-

Dorothy Savarese, the head of Cape Cod Five Cents Savings Bank in Massachusetts, seeks a financial system where the rules encourage community banks and big banks to do the things that they are best at.

October 14 -

WASHINGTON Securities and Exchange Commission Chair Mary Jo White should be demoted as head of the agency because of her lack of support for a rule that would require companies to publicly disclose their political spending, Sen. Elizabeth Warren, D-Mass., said Friday.

October 14 -

In a sit-down interview, Amy Friend, the OCC's chief counsel, details how the agency would evaluate firms for a possible fintech charter, whether the charter would favor particular kinds of companies and what happens next in the process.

October 14 -

Warren's voice is powerful in criticizing big banks, but she could play a more active role in providing relief to community banks to help boost job creation.

October 14 Florida Bankers Association

Florida Bankers Association -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

October 14 -

WASHINGTON The government should encourage the development of the fintech sector, but should not grant a safe harbor for such firms, Sen. Mark Warner, D-Va., said Thursday.

October 13 -

WASHINGTON Democratic presidential nominee Hillary Clinton would engage in a review of financial regulations and simplify or eliminate those that are found to be unnecessary if she is elected president, a top adviser said Thursday.

October 13 -

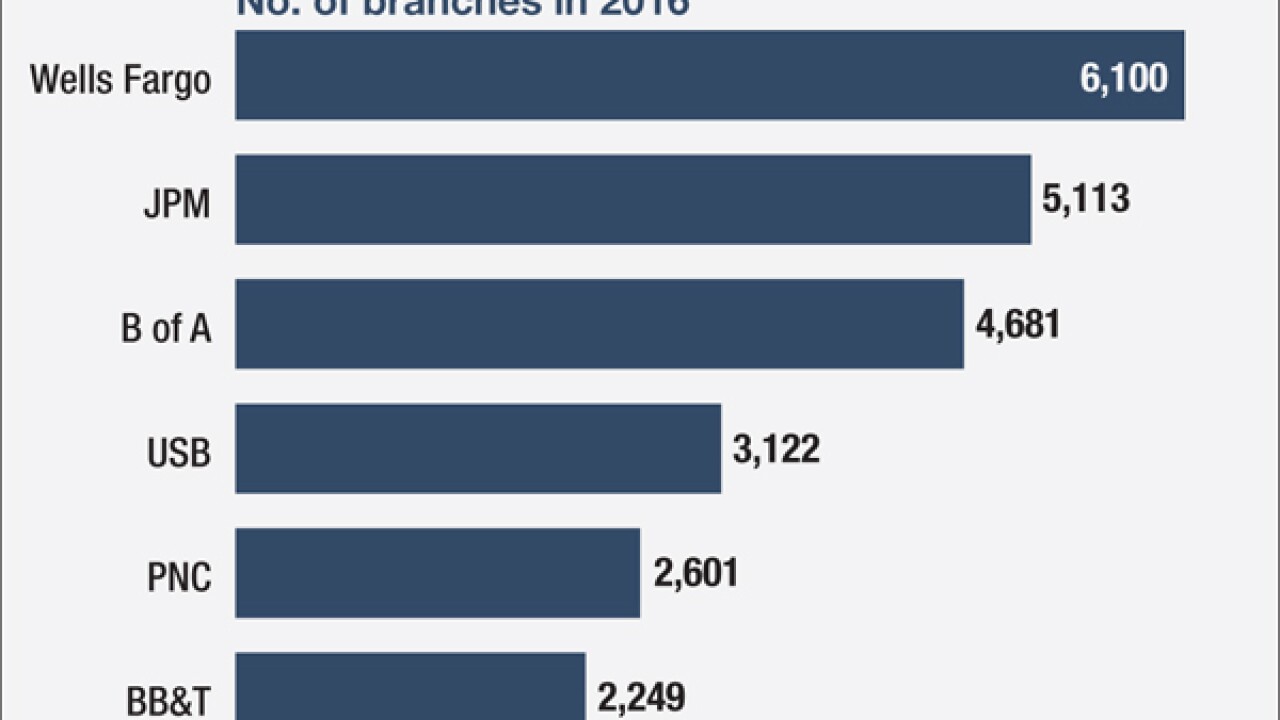

Some analysts are suggesting Wells Fargo should start closing branches, in order to move beyond the phony-accounts scandal, make up for an expected drop in fee income from reduced cross-selling and position itself for a digital future.

October 13 -

As Fannie Mae and Freddie Mac continue to experiment with upfront risk-sharing deals, some small mortgage lenders fear they will be left out of the action.

October 13 -

Without investigations by the Los Angeles Times and city prosecutors, the Wells Fargo account scandal would never have come to light. Where were federal regulators?

October 13