-

Within five years, a dramatic transformation of the mortgage market will force firms to expand product menus beyond mortgages to develop stronger relationships with their customers.

September 8

-

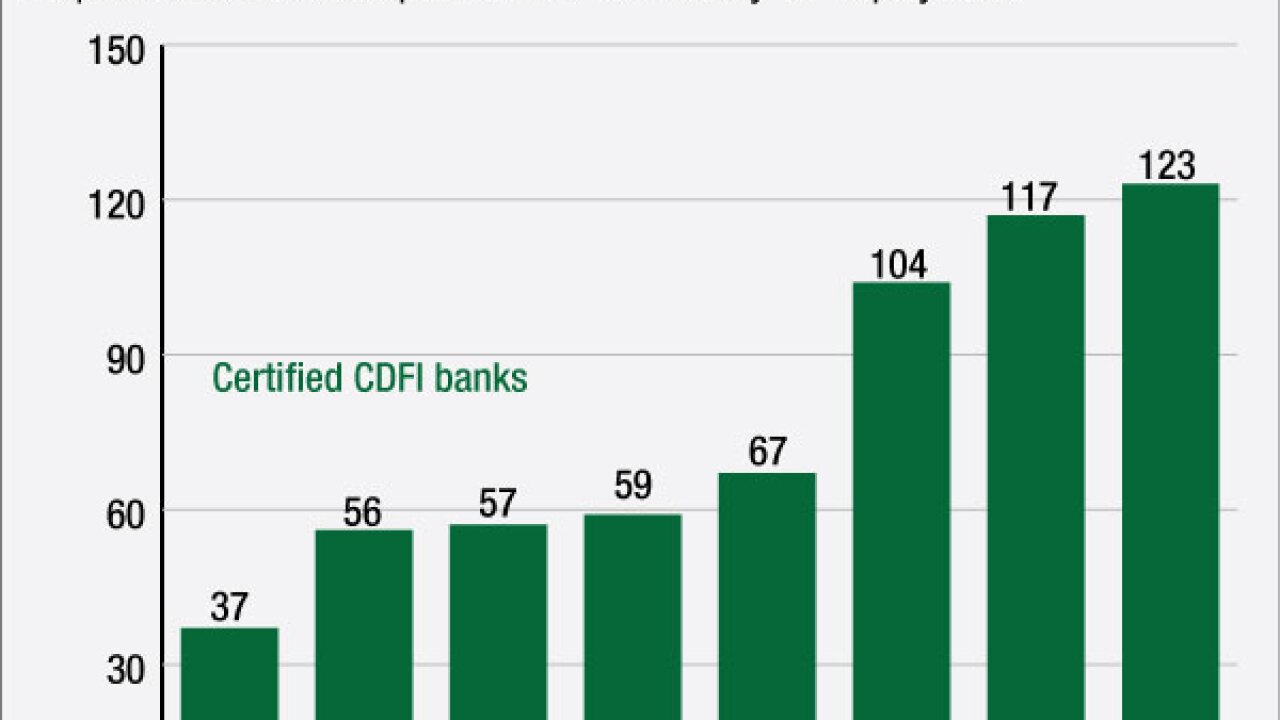

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Though the Federal Housing Finance Agency has yet to provide full details about its new refinancing program to be launched next year, some analysts and industry observers are already convinced it will have only a limited impact.

September 7 -

Regulatory infighting over bond loans offered by down payment assistance programs has the potential to curtail lending to first-time buyers and do real damage to homeownership.

September 2 Offit | Kurman

Offit | Kurman -

Fannie Mae and Freddie Mac can still manage their risk exposure even after reducing or eliminating "loan level price adjustment" fees.

September 2 National Association of Realtors

National Association of Realtors -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

The slow start to Fifth Third's 3%-down mortgage illustrates some of the logistical challenges with such programs, which are on the rise across the industry.

September 1 -

The Mortgage Bankers Association has long been a staunch defender of the mortgage interest deduction. But the group's president and CEO now says he's open to Congress reducing, or even eliminating, the tax break.

September 1 -

The National Association of Realtors is urging policymakers to implement reforms meant to qualify more condominium buyers for Federal Housing Administration loans.

August 31 -

Plenty of banks have ended their federal loss-share deals early, but despite the incentives to wind them down, plenty more still have these crisis-era arrangements in place. It may be due to varying deadlines, mistakes calculating loan values or worries that they still might need the coverage for home equity lines.

August 31