-

The United Kingdom has already seen the emergence of mobile-first institutions that have won regulatory approval for a banking charter. It is only a matter of time before they invade the U.S. market.

December 15

-

California regulators on Monday identified 14 companies that the state is targeting as part of its recently announced inquiry into the marketplace lending industry.

December 14 -

The Irvine, Calif.-based company plans to offer subprime borrowers the ability to get an auto loan online or through a smartphone.

December 14 -

The first state inquiry into marketplace lending is seeking information from a broad mix of companies, including consumer lenders, small-business lenders, and firms that are not primarily in the lending business.

December 11 -

California officials have opened a broad inquiry into the marketplace lending business, seeking data from industry participants that will be used to assess the effectiveness of the state's current regulatory regime.

December 11 -

The Dec. 2 mass shooting has shone a light on the sector's vulnerability to borrowers who, exploiting the absence of face-to-face contact on the Internet, lie on their loan applications.

December 10 -

Washington Federal is the latest bank to partner with a tech company in an effort to streamline online loan applications.

December 9 -

Why a small bank like First Mid-Illinois ignored the conventional wisdom 'Commercial banks buy property/casualty firms.' 'Private-equity will outbid you.' 'Leave the innovation to the big guys.' and bought a retail health-insurance agency.

December 8 -

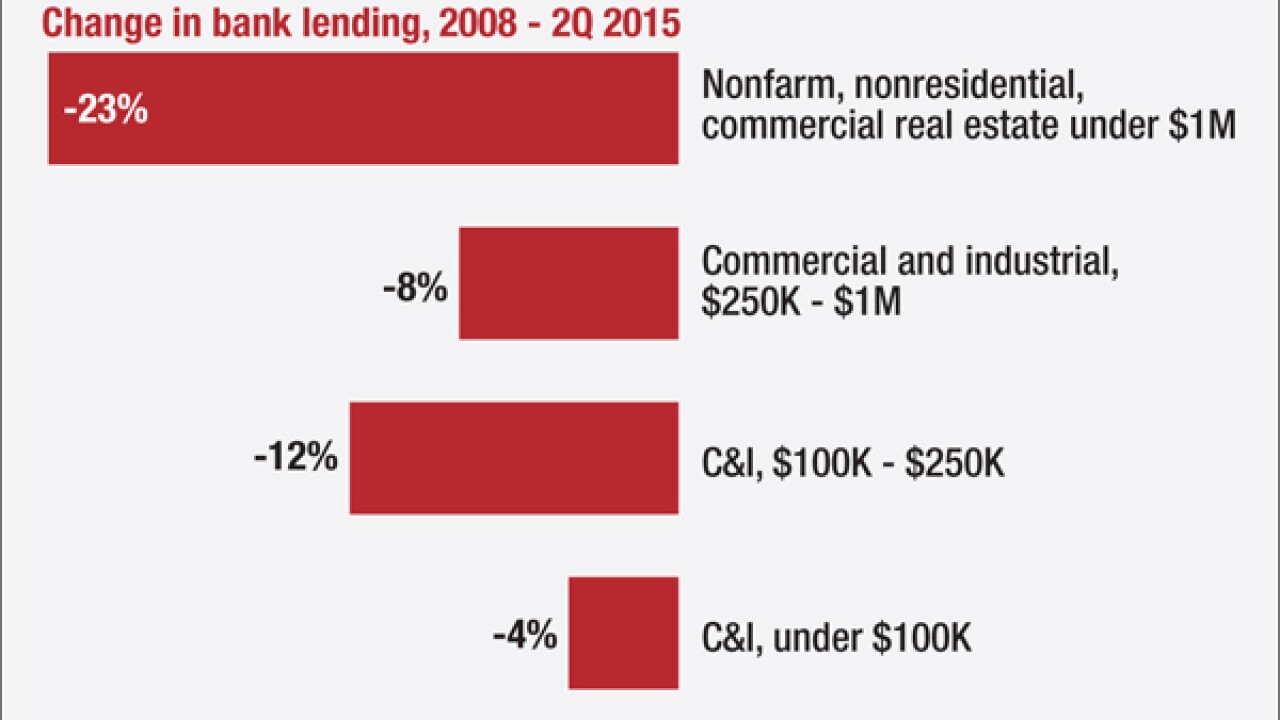

Ex-banker Frank Rotman, now a venture capitalist who focuses on marketplace lending, has a unique vantage point on the competition for small-business loans between banks and Web-based upstarts, as well as on both sides' strengths and weaknesses.

December 8 -

Hours after Jamie Dimon alluded to the budding partnership, the banking giant and marketplace lender went public with their plans to launch an online lending platform in 2016.

December 1