-

Redwood Trust is "repositioning" its mortgage business by focusing mainly on jumbo loans, according to its top executives.

February 29 -

Understanding how consumers pay their debts over time is expected to widen access to credit for consumers recovering from financial problems or who were hard to score before. Just how many it will benefit is an open debate.

February 25 -

WASHINGTON Despite dire predictions by banks and others that new mortgage rules by the Consumer Financial Protection Bureau would cut off access to credit, the industry is performing well two years after the regulations went into effect, according to the agency's top official.

February 23 -

Meaningful rules encouraging Fannie and Freddie to do more with manufactured housing would allow more lenders into the market and make pricing more competitive.

February 23

-

The affordable housing market has dried up in major cities across the country. In response, regulators and lenders are looking into new programs to get people back into single-family homes while also exploring ways to encourage multifamily developments.

February 22 -

The Treasury Department will invest an additional $2 billion from the Troubled Asset Relief Program into a federal fund that seeks to protect homeowners from foreclosure.

February 22 -

Bank of America will launch a 3% down payment home loan in partnership with Freddie Mac, but will not retain any risk if the loans default. Thats because B of A will immediately will sell the loans and servicing rights to Self-Help Federal Credit Union, a Durham, N.C., community development lender.

February 22 -

The government-sponsored enterprise was enthusiastic about launching the 97% loan-to-value product when it announced it in December 2014. But it has yet to become a sizable part of Fannie's business.

February 19 -

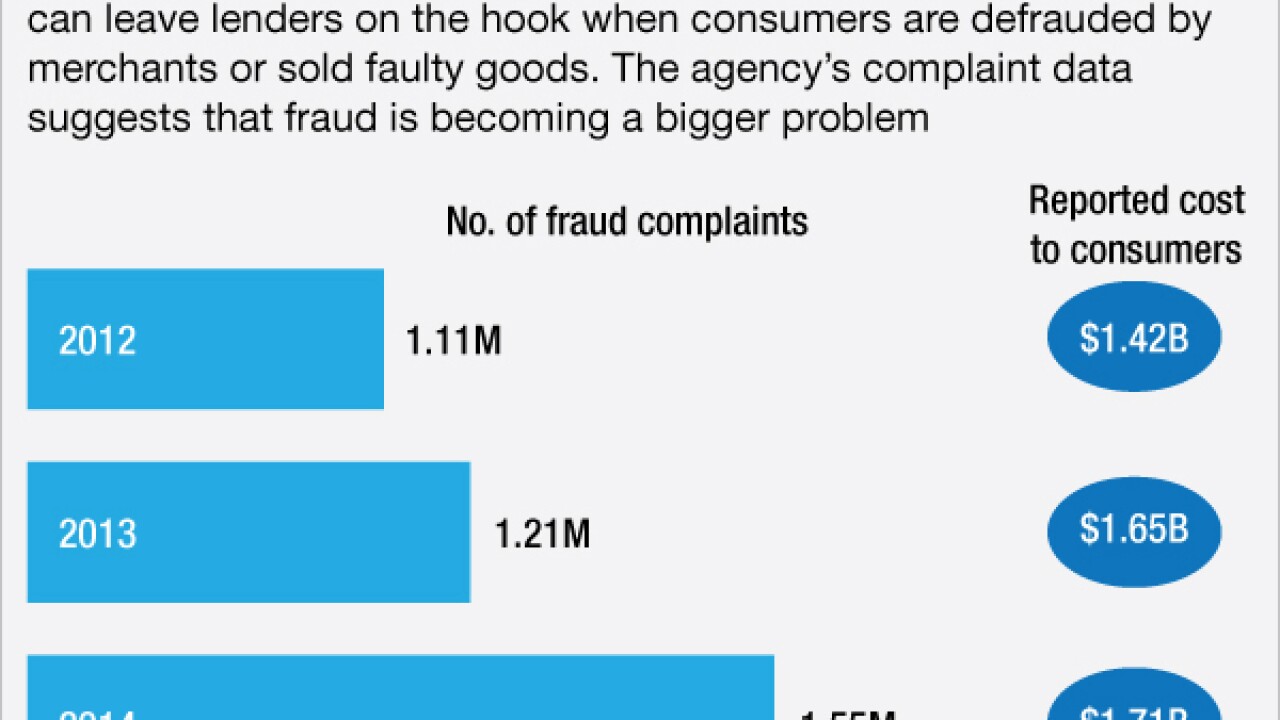

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

Fannie Mae's net income fell 23% to $11 billion in 2015 from a year earlier despite benefiting from higher purchases of single-family and multifamily loans, the government-sponsored enterprise said Friday.

