-

An effort to increase awareness of the transition to a new benchmark rate, and nudge banks to start preparing, is expected to intensify in 2019.

December 30 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

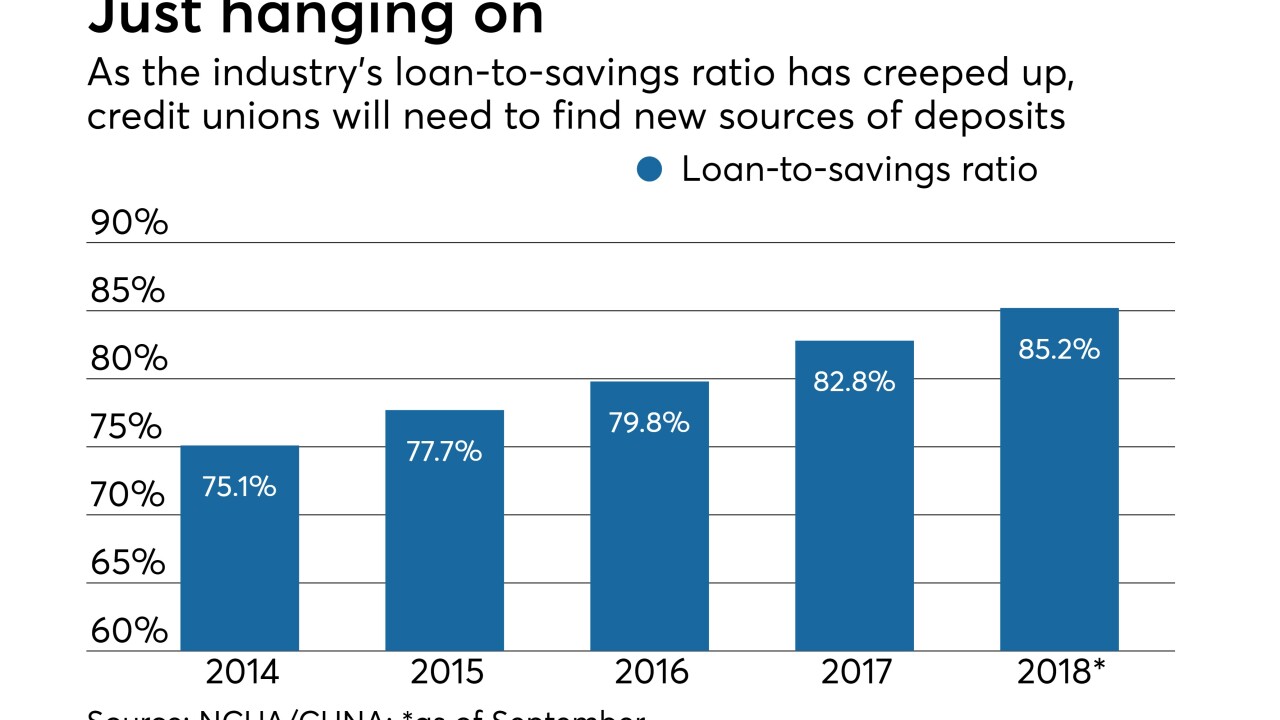

Amid rising rates and a surge in lending, credit unions will need to find additional sources of deposits to fund growth.

December 21 -

The central bank may be looking at other benchmarks besides the fed funds rate to conduct monetary policy; dropping human appraisers from most home sales raises concerns.

November 30 -

President Trump stepped up his attacks on the Federal Reserve Board and its chairman, Jerome Powell, blaming the central bank for declines in the stock market.

November 27 -

If the predictions prove correct, the benchmark rate would reach 3.50% by the end of next year.

November 21 -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

One of the world's biggest banks wants to boost profits by cutting out voice brokers acting as middlemen in the largest derivatives market.

November 7 -

Legendary former central banker Paul Volcker praised Jerome Powell as the current Federal Reserve chairman faces fire from President Donald Trump for raising interest rates.

October 25 -

TNB USA is suing the Fed to force the central bank to let it open an account that earns the same top-tier interest rate currently available only to a select few.

October 24