-

National Association of Realtors survey finds less than 30% of lenders willing to show closing document to Realtors as CFPB's new closing document put lenders on hook for accuracy.

March 3 -

During the fourth quarter of 2015, U.S. auto loans carried longer terms, while average monthly payments rose, and a larger percentage of loans went to less creditworthy borrowers, according to a new report from Experian Automotive.

March 3 -

Beige Book reports moderate, albeit inconsistent, loan demand as financial markets continue to be concerned about fallout from sustained low commodity prices and strong dollar.

March 2 -

Understanding how consumers pay their debts over time is expected to widen access to credit for consumers recovering from financial problems or who were hard to score before. Just how many it will benefit is an open debate.

February 26 -

DES MOINES--Cornerstone Community Credit Union has partnered with online marketplace lender LendingPoint to provide loan products for its members that struggle to qualify for traditional financing.

February 23 -

National Credit Union Administration board members want to make it easier for CUs to lend their members.

February 23 -

Bank of America launches a 3% down payment home loan in partnership with Freddie Mac, but the bank wont retain any risk if the loans default. Thats because it will immediately will sell the loans and servicing rights to Self-Help Federal Credit Union.

February 22 -

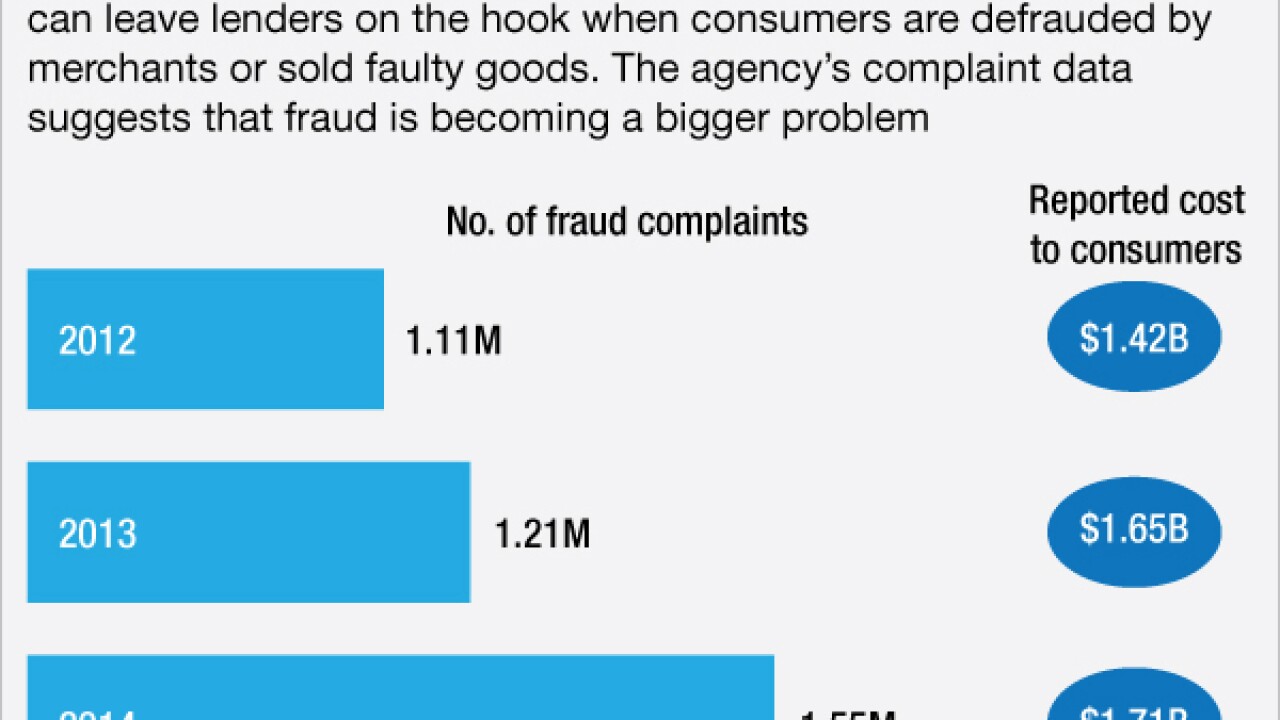

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

The mismatch between demand for new homes and the supply threatens to drive up prices and dampen lending.

February 18 -

Whitefish Credit Union business lending office announces four moves, Pennsylvania CU Foundation board news and more.

February 17 -

Home equity portfolios have shrunk at banks, but credit unions and nonbank lenders helped fuel the surge in home equity lines last year.

February 16 -

Enterprise Car Sales helped rev up auto lending among its credit union partners, generating roughly $500 million in auto loans during 2015.

February 15 -

Credit unions are outperforming other auto lenders, but experts warn some may need to rethink their pricing for risk.

February 12 -

Remember those homeowners who walked away from their underwater mortgages even though they could still afford their loans? They're back, this time as prospective borrowers.

February 11 -

Two of the think tank's incubator projects are being moved to the next phase after demonstrating they can help provide the underserved with access to financial services.

February 10 -

While most federal financial regulators use enforcement actions as a way to shape industry practices, the Consumer Financial Protection Bureau is taking that to a whole other level, frequently using orders as a substitute for new rules or guidelines.

February 2 -

WASHINGTON Key Democratic lawmakers are urging the Department of Housing and Urban Development to tighten its program for selling nonperforming guaranteed loans to ensure servicers have exhausted all loss mitigation options before the loans are sold to private investors.

February 1 -

It's easier than ever for consumers to take out personal loans to pay down high-cost debt or fund big-ticket purchases, and two new studies show that they are taking full advantage of their options.

February 1 -

NEW BRIGHTON, Minn. CU Companies on Monday said it finished 2015 with significant growth in its mortgage lending partnerships.

February 1 -

The Department of Housing and Urban Development is reducing the mortgage insurance premiums it charges on Federal Housing Administration multifamily loans to encourage the renovation of affordable housing units and promote energy-efficient upgrades.

January 28