-

Though the deadline for compliance is more than two years away, lenders are already warning that they do not have enough time to comply with a new rule that requires institutions to report additional data to regulators on home loans.

November 2 -

The administration apparently intends to leave office without addressing Fannie Mae and Freddie Mac's capital bases and therefore the tight credit conditions.

October 30

-

The report from independent auditors will likely show that FHA remains below its 2% statutory minimum capital ratio, but HUD officials and outside observers still expect it to show major improvement over last year.

October 29 -

Californias Richmond Community Foundation will pursue a new social impact bond vehicle with a $3 million revenue bond private placement it hopes to close next month with the local Mechanics Bank.

October 29 -

Department of Housing and Urban Development staff are working on a revision to the agency's condo rule and "we anticipate a rulemaking process," the HUD Secretary Julian Castro said this week.

October 27 -

Rep. Paul Ryans expected election as House Speaker this week may ultimately prove a boon for the banking industry especially for critics of the Dodd-Frank Act and the current mortgage finance system.

October 27 -

The financial condition of the Federal Housing Administrations mortgage insurance fund has improved significantly over the past year, Department of Housing and Urban Development Secretary Julian Castro predicted late Monday.

October 27 -

Lawmakers and industry groups are urging FHA to update condo rules to provide more homeownership opportunities for first-time buyers.

October 23 -

Mortgage servicer Ocwen Financial failed four servicing tests in the second half of 2014. Joseph A. Smith Jr., the monitor of the $25 billion national mortgage settlement, said the Atlanta servicer was beginning to show progress in complying with terms of the 2012 agreement.

October 22 -

The head of the Consumer Financial Protection Bureau warned software vendors that they face new scrutiny from regulators for causing mortgage lenders to miss the TRID-compliance deadline. He was vague about how far the CFPB might go, but many in the industry are prone to fear the worst.

October 21 -

Private mortgage insurers are seeking a larger share of the credit risk on Fannie Mae and Freddie Mac-guaranteed loans.

October 20 -

Housing finance reform in Congress is stalled, but Fannie Mae and Freddie Mac (often under pressure from their regulator) are forming partnerships, developing new products and finding ways to share risk with the private sector to correct flaws in the housing system.

October 20 -

Mortgage servicers have gotten a rare reprieve from the Federal Housing Administration.

October 20 -

Next year Fannie will require that mortgage lenders use so-called trended credit data for all mortgage borrowers, a move it says could broaden access to credit.

October 19 -

The Consumer Financial Protection Bureau backed off some of its initial plans in its final rule requiring lenders to collect more data from mortgage borrowers, but industry representatives warned the agency had not gone far enough.

October 15 -

WASHINGTON The Consumer Financial Protection Bureau finalized a rule Thursday that requires lenders to collect more information from borrowers as part of mortgage disclosures.

October 15 -

WASHINGTON The Consumer Financial Protection Bureau warned lenders Thursday to avoid marketing services agreements where payment for advertising is really just disguising kickbacks.

October 8 -

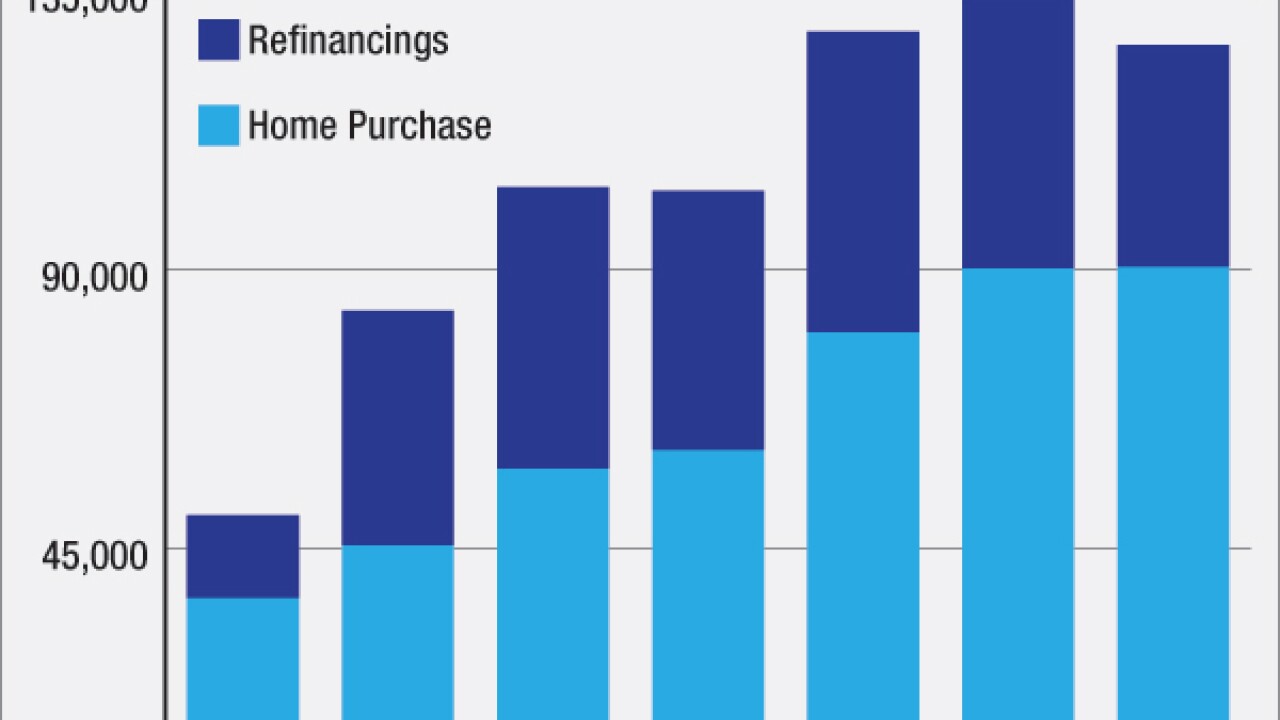

U.S. homeowners continue to take advantage of rising house prices to dig themselves out of the hole created by the Great Recession.

October 8 -

WASHINGTON The House voted 303 to 121 on Wednesday to pass a bill that would delay enforcement of new mortgage disclosures that went into effect on Oct. 3.

October 7 -

The clash between the Department of Housing and Urban Development and its inspector general over down payment assistance programs run by state or local housing finance agencies continues to heat up.

October 6