-

The emergence of lenders that have no real connection to a geographic area prompts questions over how the Community Reinvestment Act's "good neighbor" policy can continue.

August 10

-

PricewaterhouseCoopers LLP failed to spot for seven years a multibillion-dollar fraud that led to the demise of Taylor Bean & Whitaker Mortgage Corp., a lawyer for the lender's bankruptcy trustee told a Miami jury on Tuesday.

August 9 -

American International Group Chief Executive Peter Hancock said he's more focused on boosting returns than worrying about the government's classification of his company as a systemically important financial institution.

August 9 -

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

August 9 -

The marketplace lender OnDeck Capital is sticking with its lend-and-hold strategy even though the practice contributed to a second consecutive quarterly loss.

August 8 -

The Inspector General of the Department of Housing and Urban Development has found a new ally in his fight to reform the down payment assistance programs run by HUD and state and local housing finance agencies.

August 8 -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 -

The biggest change in banking in the last 60 years is the shift in balance sheets from business lending to real estate finance and therefore more risk tied to volatile real estate prices.

August 8

-

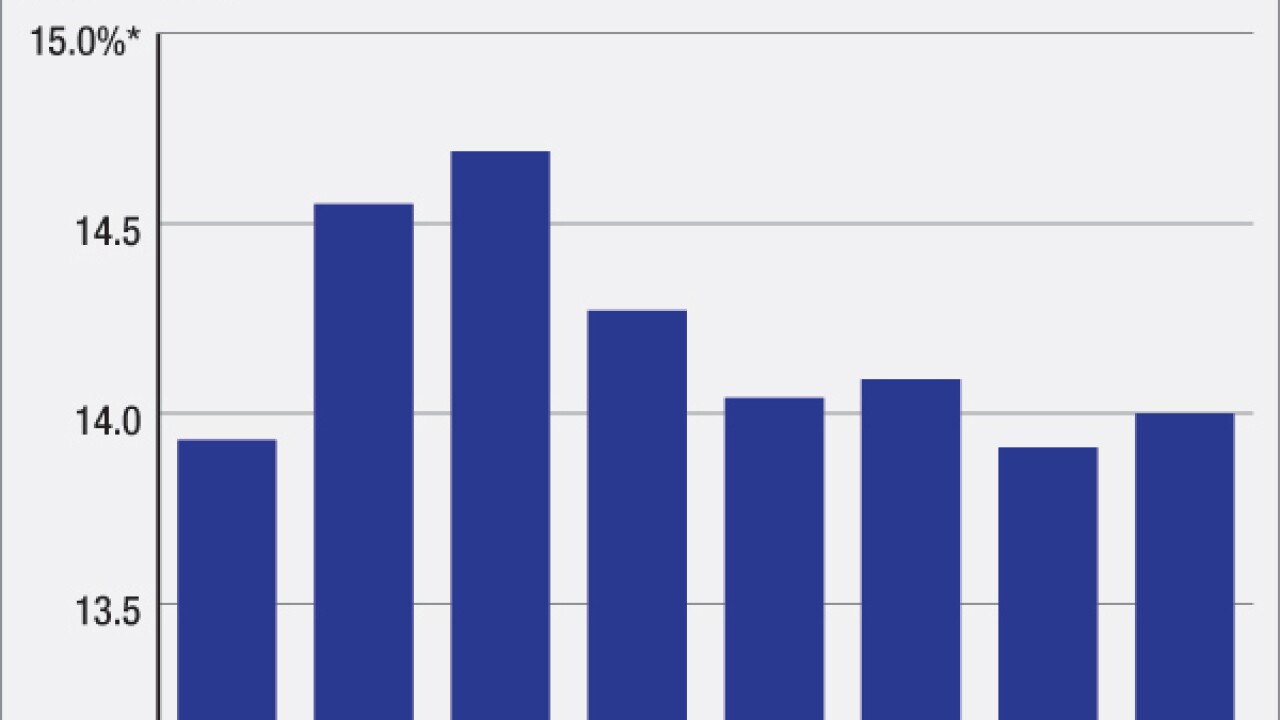

Independent mortgage banking and brokerage firms added a whopping 5,900 fulltime employees to their payrolls in June, according to a report issued Friday by the Bureau of Labor Statistics.

August 5 -

The U.S. is steadily building the foundation of a nationwide faster payments system, but not all of the pieces are connected. Many of the elements developed independently, with influence from across the globe.

August 5