-

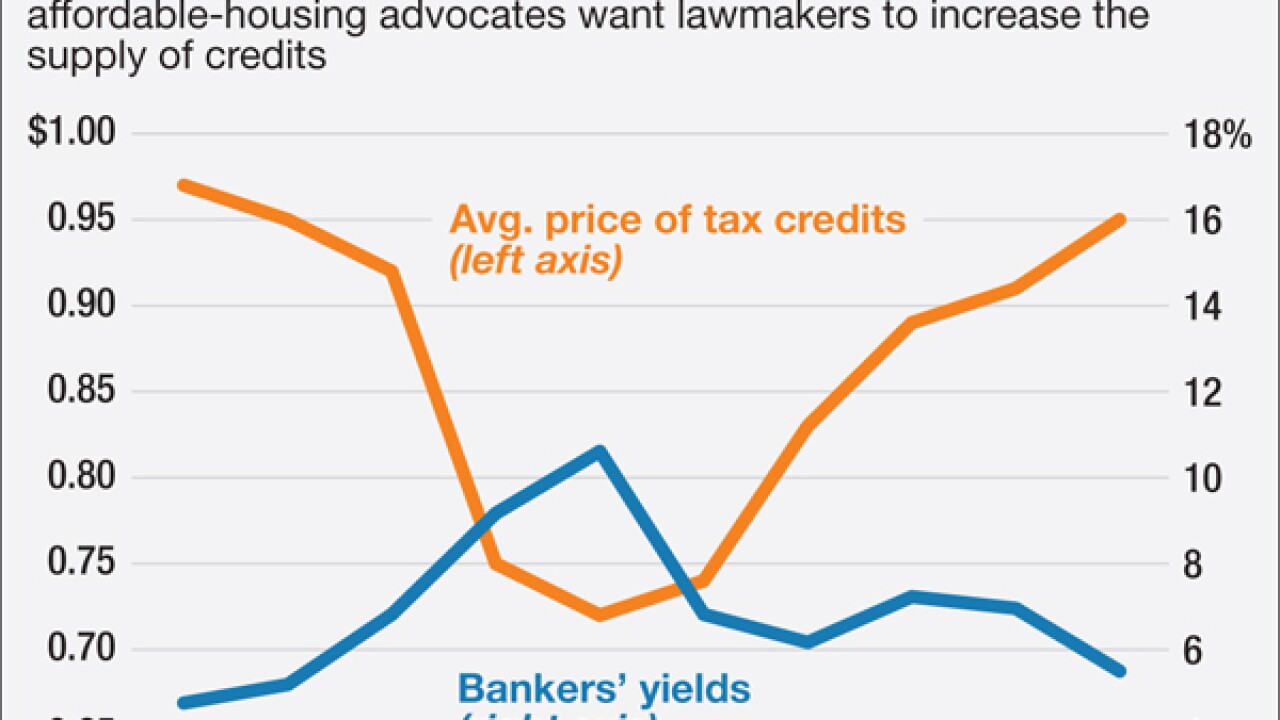

But the strong demand for tax credits from those projects is also whittling down the investment returns as their riskiness declines, according to a new report by the New York-based accounting firm CohnReznick.

January 8 -

A recent tax change will provide more stability to banks and developers that use the low-income housing tax credit program, and the supply of below-market-rate apartments should increase as a result. But it's not enough to create the economic incentives needed to meet skyrocketing demand for affordable housing in the U.S.

January 8 -

Some lenders have asked whether the bureau would adjust its so-called resubmission guidelines which determine whether lenders have to refile data based on errors found in samples and it has responded with a request for further industry input.

January 7 -

Banks can help ease a severe national shortage in affordable rental properties and make money doing it.

January 3 -

Officials who assess how well banks lend and invest in their communities seem out of sync with the experiences of Main Street.

December 29

-

Some lost their jobs while others made major missteps or faced serious challenges to their business plans. Here are the folks who had a rough 2015 and are looking forward to better times in 2016.

December 29 -

A proposal issued two weeks ago by the FHFA calls on the two government-sponsored enterprises to identify opportunities to increase their purchases of small multifamily properties in rural areas, sparking some concern among lenders.

December 28 -

The more aggressive nonbank lenders are attracting top producers by essentially allowing loan officers to set their own rate of pay. While so-called "pick-a-pay" compensation plans are not illegal, critics say they can encourage loan officers to steer consumers into more expensive loans in order to increase their own pay.

December 24 -

Fannie Mae and Freddie Mac are telling lenders that they are willing to retain loans with defects if they believe the defects are minor and can be fixed. But Freddie is one-upping Fannie by offering to retain such loans without charging lenders a fee.

December 23 -

Existing-home sales plummeted in November, confirming fears in the mortgage industry that a new consumer disclosure rule is delaying mortgage closings.

December 22