-

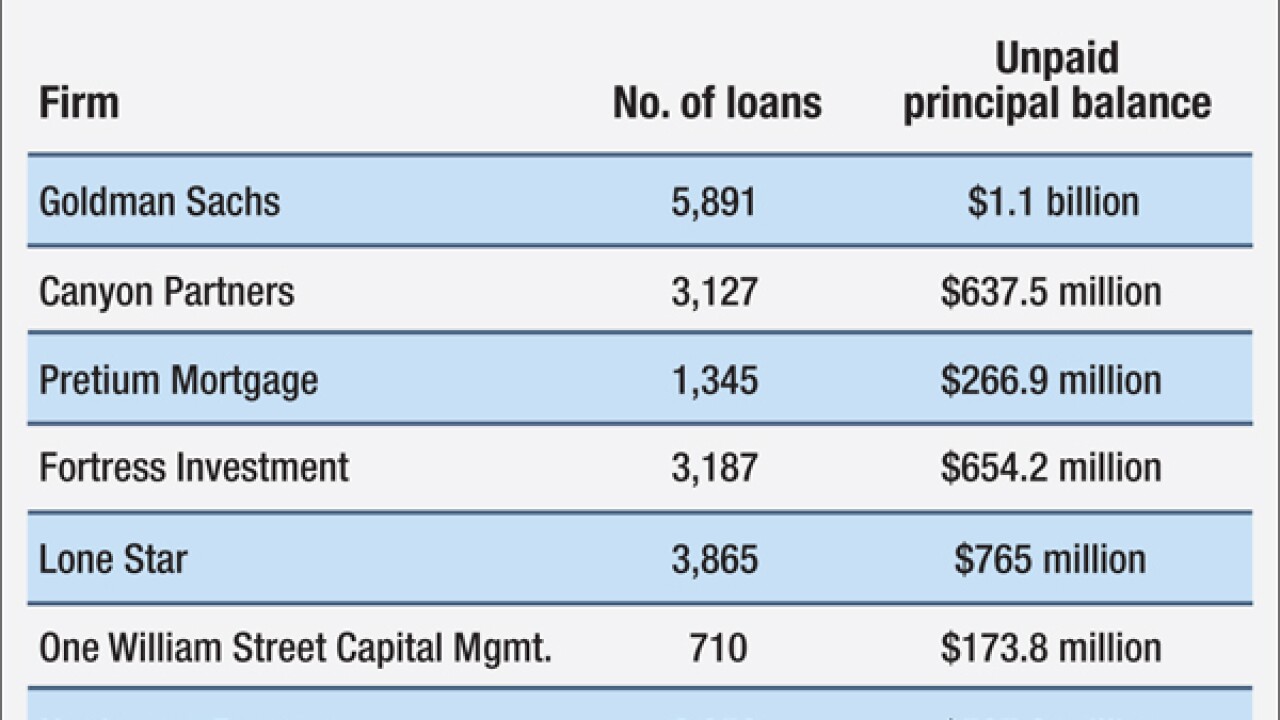

Fannie and Freddie have been selling pools of delinquent mortgages at auction to the highest bidders. Community groups say the Federal Housing Finance Agency should be giving preferential treatment to nonprofits and community development financial institutions.

February 12 -

Flagstar Bancorp in Troy, Mich., has launched a national homebuilder lending platform.

February 12 -

The Federal Housing Administration will continue to charge borrowers an annual premium over the entire life of the loan, rejecting calls from some housing advocates to change how its calculated.

February 11 -

The Detroit company is plowing ahead with its growth strategy at a time when some shareholders are agitating over its sagging share price.

February 11 -

Fifth Third Bancorp in Cincinnati said Thursday that it will spend $27.5 billion over the next five years to provide loans and other financial services to underserved communities in its region.

February 11 -

In an interview, Comptroller Thomas Curry expressed concern about eroding loan standards and the potential for crippling cyberattacks. But he also argued that the industry is much stronger than it was a decade ago.

February 11 -

Bank of Botetourt in Buchanan, Va., founded in 1899, said Thursday it has opened a mortgage division to pursue unmet demand for home loans in southwestern Virginia.

February 11 -

The Federal Housing Finance Agency's decision to exclude captive insurance companies from Federal Home Loan Bank membership makes the FHLB system like a private country club.

February 11 Mountain Lake Consulting

Mountain Lake Consulting -

Morgan Stanley agreed to pay $3.2 billion to end a joint federal-state investigation into its handling of mortgage-backed securities, the fourth deal to be struck in a probe of the big U.S. banks' role in the subprime mortgage meltdown and the financial crisis it spawned.

February 11 -

Strong demand for rentals will keep pace with new construction over the next few years, the government-sponsored enterprise says.

February 10 -

The proposal is unlikely to pass, but does shed light on the administration's plans for housing finance reform, how it views cybersecurity progress and a proposed tax on bank liabilities that could become a reality if a Democrat takes the White House in November.

February 9 -

Many institutional investors are refusing to purchase mortgages loans until they get assurance from the CFPB that they won't have to pay for others' mistakes. Their pullback could further the slow the issuance of private-label mortgage bonds this year, a huge concern at a time when the majority of home loans are insured by Fannie, Freddie and the FHA.

February 9 -

Ted Tozer, president of the Government National Mortgage Agency, wants more hands to monitor the growing number of nonbank MBS issuers.

February 9 -

U.S. Bancorp agreed to pay $10 million while Banco Santander settled for $3.4 million following missteps in how they handled earlier orders from regulators to fix faulty foreclosure practices, according to the Office of the Comptroller of the Currency.

February 9 -

The Federal Home Loan Bank System was designed to provide liquidity to community lenders and traditional insurers, not to unregulated lenders that circumvent the membership rules.

February 9

-

Mortgage REIT says five-year transition plan won't have an impact on its financing model.

February 5 -

HSBC North America Holdings has agreed to pay $470 million to settle allegations it engaged in abusive practices in its mortgage foreclosure, origination and servicing operations.

February 5 -

Remember those homeowners who walked away from their underwater mortgages even though they could still afford their loans? They're back, this time as prospective borrowers.

February 5 -

Housing policy focused on government guarantees and the 30-year mortgage hasn't done much to help low- and middle-income homeowners build wealth.

February 5 American Enterprise Institute

American Enterprise Institute -

Despite their recent growth, too few marketplace lenders are reporting data to the consumer reporting agencies, which could negative repercussions on the financial system.

February 5