Independent Community Bankers of America

Independent Community Bankers of America -

Branch acquisitions, once a popular way to scale up in new markets, have started to go by the wayside in the digital age.

December 16 -

The fintech Robinhood did not contact the Securities Investor Protection Corp. to discuss protection for deposits, according to SIPC CEO Stephen Harbeck.

December 14 -

The San Diego bank has agreed to assume $225 million in deposits at no premium from Modern Woodmen of America, which is shuttering MWABank, its direct bank subsidiary.

December 14 -

Nearly 60% of people thinking about switching banks would be open to banking with a big tech company if they ever get that option. Cash incentives or existing savings accounts are big factors in consumer decisions — and things that banks could keep in mind in their efforts to recruit or retain customers.

December 10 -

It’s still primarily a commercial bank, but the branding campaign — CIT’s first in a dozen years — is designed to appeal to the group driving its torrid deposit growth: retail savers.

December 7 -

On Jun. 30, 2018. Dollars in thousands.

December 3 -

Zions' Harris Simmons named Banker of the Year; distilling the hopes and hang-ups around CRA reform; new grist in still ongoing debate over Operation Choke Point; and more from this week's most-read stories.

November 30