-

An appeals court ruled that the electronic delivery of private information that was not made public did not constitute real harm to the consumer.

September 12 -

The state Supreme Court heard oral arguments in a lawsuit involving one of the nation's largest debt buyers. At issue is how much detail the industry must disclose about what consumers allegedly owe.

August 31 -

The Department of Justice's department of legal counsel said that the Federal Deposit Insurance Corp.'s board members can bring matters into consideration and vote, even without approval from the agency's chair.

August 30 -

A decade ago, Think Finance partnered with Native American tribes in an effort to avoid state interest-rate caps on consumer loans. After the company's legal woes finally ended this month, court documents shed light on its rapid rise and steep fall.

August 28 -

The jury at an upcoming trial can draw an adverse inference about evidence destruction by the Chicago-based bank, a federal judge ruled. The plaintiff is seeking $1.9 billion from the bank, in addition to punitive damages and other funds in a bankruptcy-related case stemming from a Ponzi scheme.

July 25 -

JPMorgan Chase must face a trial over claims by a former vice president in its anti-corruption unit that she was marginalized, mistreated and fired from the bank for complaining about compliance failures.

July 20 -

Citigroup has won part of its appeal in a discrimination suit brought by a former banker who was laid off after being called “old” at the age of 55.

July 14 -

After the Supreme Court struck down an Environmental Protection Agency rule, legal observers are wondering how far the justices will go to rein in the authority of financial regulators. A Securities and Exchange Commission proposal on climate risk disclosures could become a test case.

July 7 -

The retail giant ignored fraudsters’ use of its money transfers in consumer scams that cost victims hundreds of millions of dollars, according to the Federal Trade Commission. Walmart called the agency’s lawsuit “factually flawed and legally baseless.”

June 29 -

The prepaid card issuer has now paid a total of $18 million to Republic Bank & Trust, which sued after Green Dot's purchase of its tax-refund business unraveled.

June 7 -

An Oct. 7 trial date looms in a case involving allegations of document destruction. The high-stakes lawsuit could complicate BMO's pending acquisition of Bank of the West.

June 6 -

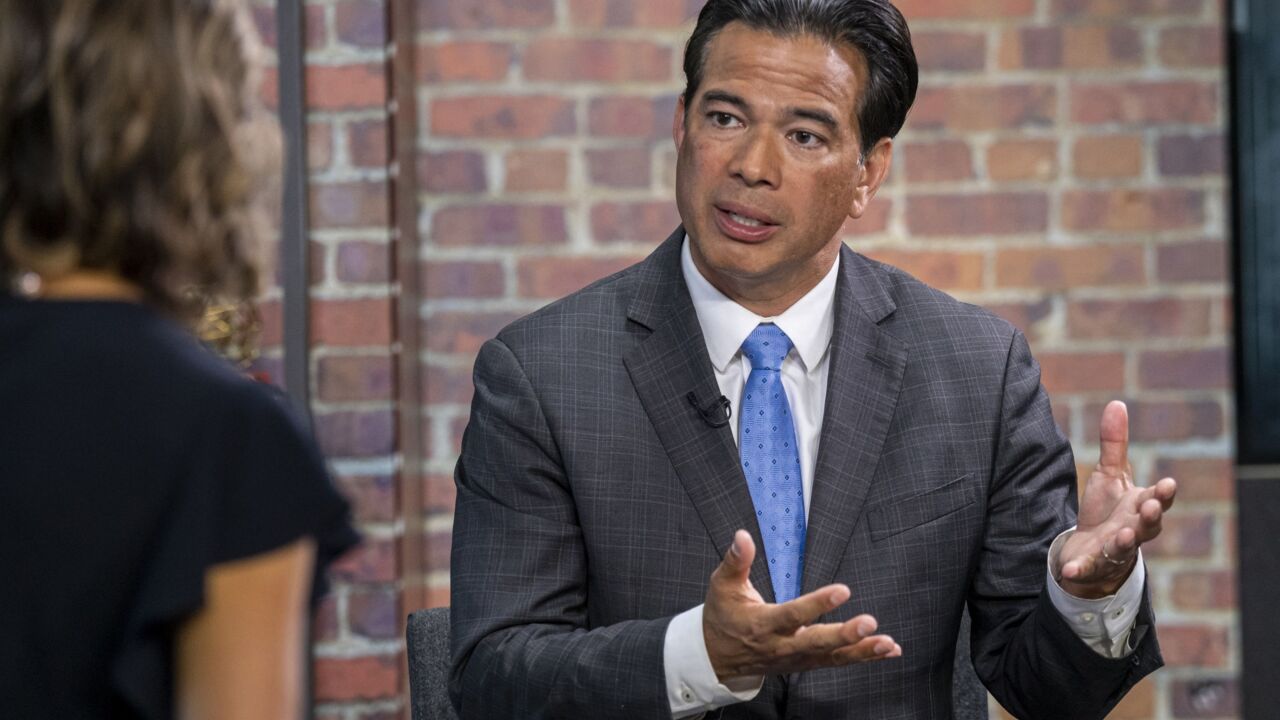

District attorneys in the Golden State are tangling with Credit One Bank over its debt-collection practices. The bank says the prosecutors have overstepped, but Democratic Attorney General Rob Bonta argues that the legal action should continue.

May 31 -

A $1.9 billion lawsuit against Bank of Montreal — which is accused of lying to a judge after a predecessor bank destroyed documents — may go to trial late this year. The legal imbroglio is coming to a head as regulators examine the Canadian banking giant’s proposed acquisition of Bank of the West.

March 22 -

The company has filed a lawsuit against the banking commissioner for threatening to end its partnership with a bank that enables consumer loans to exceed the state’s 36% interest rate cap. OppFi’s argument: Its bank partner is the true lender.

March 10 -

The Federal Trade Commission recently issued an advisory opinion that could make it easier for consumers to recover their legal costs from banks in situations where they were defrauded by a car dealer.

February 9 -

The Conference of State Bank Supervisors abandoned a lawsuit against the Office of the Comptroller of the Currency that had challenged the San Francisco fintech's effort to become a national bank without deposit insurance. The company recently amended its application to drop that controversial element.

January 14 -

Under an agreement with 40 state attorneys general, the student lender and servicer agreed to cancel debt for over 66,000 borrowers and pay restitution to another 350,000 borrowers placed in certain types of forbearance.

January 13 -

The payout will help the Delaware bank recover legal costs that stemmed from its 2010 purchase of Christiana Bank & Trust. It expects a 23-cent boost to earnings per share in the most recently completed quarter.

January 7 -

Two co-founders of the company are expected to give depositions this month in a suit brought by an entrepreneur who says one of them stole her idea of providing credit to immigrants and turned it into a multimillion-dollar venture. Petal denies the allegations.

January 5 -

The agreement resolves a lawsuit over consumer loans that had annual percentage rates as high as 198%. Chicago-based OppFi denied allegations that it engaged in unfair lending practices.

December 1