-

The mismatch between demand for new homes and the supply threatens to drive up prices and dampen lending.

February 17 -

Home equity portfolios have shrunk at banks, but credit unions and nonbank lenders like loanDepot helped fuel the surge in home equity lines last year.

February 16 -

Low borrowing costs and rising home values are just two of several reasons owning a home is far less burdensome than it was a decade ago.

February 12 -

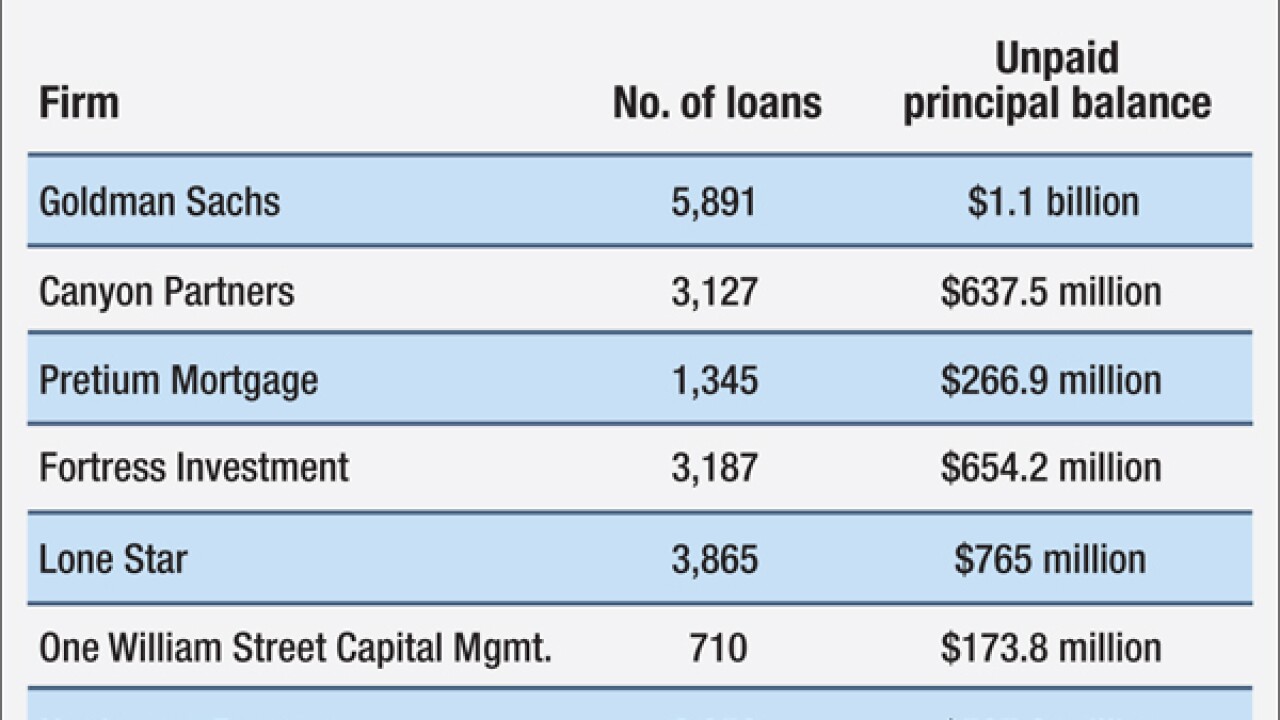

Fannie and Freddie have been selling pools of delinquent mortgages at auction to the highest bidders. Community groups say the Federal Housing Finance Agency should be giving preferential treatment to nonprofits and community development financial institutions.

February 12 -

Flagstar Bancorp in Troy, Mich., has launched a national homebuilder lending platform.

February 12 -

The Federal Housing Administration will continue to charge borrowers an annual premium over the entire life of the loan, rejecting calls from some housing advocates to change how its calculated.

February 11 -

The Detroit company is plowing ahead with its growth strategy at a time when some shareholders are agitating over its sagging share price.

February 11 -

Fifth Third Bancorp in Cincinnati said Thursday that it will spend $27.5 billion over the next five years to provide loans and other financial services to underserved communities in its region.

February 11 -

In an interview, Comptroller Thomas Curry expressed concern about eroding loan standards and the potential for crippling cyberattacks. But he also argued that the industry is much stronger than it was a decade ago.

February 11 -

Bank of Botetourt in Buchanan, Va., founded in 1899, said Thursday it has opened a mortgage division to pursue unmet demand for home loans in southwestern Virginia.

February 11