-

HUD reverses course and decides to investigate findings by Inspector General that some DPA programs don't comply with FHA rules.

July 21 -

The $24.4 billion-asset company reported a $50 million profit in the second quarter, up 2% from the first quarter.

July 20 -

Mortgage originators aren't lending enough to people of color or the poor in the St. Louis, Milwaukee and Minneapolis metropolitan areas, the National Community Reinvestment Coalition said.

July 20 -

A private flood insurance bill passed by the House is making Fannie Mae and Freddie Mac uneasy because they fear it could lead to greater losses, according to a recent report by the Government Accountability Office.

July 20 -

The best thing about second-quarter results so far is that the bigger banks met or beat low earnings-per-share expectations. Otherwise they were challenged on many fronts, including revenue, expenses and margins.

July 19 -

A California man was sentenced to more than nine years in federal prison for his role in leading a mortgage loan modification scheme that defrauded more than 1,000 homeowners nationwide.

July 19 -

Federal Housing Administration borrowers have been refinancing faster than expected, creating a drag on efforts to build up the capital reserves of the agency's mortgage insurance fund.

July 19 -

The Mortgage Partnership Finance Direct program will now accept larger jumbo mortgages and a wider variety of products including hybrid adjustable rate mortgages, the Federal Home Loan Bank of Chicago and Redwood Trust said Monday.

July 18 -

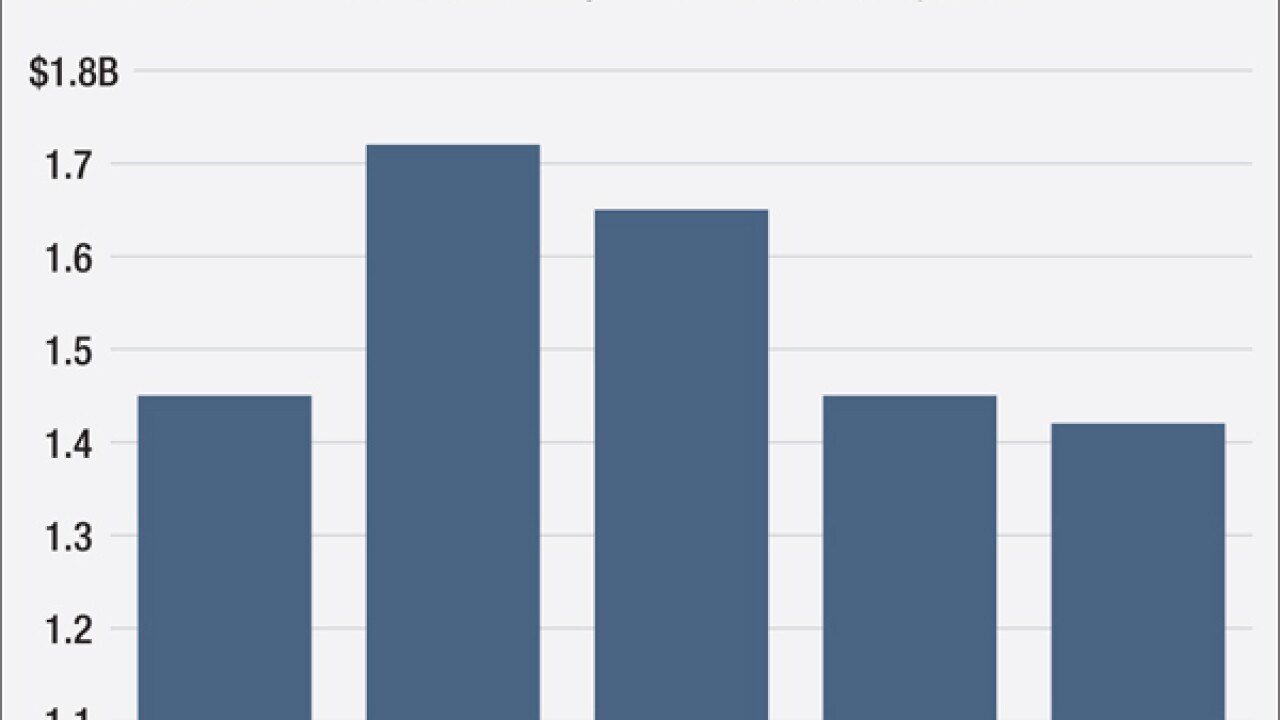

Mortgage originations typically surge in a low-rate environment. Second-quarter reports should show an uptick in fees from selling those loans, but what will bankers say about the rest of this year?

July 18 -

The San Francisco bank reported a 17% drop in mortgage fee income during the second quarter as other lenders made inroads by refinancing its customers.

July 15