-

After hurricanes and strikes stalled job growth in October, the economy added 227,000 jobs in November.

December 6 -

The Federal Reserve chair is not concerned about President-elect Trump nominating his successor well in advance of the end of his term in 2026, saying he is "confident" he will have a productive relationship with the next Treasury Secretary.

December 4 -

Federal Reserve Gov. Adriana Kugler credited immigration and rising productivity for the U.S. economy's resilience while emphasizing vigilance against risks to inflation and employment stability.

December 3 -

Federal Reserve Gov. Christopher Waller said the central bank's last framework review was too focused on the post-global financial crisis period and difficult to explain.

December 2 -

Federal Reserve Gov. Christopher Waller, a Trump appointee, said that while recent inflation readings are concerning, monetary policy would remain restrictive even if the central bank cuts interest rates by another quarter-point this month.

December 2 -

Donald Trump discussed various items related to the Fed and its independence and stated he would not nominate Jerome Powell for another term as chair. Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, discusses what a Trump presidency may mean for the Fed.

-

The Federal Reserve chair said there are no economic indicators calling for rapid rate cuts. He also addressed Fed independence, the impact of Trump's economic agenda and more.

November 14 -

In a speech, Federal Reserve Gov. Adriana Kugler said sound monetary policy comes when electoral politics are kept out of central banking.

November 14 -

The Federal Reserve's top official was emphatic that he and other leaders on the Board of Governors cannot be dismissed or demoted at will by the president.

November 7 -

The Federal Reserve's Federal Open Market Committee will announce its interest rate decision at 2pm, followed by a press conference with Federal Reserve chair Jerome Powell. Markets are expecting a 25 basis point rate cut at today's meeting.

November 7 -

At a minimum, president-elect Donald Trump can make two appointments to the Federal Reserve Board of Governors and choose new leadership. But more substantial changes could be in the offing.

November 7 -

The impact of both presidential candidates' fiscal promises around taxation and spending could have dramatic effects on the Federal Reserve's outlook for monetary policy, which has become more aggressive toward rooting out inflation.

November 5 -

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.

-

The Federal Open Market Committee is expected to cut interest rates at its September meeting, which will also provide a new Summary of Economic Projections. Marvin Loh, senior macro strategist at State Street Global Markets, examine the meeting, the SEP and Fed Chair Powell's press conference.

-

A survey of more than 400 bank executives found that while many support the former president, the vast majority disagree with his attitude toward independence at the Federal Reserve — a stance that would impact banks' business models most directly.

October 17 -

Federal Reserve chair Jerome Powell flagged a recent upward revision to income and savings data as a sign of economic strength. He said the information could factor into the central bank's monetary policy discourse during the Fed's next interest rate meeting in November.

September 30 -

After cutting rates 50 basis points in September, the Federal Open Market Committee meets after Election Day to determine monetary policy. Gary Pzegeo, head of fixed income at CIBC Private Wealth U.S., provides his take on the latest move.

-

This week, Federal Reserve Gov. Michelle Bowman cast the first dissenting vote at an FOMC meeting in years. On Friday, she explained why the economic data she's seen didn't convince her of the need to cut rates as much as her fellow governors thought.

September 20 -

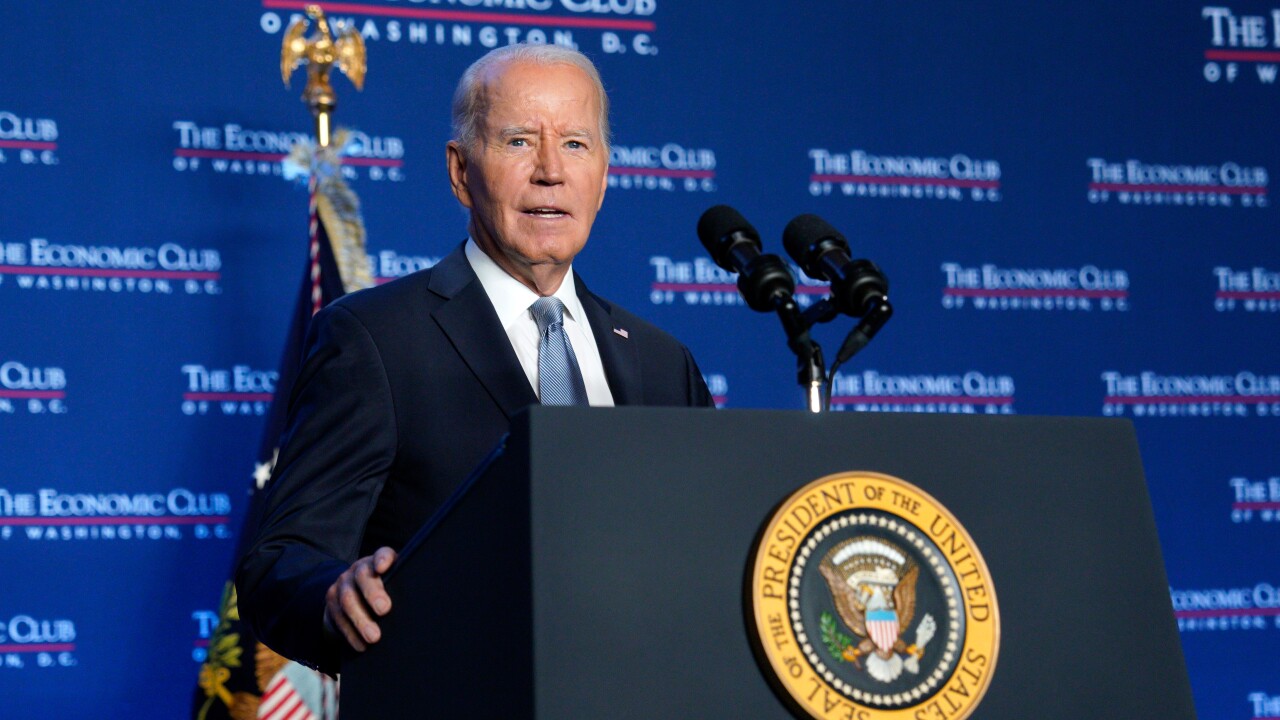

President Joe Biden, in a speech emphasizing the progress made on the economy during his administration, said he has never called Federal Reserve Chairman Jerome Powell during his time as president.

September 19 -

The move signals the end of the Federal Reserve's battle against runaway inflation in the wake of the COVID-19 pandemic. Fed officials expressed divergent views on further action this year.

September 18