-

Credit card networks and issuers have done a poor job in explaining the implications of the just-passed Oct. 1 deadline for moving to EMV chip-and-PIN cards, leaving many small businesses confused, lawmakers said Wednesday during a hearing on Capitol Hill.

October 7 -

Banks say the Consumer Financial Protection Bureau plan to ban arbitration clauses for individual claims will aid trial lawyers, while consumer advocates say the move is overdue and may not go far enough.

October 7 -

Traditional banks avoid the short-term-credit market because its customers demand a level of customer service that is inconsistent with current models of retail banking, the head of a payday lending group writes.

October 7

-

The U.S. version of an international liquidity rule may include additional factors that make it harder to accurately compare between banks or examine the same institutions liquidity holdings over time, according to a paper issued Wednesday by the Office of Financial Research.

October 7 -

From "too big to fail" to Glass-Steagall, the two leaders of the postcrisis recovery hashed out the economic issues, while pitching Bernanke's new book.

October 7 -

Democratic presidential candidate Hillary Clinton staunchly defended the Consumer Financial Protection Bureau on Wednesday in a letter urging House Democrats to stand by the agencys single-director structure.

October 7 - Ohio

Fifth Third Bancorp has agreed to pay nearly $85 million to settle fraud charges related to undisclosed defective Federal Housing Administration-insured loans.

October 7 -

It may not be an outright ban on arbitration clauses, but the Consumer Financial Protection Bureaus impending proposal to enable more class-action lawsuits comes close.

October 7 -

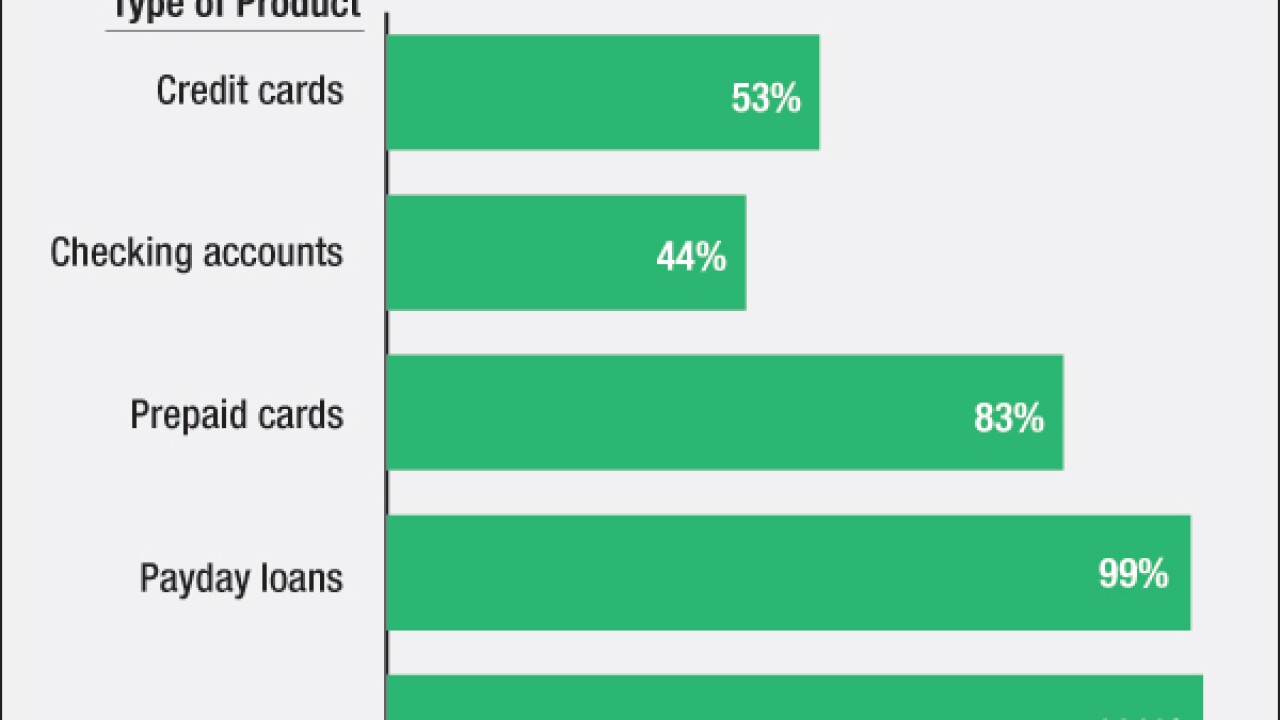

The Consumer Financial Protection Bureau's impending proposal, to be reviewed by a small business advisory panel, would block companies from using arbitration clauses to avoid class actions but allow them for individuals.

October 7 -

The clash between the Department of Housing and Urban Development and its inspector general over down payment assistance programs run by state or local housing finance agencies continues to heat up.

October 6