-

As the Consumer Financial Protection Bureau finishes regulations dealing with mortgage data reporting, a similar set of requirements for small business loans is waiting in the wings.

August 28 -

Banks need more clarity about the circumstances under which attorney-client privilege applies. Otherwise they may decline to ask questions about the legality of their actions, leading to even more compliance problems.

August 28

-

The largest bank in Tanzania has sued the U.S. Treasury Department to halt a rule that designates the bank as a "primary money laundering concern," which cuts off its access to dollar funding and may prove to be a death sentence for the institution.

August 26 -

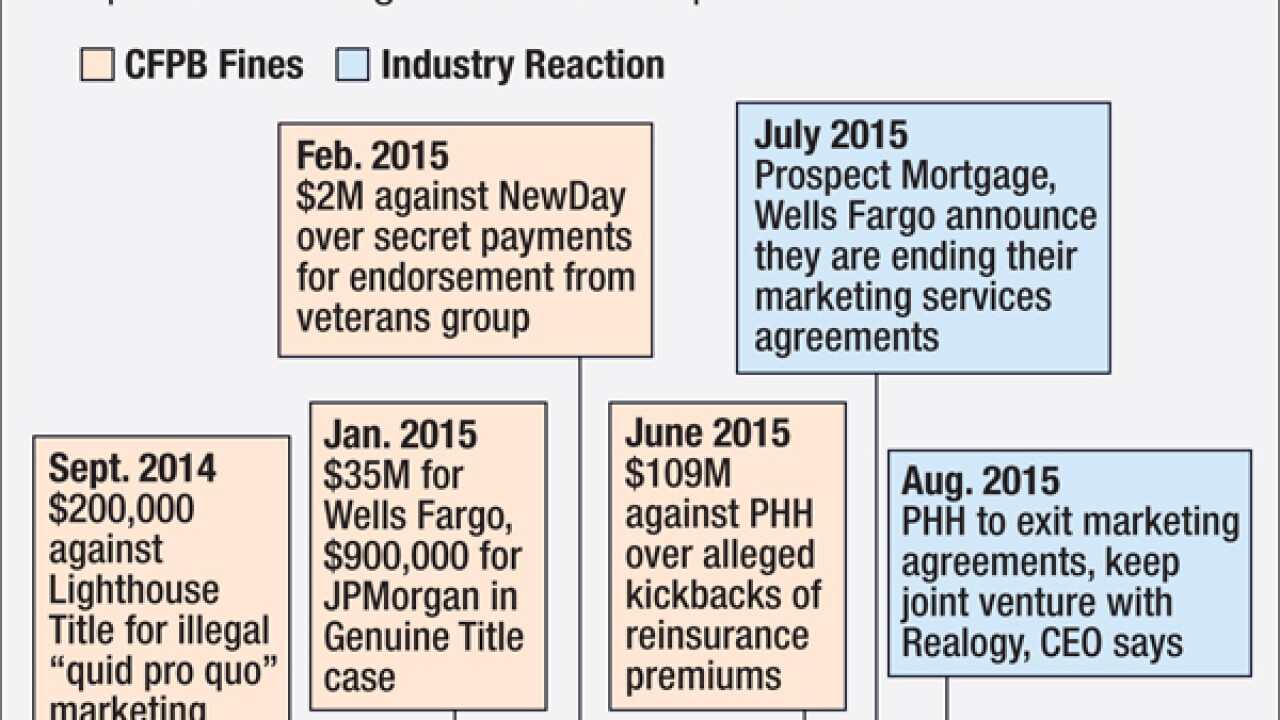

Nothing touches off an argument more than questions about whether the CFPB will allow any marketing services agreements to continue. Some mortgage lenders say no and are winding down their agreements, others insist regulators can be satisfied, and still others are just plain confused.

August 21 -

WASHINGTON Two California companies allegedly sold pension advance loans that they claimed were not credit products but in fact charged usurious interest rates, according to a lawsuit brought Thursday by the Consumer Financial Protection Bureau and New York regulators.

August 20 -

Banks have ramped up foreclosure activity in the past five months, with default notices, scheduled auctions and bank repossessions at their highest levels in two years. It's a positive sign that banks are finally clearing out all the distressed loans still lingering from the housing crisis. Meanwhile, banks remain cautious about new lending, partly because of regulatory actions.

August 20 -

Citigroup has agreed to refund $4.5 million to global markets customers who were charged excessive fees and did not receive appropriate rebates.

August 19 -

The Consumer Financial Protection Bureau said Springstone Financial, acquired last year by Lending Club, misled borrowers into thinking loans carried zero interest.

August 19 -

Promontory Financial Group on Tuesday agreed to a $15 million settlement, and a six-month ban from accepting certain new consulting work in New York, to resolve an investigation by the state's department of financial services into its consulting work at Standard Chartered Bank.

August 18 -

Bank of New York Mellon has agreed to pay $14.8 million to settle Securities and Exchange Commission allegations that it used its internship program to violate the Foreign Corrupt Practices Act.

August 18