-

Lenders are becoming more reluctant to share closing documents with real estate agents now that they have more responsibility for them, the National Association of Realtors claimed Thursday.

March 3 -

Oversight of the four largest mortgage servicers' compliance with the national mortgage settlement is officially over, the watchdog overseeing the process said Thursday.

March 3 -

A consumer group argues in a new report that banks are being too aggressive as they try to persuade their customers to switch to the electronic delivery of monthly statements. Now it's calling for the CFPB to step in.

March 2 -

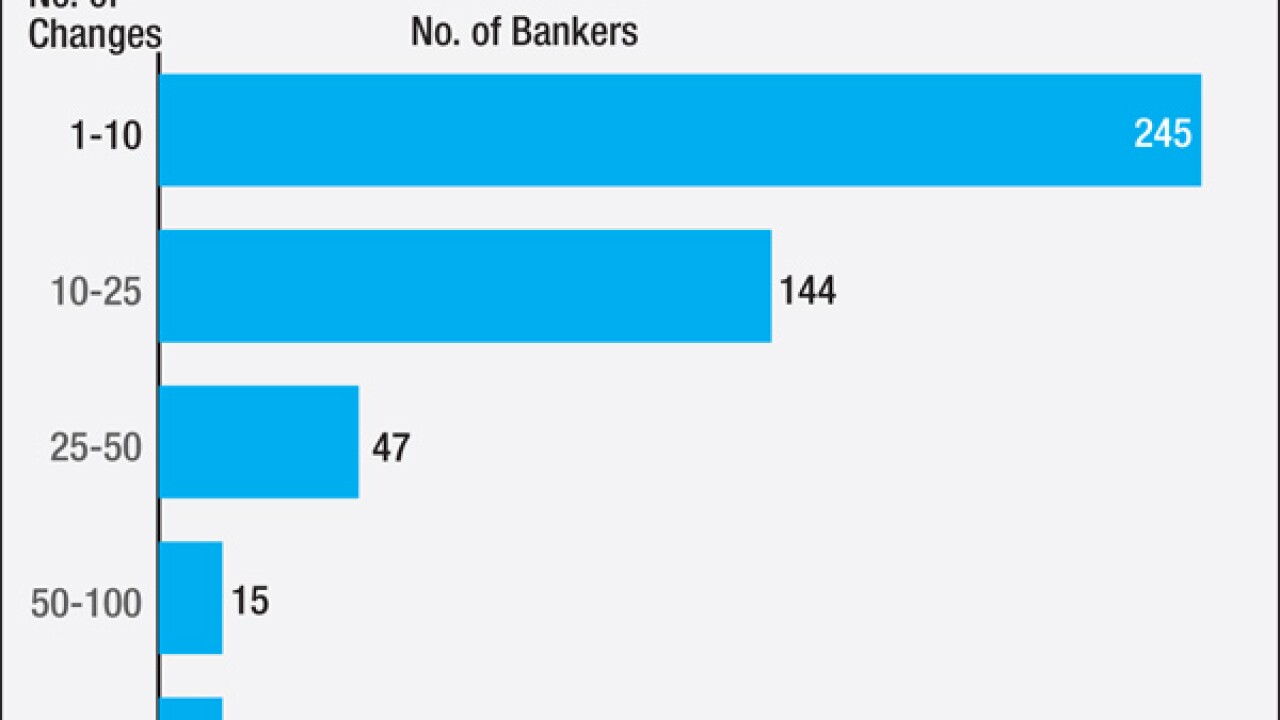

Bankers are still grappling with vendor software problems, longer processing times and delays in mortgage closings as a result of new disclosures that went into effect four months ago, according to a new survey by the American Bankers Association.

March 1 -

The mortgage servicer said it has received letters from the Securities and Exchange Commission regarding separate probes into its collection practices and fees.

March 1 -

Estimates of nonbank mortgage providers that will close or change hands should worry consumers and policymakers about access to credit.

March 1 Community Home Lenders of America

Community Home Lenders of America -

CIT Group, the commercial lender run by John Thain, found a material weakness in the accounting of a mortgage business, causing the company to delay the filing of its annual report to the Securities and Exchange Commission.

March 1 -

First Federal Bank of Kansas City has agreed to a $2.8 million settlement with the Department of Housing and Urban Development to resolve allegations of redlining in African-American neighborhoods.

February 29 -

New services seek to replace lender processes that often involve manually updated spreadsheets and other efforts pieced together to meet steepening regulatory requirements for vendor management.

February 29 -

Radian Guaranty is the latest private mortgage insurer to announce a change to its pricing structure for borrower-paid policies.

February 29