-

Previous natural disasters in the Gulf region have taught banks like MidSouth, Regions and Hancock how to swing into action to help customers and manage sudden risks.

August 18 -

Like its peers, the San Francisco-based marketplace lender is struggling to manage the fallout of a sharp reversal in the interest of investors.

August 16 -

The Ohio company is eager to rev up SBA lending in the Windy City now that it has closed on its purchase of FirstMerit. CEO Steve Steinour also credits his company's willingness to make big upfront community commitments for a seamless approval process.

August 16 -

Possible bad outcomes from the slowdown in bank chartering include less financial access in rural areas and further concentration of industry assets in just a few large banks.

August 16 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

Basel III could deal some serious blows to capital levels at First NBC Bank in New Orleans. The big question is how large will the issue become over the next two years.

August 15 -

Many energy lenders are paring back exposure to the energy sector, creating opportunities for banks like First Horizon and Bank of the Ozarks.

August 11 -

A Federal Housing Finance Agency rule that will force some members of the Federal Home Loan Bank System out next year is likely to have a material effect on several of the cooperative institutions.

August 11 - Ohio

Lending margins are once again contracting thanks to a confluence of factors, and bankers are doing everything from shifting cash into higher-risk securities to reconfiguring branches to pad profits.

August 10 -

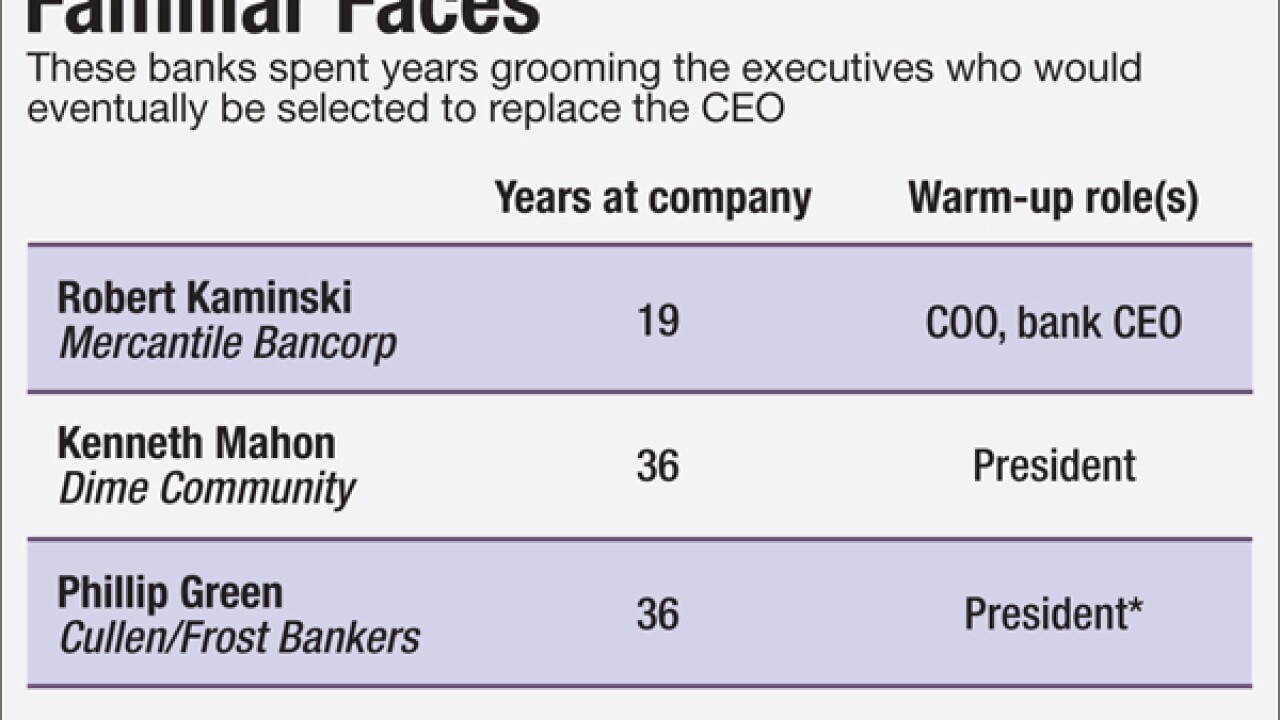

Mercantile Bank and Dime Community recently outlined plans for their CEOs' retirements, while Cullen/Frost made the transition earlier this year. Each transition is anchored in a belief that success hinges on turning day-to-day operations over to a trusted lieutenant.

August 10 -

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

August 9 -

Lending Club announced the resignation of its chief financial officer while reporting an $81.4 million quarterly loss due largely to fallout from the scandal that rocked the firm in May.

August 8 -

By buying EverBank Financial, the insurance and retirement savings behemoth will gain billions of dollars in low-cost deposits and access to many new lending products that it can offer to millions of clients.

August 8 -

The scandal-plagued marketplace lender is set to report earnings Monday, and the results aren't likely to be pretty. The big question going forward is how quickly can it reverse the damage and win back the trust of investors.

August 5 -

Despite ongoing challenges, executives at community banks believe they can boost revenue this year. At the same time, pressure is mounting to build scale, which could mean more consolidation.

August 5 -

Banks must use analytics rather than customer surveys to determine what does and what does not inspire prospects to become customers.

August 5 Liberty Bank

Liberty Bank -

Green Dot profits more than doubled to $8 million in the second quarter as revenues rose slightly and expenses ticked down.

August 4 -

During a conference call with analysts on Thursday, executives at Ally Financial sought to dispel concerns that losses may soon rise in the lender's $63 billion retail auto loan portfolio.

August 4 -

Nonbanking fees are also allowing Community Bank System in New York to be a patient acquirer even though it is creeping up on $10 billion in assets.

August 4 -

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4

-

The age-old fight over whether earnings forecasts are essential for investors or bad for the economy has new legs, and banks are square in the middle of it.

August 4