-

Wells Fargo's tentative agreement to pay $1.2 billion to resolve claims by the Justice Department that it made shoddy FHA loans is bad news for other banks that are the targets of similar probes.

February 3 -

More than 1 million homebuyers qualified for a mortgage in the third quarter, the first time since the financial crisis that lenders reached such a threshold, according to research by the Urban Institute.

February 3 -

The House approved a bill 427-0 that would revamp the Federal Housing Administrations condominium loan program and expedite the approval process for Rural Housing Service guaranteed loans.

February 3 -

Fannie Mae and Freddie Mac unveiled an appeals process Tuesday that will allow an independent arbitrator to resolve disputes between lenders and the government-sponsored enterprises over loan repurchase demands.

February 2 -

Lenders argue that the GSEs would be better off buying more loans that are already insured, rather than transferring credit risk after holding them for a time. But Freddie Mac's Kevin Palmer says certainty of reimbursement is more important than the timing of risk transfers.

February 2 -

The near future may find more banks ceasing to originate residential mortgages in an effort to stop the slide in stock prices.

February 2

-

WASHINGTON Key Democratic lawmakers are urging the Department of Housing and Urban Development to tighten its program for selling nonperforming guaranteed loans to ensure servicers have exhausted all loss mitigation options before the loans are sold to private investors.

February 1 -

The Department of Housing and Urban Development is reducing the mortgage insurance premiums it charges on Federal Housing Administration multifamily loans to encourage the renovation of affordable housing units and promote energy-efficient upgrades.

January 28 -

Royal Bank of Scotland Group took a surprise 3.6 billion-pound ($5.2 billion) hit to the value of its assets and set aside more money for past misconduct, limiting Chief Executive Officer Ross McEwan's ability to return capital to shareholders.

January 27 -

In the absence of congressional action on housing finance reform, here is what the Federal Housing Finance Agency should do sooner rather than later.

January 26

-

The Federal Housing Finance Agency may face legislation or a lawsuit in the near future as it tries to force captive insurance companies to exit the Federal Home Loan Bank System.

January 22 -

In one corner are groups like the Community Home Lenders Association and the major credit union groups, which are hoping the administration will further cut premiums after a reduction a year ago. In the other are the MBA and the ICBA, which argue a cut now would be too soon.

January 19 -

Executives of Wells Fargo, especially CEO John Stumpf, have repeatedly insisted that the economy (and their bank) will be fine despite the collapse in oil prices. But now they are acknowledging efforts to think about what happens if they are wrong.

January 15 -

The reverse mortgage industry is optimistic after recent reforms to the Home Equity Conversion Mortgage by the FHA and newfound respect from financial planners.

January 14 -

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

The Department of Housing and Urban Development has rejected a nonprofit housing group's allegations of racial discrimination against U.S. Bank. HUD found that the bank properly maintain foreclosed homes in predominantly black and Hispanic neighborhoods and in some cases spent more rehabilitating the homes than in white areas.

January 13 -

Community bankers and credit unions scored a significant victory while others in the mortgage industry lost out in the Federal Housing Finance Agency's final rule establishing membership standards for the Home Loan banks.

January 12 -

The agency scrapped a part of its 2014 proposal that would have required Home Loan bank members to maintain a certain percentage of residential mortgage assets in order to keep their membership. But it held fast on a provision that would disqualify captive insurance firms from membership.

January 12 -

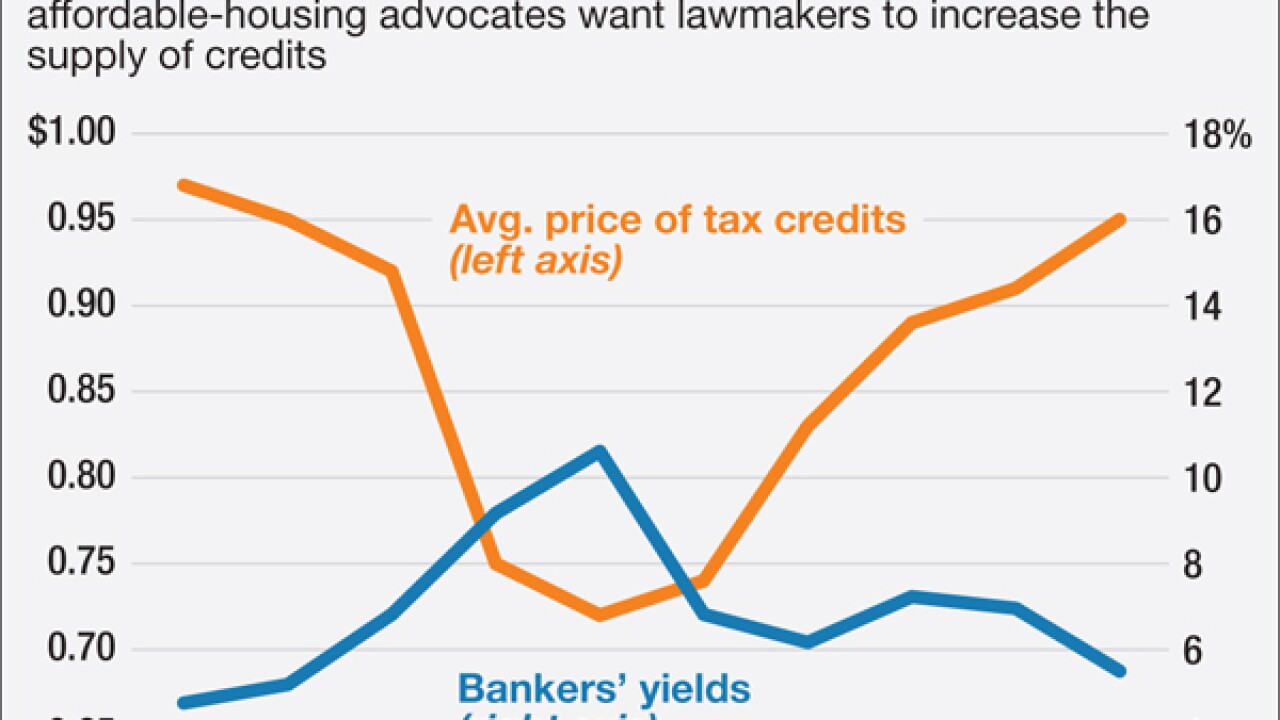

But the strong demand for tax credits from those projects is also whittling down the investment returns as their riskiness declines, according to a new report by the New York-based accounting firm CohnReznick.

January 8 -

A recent tax change will provide more stability to banks and developers that use the low-income housing tax credit program, and the supply of below-market-rate apartments should increase as a result. But it's not enough to create the economic incentives needed to meet skyrocketing demand for affordable housing in the U.S.

January 8