-

The solution to "too big to fail" is requiring all creditors, other than insured depositors, to face the risk of loss so that neither the FDIC nor taxpayers lose any money.

August 5 -

Settlements related to court fights over private-label mortgage-backed securities are significantly boosting the bottom lines at a few Federal Home Loan banks.

August 4 -

Nonbanking fees are also allowing Community Bank System in New York to be a patient acquirer even though it is creeping up on $10 billion in assets.

August 4 -

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

-

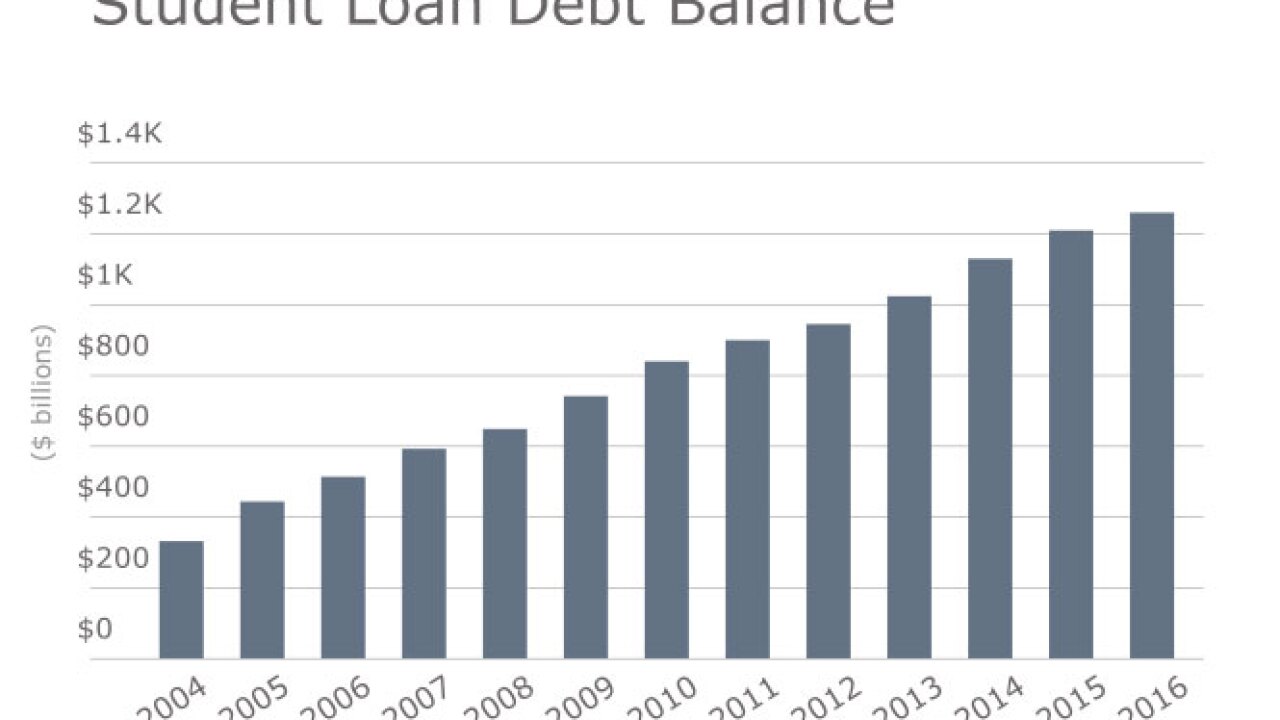

Fintech firms and millennial-focused advisers are providing advice on student loan refinancing, with the expectation that over time it will eventually lead to new business, in the form of brokerage and retirement accounts.

August 4 -

Returning Fannie Mae and Freddie Mac to their status as privately owned public utilities is consistent with their mandate and makes the most policy sense.

August 4

-

A proposed 50% expansion to the Low Income Housing Tax Credit program would yield new opportunities for banks to finance development projects and meet their Community Reinvestment Act obligations.

August 3 -

In a political season teeming with tension around income inequality, racial economic disparities and animus toward the banking industry, reforming the Community Reinvestment Act seems like it should be a cornerstone of the debate. Yet the law has been almost entirely absent from the discussion. Here's why.

August 2 -

Benefiting from higher loan guarantee income and lower derivative losses, Freddie Mac said Tuesday it had made $993 million in the second quarter, a dramatic reversal from its $354 million loss a quarter earlier.

August 2 -

The linchpin of the federal government's payday lending proposal is a credit-reporting system for small-dollar loans created by the private sector, but the kinds of companies that could create it haven't stepped forward.

August 1