-

Many bankers say the agency needs to rethink its definition of brokered deposits and how it sets interest rate caps.

October 16 -

Net income soared 32% thanks to higher interest rates that contributed to a wider net interest margin and its most interest income in a quarter in years.

October 15 -

CIT Bank and Simple recently started offering higher yields on the condition that customers make regular contributions to savings. The offers are designed to help the banks avoid rate wars, but some analysts question whether they will appeal to enough consumers.

October 10 -

Liang is currently a senior fellow at the Brookings Institution in Washington and previously led a Fed board division in charge of financial stability policy and research.

September 19 -

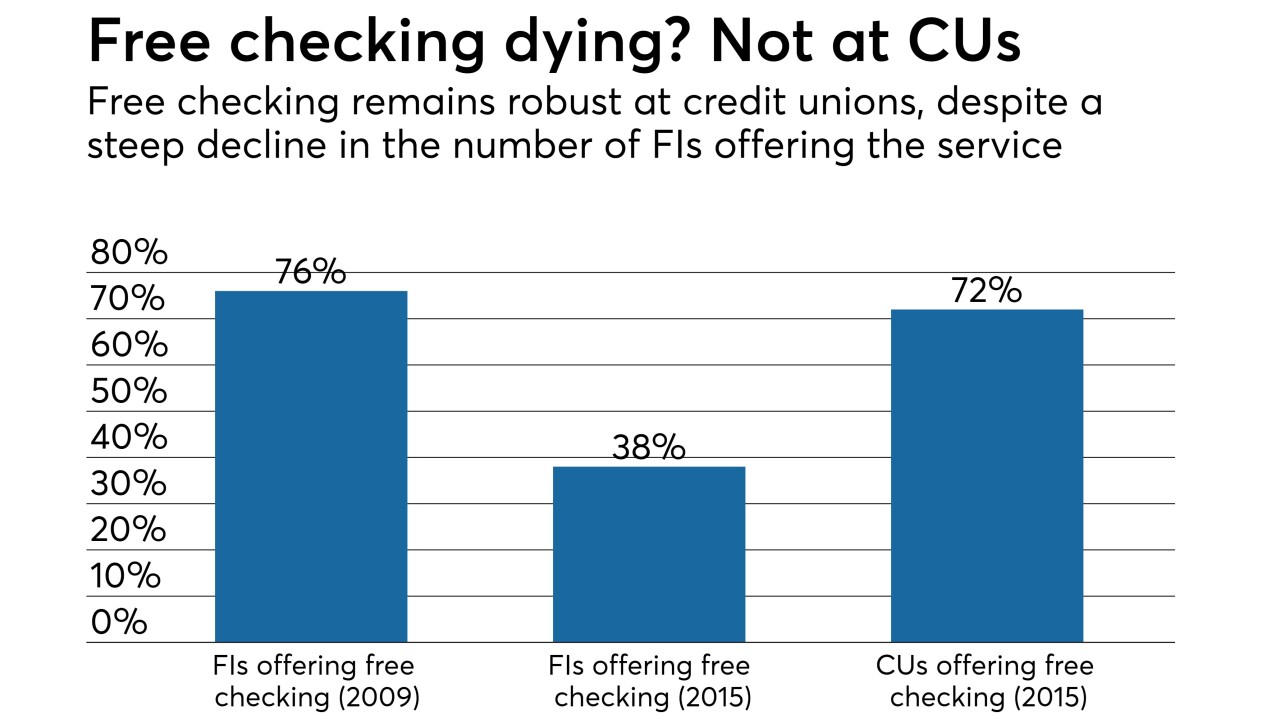

Free checking peaked nearly a decade ago, but more than half of all credit unions continue to offer it, despite new players fighting for that business.

August 28 -

The new policy, meant to assist borrowers in Puerto Rico and the U.S. Virgin Islands, will let servicers evaluate borrowers using pre-disaster payment information.

August 16 -

Judges say a CashCall loan may have fit the state’s definition of an “unconscionable” interest rate.

August 13 -

The combination of rising interest rates and increased competition from nonbank lenders is prompting many commercial real estate investors to seek better deals elsewhere.

July 23 -

As interest rates rise, banks need to watch how much they are paying on deposits to avoid exceeding rate caps designed to ensure liquidity.

July 23 Texas Tech University

Texas Tech University -

Despite some green shoots in key credit segments, total loan growth was light at many banks last quarter. Rate hikes are threatened, and deposits will get pricier — where will the earnings come from?

July 20