-

Named interim CEO in August, Noel Quinn now appears to be the front-runner to lead the global bank's next turnaround.

December 11 -

The Rakuten application has piqued interest in reviving legislation aimed at stopping commercial firms from owning banks. Yet Congress previously had the chance to enact such a measure and declined.

December 10 -

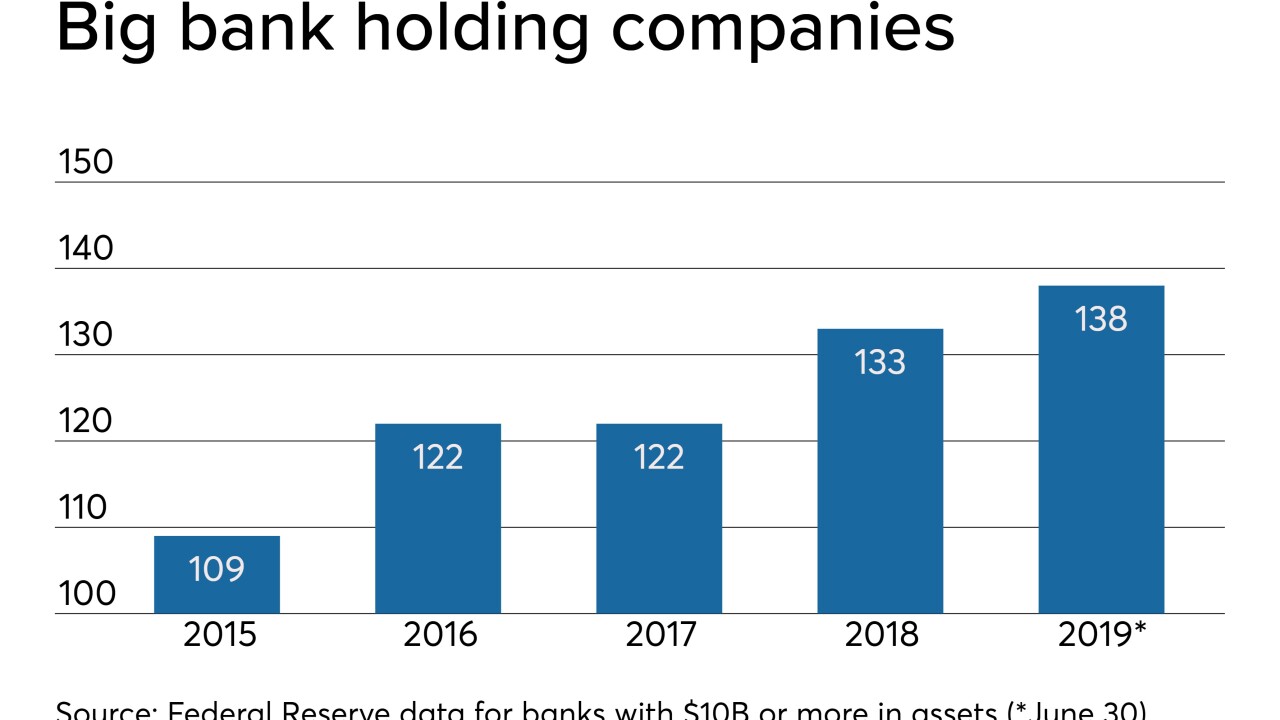

Several banks abandoned their BHCs two years ago to cut costs and reduce regulatory burden. But the strategy never really took hold as most bankers determined there were more benefits to having holding companies than eliminating them.

December 10 -

Brendan Coughlin will succeed Brad Conner as head of consumer banking, and Beth Johnson will be the bank's first chief experience officer.

December 10 -

BB&T and SunTrust showed that big-bank mergers are still possible, but top executives at other large regional banks say that a knee-jerk response would be a mistake.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

Raging Capital Management also urged the company's board to repurchase stock and think about selling a minority stake in the payments processor Evertec.

December 10 -

The sale comes just three years after the San Francisco bank bought the platform.

December 9 -

Credit unions today regularly receive monies from the CDFI Fund, but it wasn't always that way. Here's a look back at the last quarter-century and the progres that still needs to be made.

December 9 Archer+Rosenthal

Archer+Rosenthal -

Cost cutting and systems integrations are short-term priorities, but over time CEO Kelly King and his heir apparent, Bill Rogers, will have to exploit the combined BB&T-SunTrust's revenue potential and prove the biggest post-crisis merger was a good idea.

December 9