February 19 -

The decision in Yvanova v. New Century Mortgage Corp. has the potential to radically increase the number of lawsuits brought by borrowers, particularly on loans that were pooled into securitized trusts.

February 18 -

Federal Housing Finance Agency Director Mel Watt stopped short of calling for Treasury to recapitalize the government-sponsored enterprises, but said "something needs to be done" before they run out of capital.

February 18 -

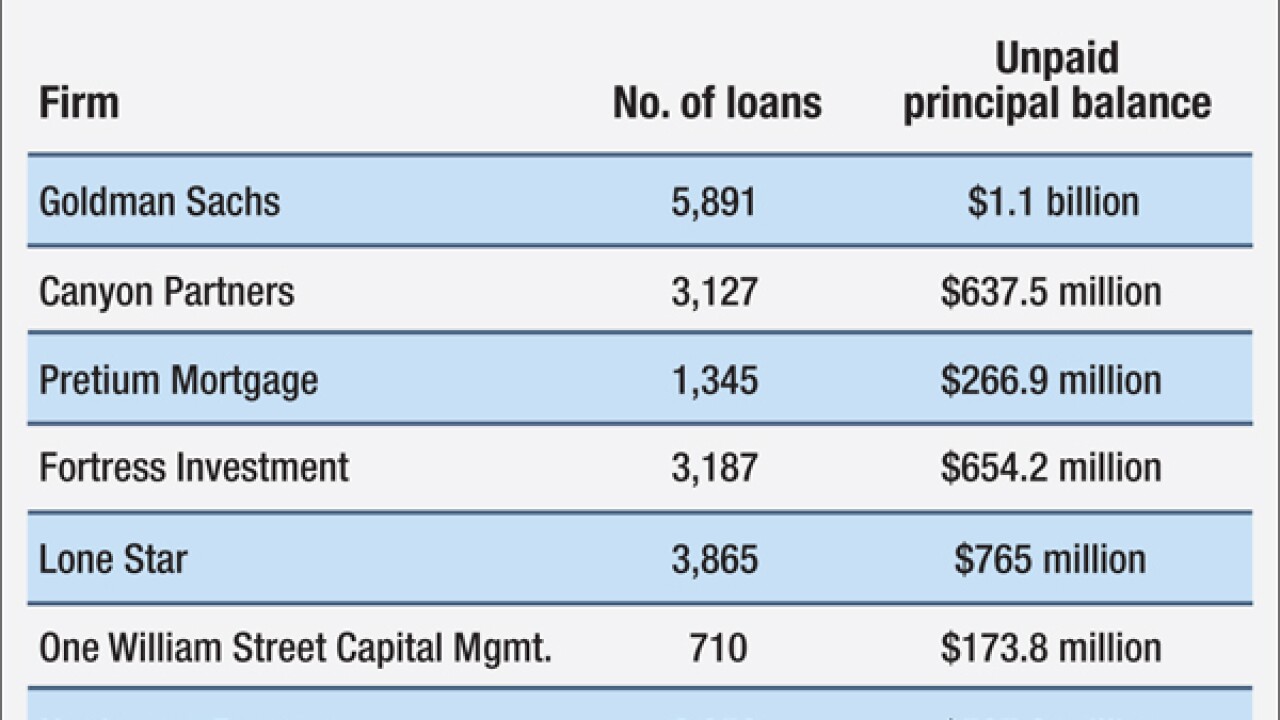

Lenders are still holding on to scores of delinquent mortgages that date to the real estate crash, but a surge in home values across the country is motivating them to move the most troublesome loans off their books more quickly.

February 18 -

The Mortgage Bankers Association increased its 2016 industry originations forecast to $1.48 trillion from its January projection of $1.38 trillion to reflect market turmoil that has held interest rates down.

February 18 -

Freddie Mac on Thursday reported strong fourth quarter and year-end profits driven by a surge in demand for both home purchase and apartment loans.

February 18 -

Troubled loans no longer overwhelm the market, but there could be smaller outbreaks that servicers must be ready to deal with, a real estate services vendor says.

February 18 -

The Federal Housing Finance Agency is launching a 10-day social media campaign, #HARPNow, to alert struggling homeowners in 10 states that they can still refinance via the program before it expires at year-end.

February 17 -

The Chicago, Des Moines and Cincinnati FHLBs have grown their life insurance company membership the most in recent years.

February 12 -

Fannie and Freddie have been selling pools of delinquent mortgages at auction to the highest bidders. Community groups say the Federal Housing Finance Agency should be giving preferential treatment to nonprofits and community development financial institutions.

February 12 -

The Federal Housing Administration will continue to charge borrowers an annual premium over the entire life of the loan, rejecting calls from some housing advocates to change how its calculated.

February 11