-

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

With even community banks getting hit by ransomware attacks, there's a long list of cybersecurity practices that bankers can expect their supervisors to scrutinize during upcoming exams.

September 1 -

The suggestion that any area has too many local institutions dismisses the importance of community banks and overlooks the dangerous effects of consolidation.

September 1 Calvert Advisors LLC

Calvert Advisors LLC -

A breakdown in internal controls at Bank of Princeton almost killed a deal to sell the company to Investors Bancorp.

August 31 -

First NBCs annual report disclosed a full-year loss, lower capital levels and a spike in nonperforming loans, leaving outsiders to ponder how long it will take for the company to get back on track.

August 29 -

U.S. acquisitions have buoyed profits at Canadas biggest banks, whose domestic economy is sluggish and possibly on the verge of a housing crisis. The banks are expected to pursue more M&A in the U.S. if that problem persists.

August 26 -

The Federal Deposit Insurance Corp. is set to release its quarterly update on the industry's health on Aug. 30. The second-quarter Quarterly Banking Profile will indicate whether banks have rebounded from their slight slump in the first quarter.

August 26 -

LendingClub wasnt alone in its suffering during the second quarter.

August 24 -

Royal Bank of Canada beat analysts' estimates for the fiscal third quarter as its City National purchase in the U.S. bolstered wealth management and capital markets earnings surged. Canada's largest lender raised its dividend 2.5% to 83 cents a share.

August 24 -

In a belated regulatory filing, Carver Bancorp in New York said its profits in the quarter that ended June 30 fell 8% from a year earlier, to $408,000, due to a double-digit increase in expenses.

August 23 -

Previous natural disasters in the Gulf region have taught banks like MidSouth, Regions and Hancock how to swing into action to help customers and manage sudden risks.

August 18 -

Like its peers, the San Francisco-based marketplace lender is struggling to manage the fallout of a sharp reversal in the interest of investors.

August 16 -

The Ohio company is eager to rev up SBA lending in the Windy City now that it has closed on its purchase of FirstMerit. CEO Steve Steinour also credits his company's willingness to make big upfront community commitments for a seamless approval process.

August 16 -

Possible bad outcomes from the slowdown in bank chartering include less financial access in rural areas and further concentration of industry assets in just a few large banks.

August 16 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

Basel III could deal some serious blows to capital levels at First NBC Bank in New Orleans. The big question is how large will the issue become over the next two years.

August 15 -

Many energy lenders are paring back exposure to the energy sector, creating opportunities for banks like First Horizon and Bank of the Ozarks.

August 11 -

A Federal Housing Finance Agency rule that will force some members of the Federal Home Loan Bank System out next year is likely to have a material effect on several of the cooperative institutions.

August 11 - Ohio

Lending margins are once again contracting thanks to a confluence of factors, and bankers are doing everything from shifting cash into higher-risk securities to reconfiguring branches to pad profits.

August 10 -

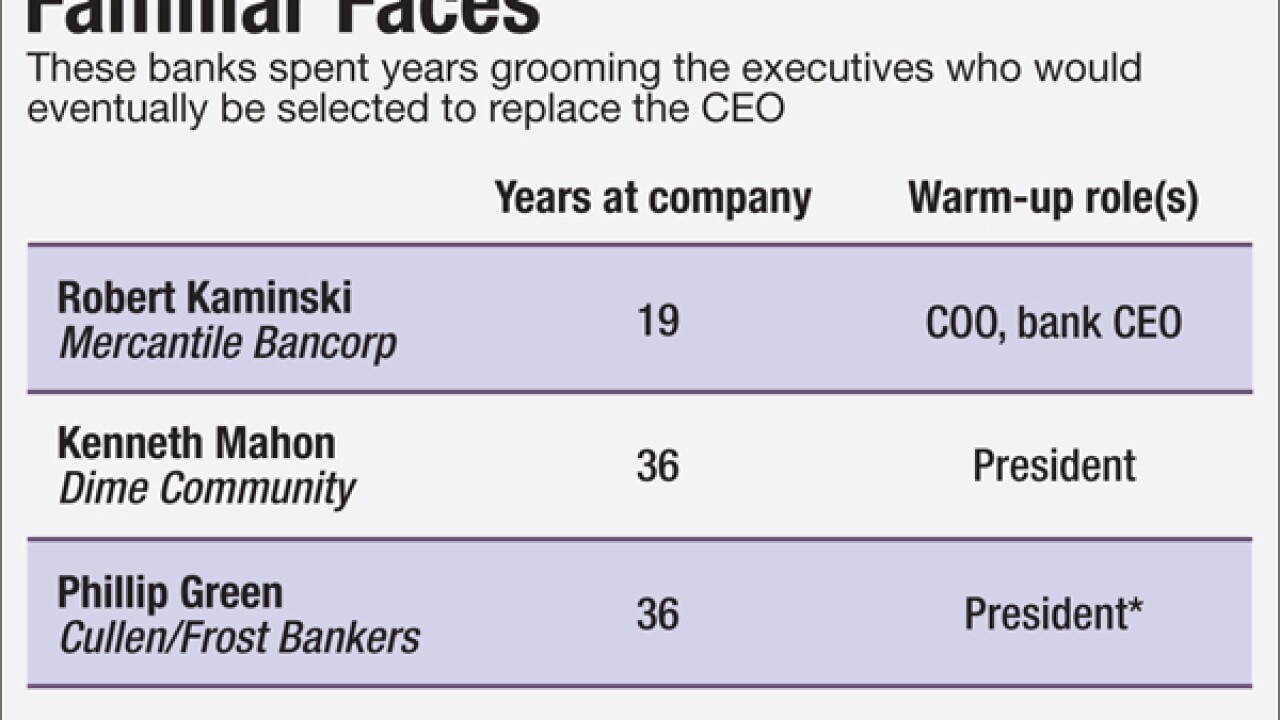

Mercantile Bank and Dime Community recently outlined plans for their CEOs' retirements, while Cullen/Frost made the transition earlier this year. Each transition is anchored in a belief that success hinges on turning day-to-day operations over to a trusted lieutenant.

August 10 -

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

August 9